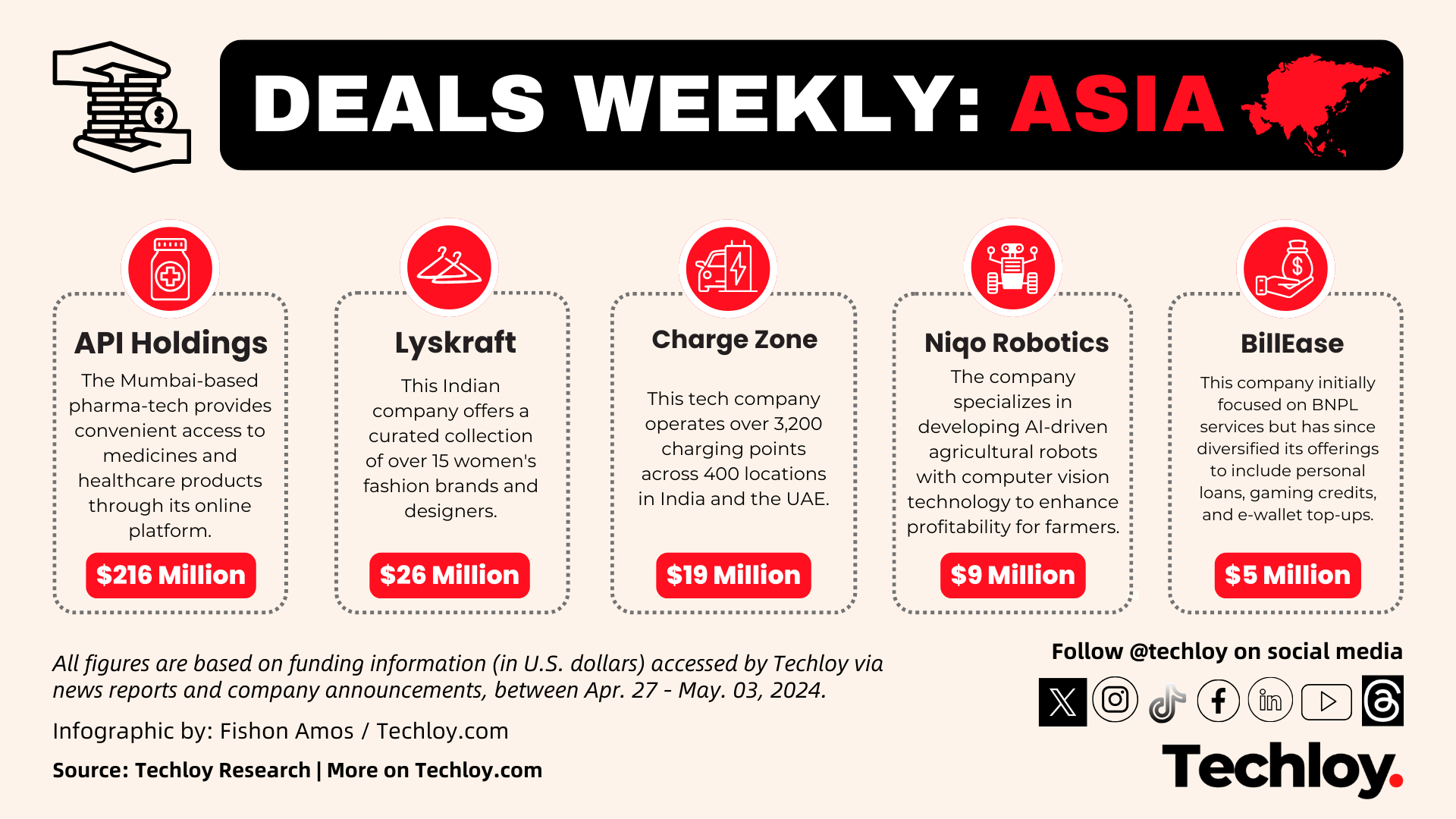

INFOGRAPHIC: Top Asian Startup Funding — Week 18

These are the funding deals we tracked in the Asian region this week – including API Holdings, Lyskraft, Charge Zone, Niqo Robotics and BillEase.

