Apple and Samsung have spent years trying to outdo each other with bigger screens, sharper cameras, and faster processors. Yet, in one of tech’s stranger turns, the next big iPhone camera upgrade could come from a Samsung factory floor in Texas.

The backstory starts in Japan, where Sony has long been the go-to supplier for iPhone image sensors. That relationship worked fine until politics got in the way. The U.S. is preparing steep new tariffs on chips made overseas, and Sony doesn’t have a U.S. factory to sidestep them. Suddenly, importing those sensors could get a lot more expensive.

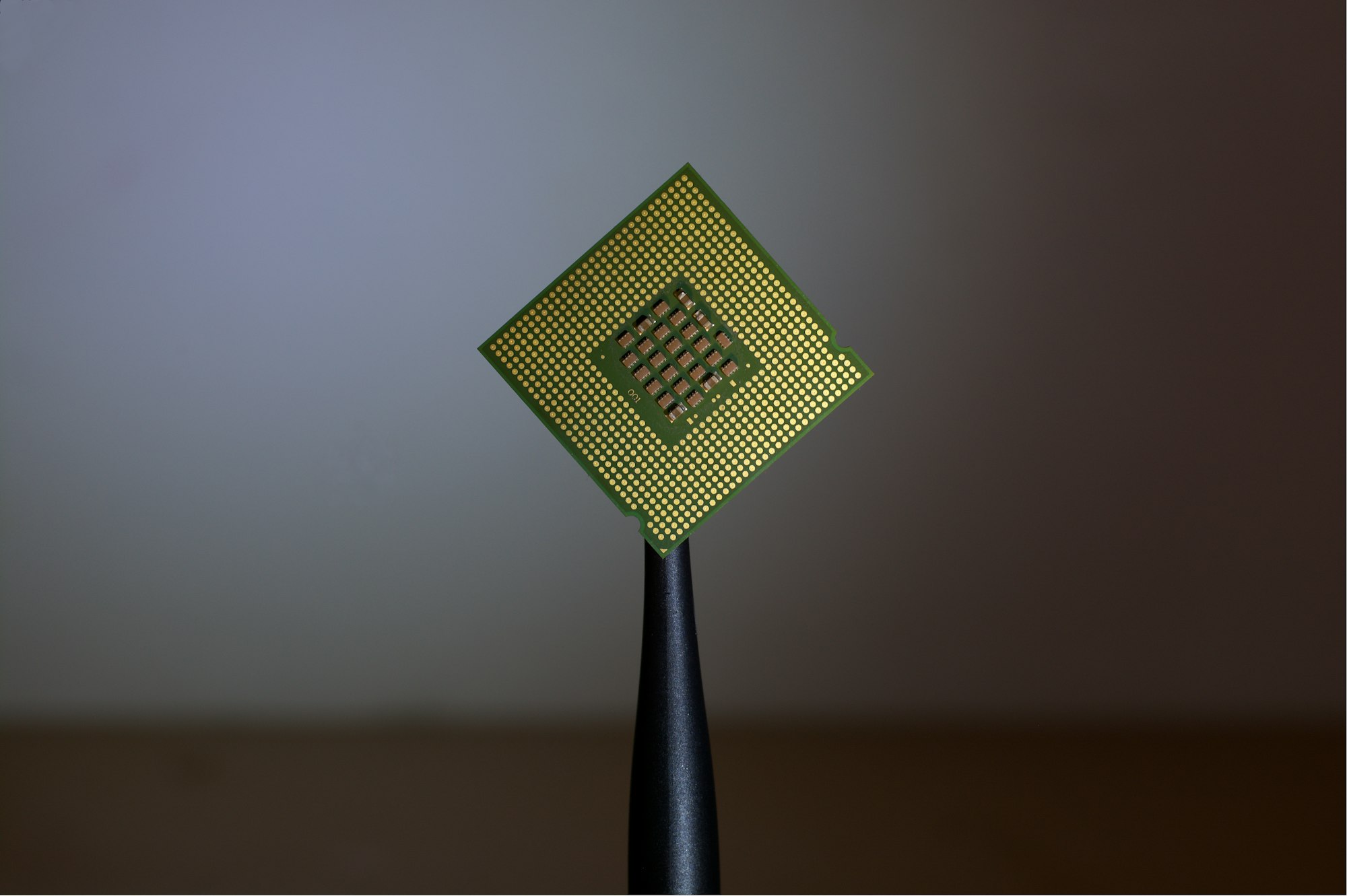

Samsung, however, runs a semiconductor facility in Austin. According to The Financial Times, that plant will soon start making three-layer stacked image sensors for the iPhone 18, using a process Apple says has “never been used before anywhere in the world.” It’s an unusual arrangement; Apple doesn’t often entrust a direct rival with such a key part, but the economics make it hard to ignore.

It’s a trend with deeper roots. Since the CHIPS and Science Act passed in 2022, which pushed for more semiconductors to be made locally in the U.S., over $540 billion in semiconductor investments have been announced in the U.S., according to the Semiconductor Industry Association. Texas alone has pulled in more than $60 billion of that, becoming a manufacturing hub for companies looking to dodge tariffs and shorten supply chains.

Tesla is already there. In July, Elon Musk signed a $16.5 billion deal for Samsung to build the automaker’s next-generation AI6 chips in the same Austin complex. For Samsung, that means a steady stream of high-value contracts. For Tesla and Apple, it means avoiding overseas supply risks and potentially cutting production lead times by months.

Apple’s $100 billion expansion of its American Manufacturing Program fits neatly into this picture. The Samsung deal ensures that more of its supply chain sits on US soil and that Austin stays busy.

If it works, the iPhone 18’s camera could be more than a hardware upgrade. It could be a marker of how quickly U.S. trade policy is rewiring the tech supply chain, where competitors become collaborators, and the road to your next gadget runs straight through Austin.