If history is anything to go by, we could see an unprecedented rally much like the one that followed the COVID-era stimulus. As the U.S. government inches closer to ending its shutdown, President Trump’s surprise announcement of a $2,000 “dividend” for citizens except high-income individuals has sent both traditional and digital markets buzzing.

You can almost tell this is shaping up to be another “buy the rumor, sell the news” moment. With liquidity expectations rising and traders eyeing fresh capital inflows, attention is turning back to the blockchain sector, especially Layer 0 networks, which form the foundation for next-gen interoperability and scaling.

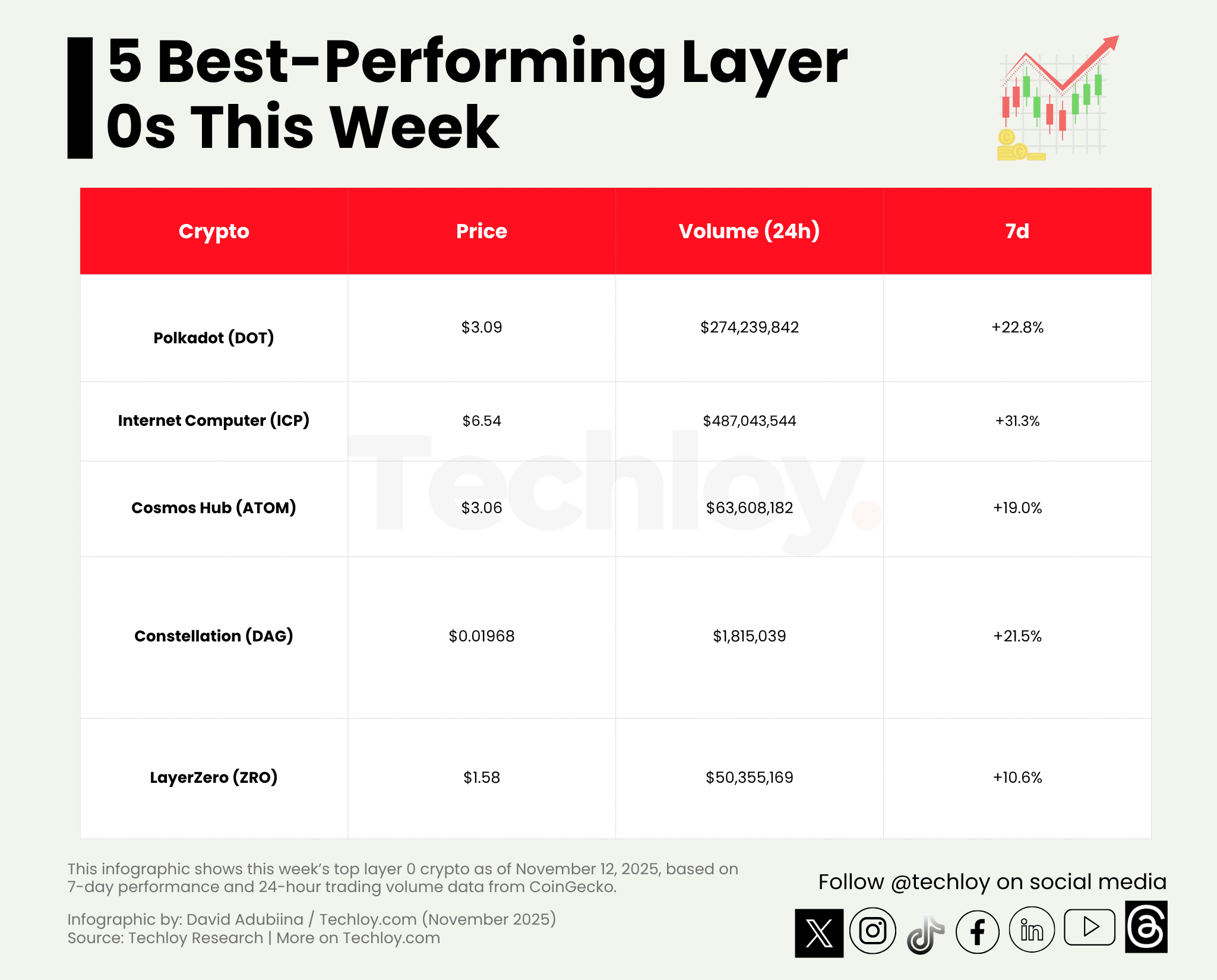

According to CoinGecko, the Layer 0 category has climbed over 20% in the past week, suggesting that the protocols quietly building the infrastructure for the next bull cycle might be gearing up for a major upside. Here in this article are five Layer 0 cryptos worth watching as the liquidity returns and the next wave of capital rotation begins.

/1. Polkadot (DOT)

Polkadot has been a steady force in the Layer 0 race, connecting independent blockchains through its relay chain model (now JAM). With DOT trading around $3.09, the token has climbed over 20% in the past week, fueled by renewed interest in cross-chain applications and upcoming ETF news. The ecosystem’s parachain model gives it flexibility that many competitors still lack—positioning it as one of the top beneficiaries if liquidity flows back into infrastructure plays.

/2. Internet Computer (ICP)

As federal spending and tech stimulus talks grow louder post-shutdown, ICP could ride a broader wave of U.S.-centric digital infrastructure narratives. The project has come a long way from its early hype cycle, down roughly $700–$750 from its all-time high, but is slowly rebuilding credibility.

After months of flat performance, ICP has staged a quiet comeback, up 30% in the last seven days and now trading near $6.56. Its core idea—hosting full-stack dApps directly on-chain is resonating again as developers search for alternatives to centralized cloud providers.

/3. Cosmos Hub (ATOM)

One thing about Cosmos is that it has always been about connecting blockchains through its Inter-Blockchain Communication (IBC) protocol, linking ecosystems that otherwise can’t talk to each other. ATOM sits at the center of the modular blockchain movement. Priced around $3.00, it’s up 16% this week, with a market cap of around $1.4 billion.

/4. Constellation (DAG)

Constellation’s Directed Acyclic Graph (DAG) architecture, which it calls the Hypergraph Network, may not be as hyped as some of the bigger names, but that might change soon. With 21% weekly growth and a sub-$0.02 price tag, it’s becoming one of those quiet low-cap Layer 0 bets that can move fast when sentiment flips. It’s focused on real-world data and enterprise-level scalability—the kind of infrastructure narrative that institutions tend to notice once the market heats up.

/5. LayerZero (ZRO)

Priced near $1.56, ZRO’s tech powers seamless cross-chain messaging, which has quickly made it a go-to bridge for DeFi protocols. With Asia expansion news and an airdrop still buzzing around, it’s one of those plays that could explode as liquidity returns. Unlike Polkadot and Cosmos, LayerZero doesn’t rely on intermediaries or shared security models; it lets blockchains communicate directly, giving it a faster, lighter edge in cross-chain interoperability.

Conclusion

If the U.S. really moves forward with reopening and that $2,000 dividend hits, fresh money is coming, and history tells us it won’t just sit idle. Markets always find a story, and right now, that story could start at the foundation of Web3.

Layer 0 networks like Polkadot, Cosmos, and LayerZero aren’t chasing hype; they’re building the rails everyone else will eventually need. That’s why smart money is already circling, not waiting for headlines, but getting in before them.

So, as liquidity returns and traders start positioning, it really comes down to one choice: are you buying the rumor or waiting for the news?