News of Apple exploring a return to Intel feels a bit like running into an old colleague who once let you down, only to find they’ve finally sorted themselves out.

According to TF International analyst Ming-Chi Kuo, after years of relying entirely on TSMC to build every chip inside the Mac, Apple may hand part of that workload back to Intel, the same company whose delays pushed Apple toward its own silicon in the first place.

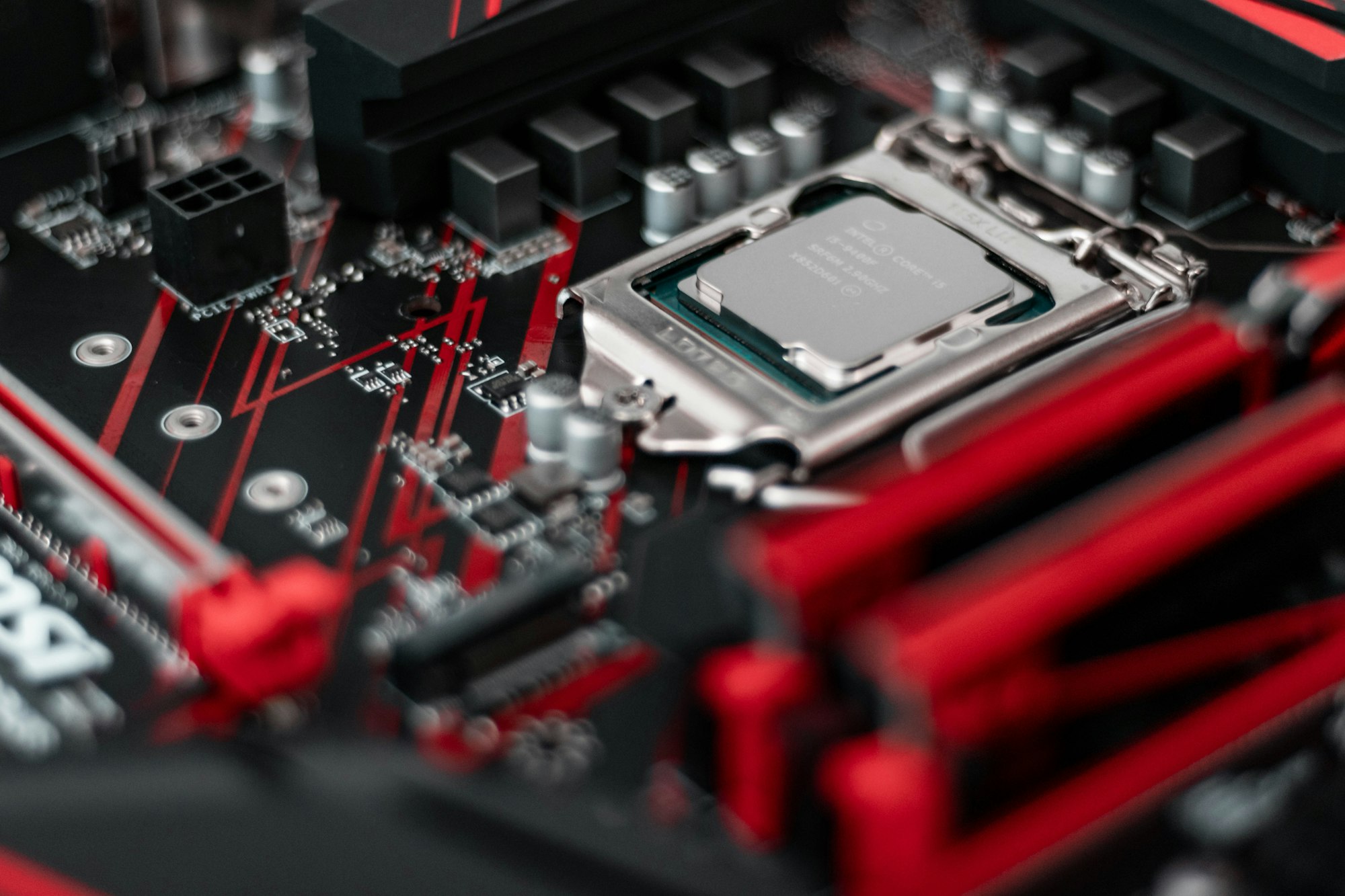

The move makes sense when you consider Apple’s current setup. TSMC has been Apple’s sole chip manufacturer for years, producing the advanced processors that power Macs, iPhones, and iPads. That exclusivity works well for TSMC, but it leaves Apple exposed.

Any disruption, a natural disaster in Taiwan, geopolitical tensions, or tariffs could directly threaten the supply chain. Bringing Intel on board offers a domestic alternative, giving Apple leverage in negotiations and a safety net if TSMC faces issues.

What This Means for Intel, and the Market

Intel’s progress changes the equation. Apple has reportedly tested Intel’s early 18A-P process and found it promising enough to wait for the full version expected in early 2026.

If all goes according to plan, Intel could start producing Apple’s lower-end M-series chips by 2027, covering the MacBook Air and iPad Pro, with initial volumes between 15 million and 20 million units, a welcome gain for any foundry.

The news sent Intel’s stock up more than 7%, reflecting optimism about a potential boost to its foundry business. If these chips perform well, Apple could expand orders over time, providing more revenue to Intel.

But winning Apple would do more than boost Intel’s revenue. It would restore legitimacy to a foundry business that once failed to attract customers. Landing the world’s largest chip buyer sends a message to AMD, Nvidia and every startup designing custom silicon: Intel wants to be taken seriously again.

For Apple users, the impact will be largely invisible. Your next Mac might still feel and perform like a Mac should, but behind the scenes, the supply chain is evolving. For Intel, success with Apple could finally mark the start of a foundry comeback that’s been a long time coming. The road ahead is far from certain, but one thing is clear: the dance between Cupertino, Santa Clara, and Hsinchu is entering a new, high-stakes chapter.