- API Holdings Raises $216 Million to Address Debt and Fuel Expansion

- Lyskraft Secure $26 Million Seed Funding for Omnichannel Fashion Experience

- Charge Zone Secures $19 Million for EV Charging Expansion

- Agritech Robotics Firm Niqo Robotics Raises $9 Million in Funding Round

- BillEase Secures $5 Million Investment to Expand Credit Facility

API Holdings Raises $216 Million to Address Debt and Fuel Expansion

- API Holdings, the parent company of PharmEasy, a prominent online pharmaceutical platform, has successfully raised $216 million in its latest funding round valuing the company at $710 million. This is a 90% drop for the company that was once valued at $5.6 billion in 2021.

- Founded in 2015, the pharma-tech headquartered in Mumbai, specializes in providing convenient access to medicines and healthcare products through its online platform.

- With the infusion of fresh capital, API Holdings aims to address debt obligations and bolster its financial position. The funding will enable the company to navigate challenges and pursue strategic initiatives for further expansion and innovation in the healthcare sector.

- The round was led by Manipal Education and Medical Group (MEMG), with participation from CDPQ Private Equity, WSSS Investments, Goldman Sachs, and Evolution Debt.

Lyskraft Secure $26 Million Seed Funding for Omnichannel Fashion Experience

- Lyskraft, a Gugugram omnichannel and lifestyle fashion startup co-founded by Zomato's Mohit Gupta and Myntra's Mukesh Bansal, has raised $26 million in seed funding.

- Led by Peak XV Partners (formerly Sequoia Capital India), this funding round marks one of the largest early-stage investments in an Indian startup amidst the current funding landscape. Global tech investor Prosus, Belgian investment fund Sofina, and partners of DST Global are among the other prominent investors in this round.

- Lyskraft already offers a curated collection of over 15 women's fashion brands and designers. The investment will fuel further development of its omnichannel platform for premium brands and expand its curated collection of women's fashion brands and designers.

Charge Zone Secures $19 Million for EV Charging Expansion

- Charge Zone, a Vadodara-based electric vehicle (EV) charging network, has received a $19 million commitment from British International Investment (BII), the UK’s development finance institution (DFI) and impact investor.

- Led by Kartikey Hariyani, Charge Zone operates over 3,200 charging points across 400 locations in India and the UAE. With the new funding, the company plans to deploy over 1,500 supercharging stations within the next 18 months and aims to establish a portfolio of over 10,000 charging stations by 2027.

- This investment will fuel the expansion of Charge Zone's high-speed charging network for electric cars, buses, and trucks across India's key cities and highways.

Agritech Robotics Firm Niqo Robotics Raises $9 Million in Funding Round

- Bengaluru-based agritech robotics company Niqo Robotics (formerly TartanSense) has secured Rs 74.7 crore ($9 million) in a new funding round, marking its return to the investment arena after a three-year hiatus. It has raised a total of $16 million in funding, including a $5 million Series A round in August 2021.

- Established in 2015 by Jaisimha Rao, Niqo Robotics specializes in developing AI-driven agricultural robots equipped with computer vision technology, aiming to reduce costs and enhance profitability for farmers.

- With the fresh funding, Niqo Robotics plans to further develop its robotic solutions and expand its market presence in the agritech sector.

BillEase Secures $5 Million Investment to Expand Credit Facility

- Philippine-based buy now, pay later (BNPL) provider BillEase has raised $5 million in a recent investment round led by Saison Investment Management Private Limited (SIMPL), a division of Japan's Credit Saison. This investment bolsters BillEase's credit facility to $40 million

- Founded by former McKinsey executives, BillEase initially focused on BNPL services but has since diversified its offerings to include personal loans, gaming credits, and e-wallet top-ups.

- With the newly acquired funds, the company aims to strengthen its loan portfolio further and introduce innovative credit products to its platform.

Follow our full coverage of the Asian startup and technology scene and get up to date with what's happening in the key markets within the region.