It is easy to feel a bit confused when tax season rolls around in Australia if you work in the IT industry, where job configurations, contract types, and side projects are the status quo. The good news is that with a little creative planning, you can minimise your tax, keep more of what you have earned, and spare yourself the shock.

Let's deal with some of the most effective strategies by examples of how they play out in everyday life.

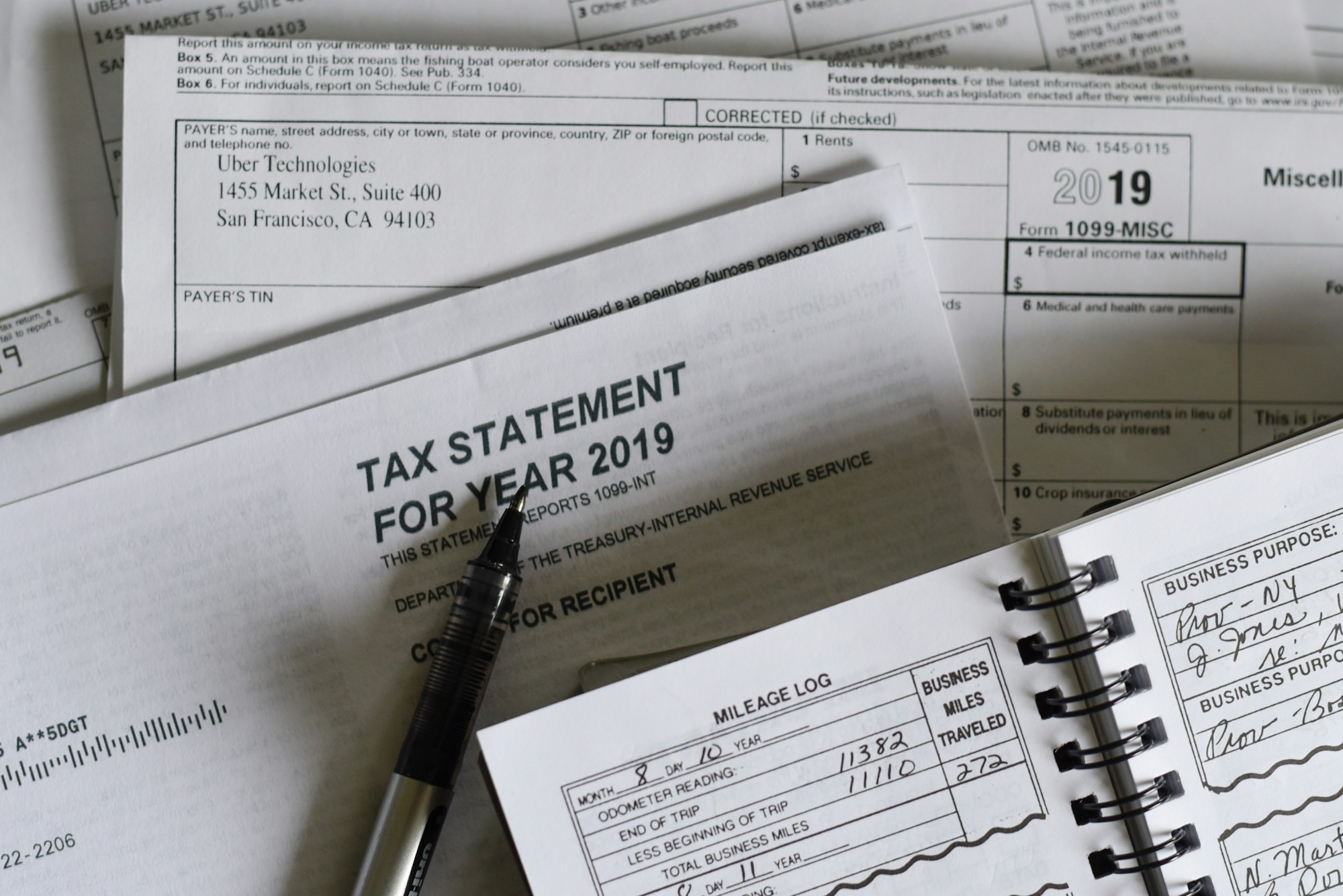

Claiming Work-Related Expenses

The simplest way to reduce your tax bill is by claiming genuine expenses related to your profession. For professionals working in IT, these often come in the form of home office expenses, software licenses, or part of their internet bill if they work from home.

Example: If your internet subscription is $100 per month and half of the consumption is for work, then $50 a month is an allowable claim. Within a period of twelve months, this amounts to $600 and reduces your taxable income. Record-keeping and saving receipts are the real hacks here. Without those, you cannot utilise these deductions.

Making the Most of Super Contributions

The majority of technology experts care about short-term earnings and forget superannuation. Superannuation, also called "super," is Australia's forced retirement savings plan.

Employers are required to put a percentage of your wages into a super fund, and you can even add more yourself. The super funds get invested and grow over time, becoming a valuable security blanket for retirement days. Adding extra to super creates long-term funds as well as potentially reducing how much you pay in tax today.

Example: Suppose a cloud engineer adds another three thousand dollars to super before the end of the financial year. That reduces taxable income while building retirement savings at the same time. It's like paying yourself twice, once today in tax relief and again in the future when you retire.

Managing Side Income from Freelance Work

The technology industry is prone to attracting side hustles as freelance programming, app building, or IT consulting businesses. The proceeds from these enterprises need to be reported, but so do the expenses of keeping them going.

Example: A UX designer works some freelance in addition to their regular working hours and buys a new drawing tablet just to do that. To report both the income and expenses is to essentially cancel the two out, reducing what they pay taxes on come tax time.

Maximising Salary Packaging

Some technology firms offer salary packaging benefits, such as including the price of laptops or even company trips. It means part of your salary is directed to benefits rather than straight cash, which minimises taxable income.

Example: A network engineer negotiates to receive a portion of their salary as a contribution to a new work laptop. Instead of paying for the laptop from after-tax income, they receive the benefit as salary packaging and pay less overall tax.

Keeping Records Neat During The Year

The secret to stress-free filing is planning ahead. Don't scramble around in June; digitise receipts and records all year round. See it as building one's own archive piece by piece rather than digging through emails and paper receipts.

This system not only saves time but also reduces the risk of missing deductions. With records spread out, you're most likely to forget that new computer you bought for work or that professional course you invested in half a year ago. Having them in order from day one makes you include every qualifying expenditure, which means there is more money in your pocket.

Example: A data analyst, could make a special folder in the cloud where each receipt, invoice, or donation slip is stored as soon as it's received. After some time, this folder is an organised library that removes the mess of tax season. By July, all is already in one spot, so the filing is smoother and faster.

Getting Professional Advice When Needed

Even the most tech-savvy worker can benefit from some expert guidance. Tax law is constantly evolving, and yesterday's solution might not be today's solution. A good accountant will review your specific situation and highlight deductions or methods you never would have thought of.

Example: Take a cybersecurity specialist who works on multiple contracts. Without guidance, they might miss out on foreign travel allowances or education expenses appropriate to their own role. Under guidance, they take more with them in their refund and have less doubt.

Final Thought

For Australian technology professionals, tax time is less about form-filling and more about planning. Every choice you make throughout the year contributes to the end return. Whether it is logging expenses, increasing super, or managing side income neatly, the little things add up to matter. With some planning ahead, tax time is less of a strain and more of an opportunity to keep your cash working for you.