As we move further into the holiday season, Africans earning in foreign currencies are once again looking for the best ways to send money to friends and family back home on the continent. The challenges that once plagued money transfers to Africa have largely faded, thanks to ambitious cross-border payment apps that have stepped in to fill the gap.

Whether you’re planning a trip to Lagos for Detty December or simply want to send money home, there are now numerous apps — many built by Africans on the continent — designed to meet these needs.

That said, not every app offers the level of speed and efficiency users expect. That’s why we spent the past few days testing multiple platforms for speed, reliability, and overall performance.

Here are 10 of the best cross-border payment apps for sending money to Africa, and why they stand out.

1. Chipper Cash

Chipper Cash remains one of the most reliable cross-border payment apps on the continent. Valued at over $2 billion, the startup, which began in Lagos, has become a go-to option for many users looking to send money back home.

Chipper Cash is particularly popular for its USD accounts, which allow customers to hold and receive dollars. The app has also built a reputation for reliability, with very few reported downtimes, and has largely avoided major controversy in a still-nascent industry.

However, some users have raised concerns about high exchange rates, which are among the highest on the continent and remain a key drawback of the service.

Why it stands out: One of the oldest and most reliable native cross-border payment apps in Africa.

2. LemFi

LemFi is fast becoming the number one choice for Africans living abroad looking to move money to West and East Africa. With a recent $53 million Series B raise, the company has expanded from a simple remittance tool into a multi-currency bank.

Its multi-currency wallet is a feature that has garnered a cult following, allowing users to hold funds in foreign currencies before swapping them. The app has also built a robust fraud detection system and offers competitive rates that often beat traditional high-street banks.

However, its popularity is a double-edged sword. During peak transaction windows, LemFi can suffer from congestion delays, leading to "processing" hang-ups that can frustrate users in a rush, an issue that it has attributed to infrastructure problems on the side of some of its partners.

Why it stands out: It comes with a multi-currency wallet worth boasting about.

3. NALA

NALA has carved out a reputation as the "Rate King" of the ecosystem. Pivoting from a general financial tool to a specialised remittance player, it consistently offers exchange rates that beat the market average for East Africa, making it a preferred choice for many sending lump sums where a tiny difference in rate adds up to significant value.

NALA is particularly popular for its seamless integration with M-PESA (another regional favourite), making it nearly flawless for transfers into Kenya and Tanzania.

However, the downside is often speed in high-traffic corridors outside of East Africa. Users in West Africa have occasionally noted lags compared to competitors, forcing a trade-off between the best rate and the fastest delivery.

Why it stands out: It provides some of the best rates in East Africa.

4. Send App by Flutterwave

Send App is backed by Flutterwave, one of the highest-valued fintechs in Africa. Because Flutterwave owns the underlying payment rails that many other apps rent, Send App is arguably one of the fastest. It cuts out intermediaries, making it an ideal choice for business-to-business transfers or heavy lifters who need to move large sums directly into their bank accounts.

At over $20,000 per transaction, Send App has become popular for its high transaction limits and professional assurance. If you are paying a supplier or a contractor, the app provides a level of paper trail and security that peer-to-peer apps often lack.

However, the reality is that when it fails, it fails hard. Because it relies on its own infrastructure, any downtime at the Flutterwave gateway can bring the app to a complete halt.

Why it stands out: Arguably one of the fastest transaction processing speeds.

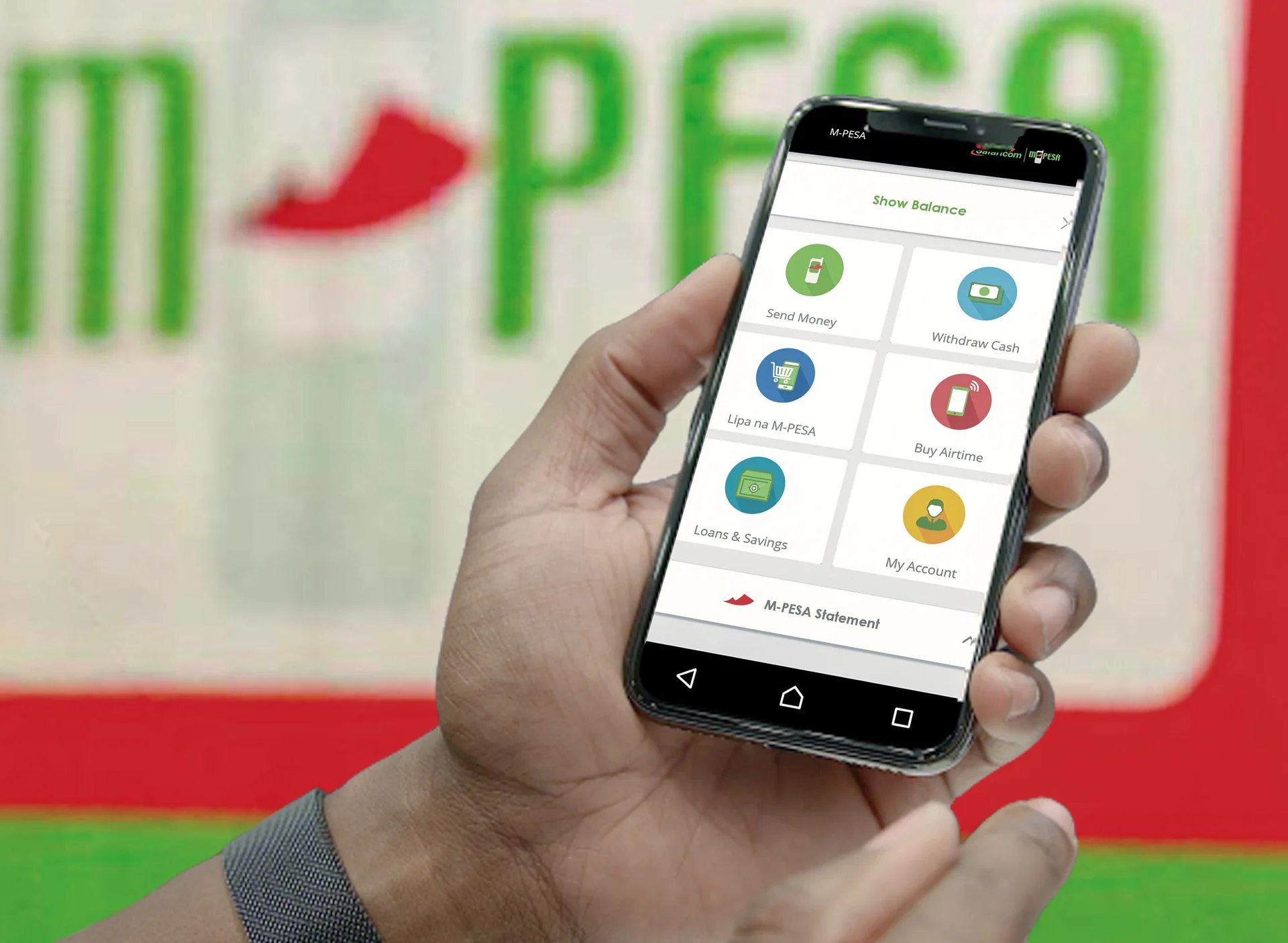

5. M-PESA Global

Part app, part economic infrastructure, Safaricom-operated M-PESA Global has become the premier service for anyone in East Africa, allowing users to send money across borders to Tanzania, Uganda, and Rwanda as easily as sending a text message. It integrates directly with the contacts on your phone and requires no traditional bank account to function.

M-PESA Global is particularly popular for its ecosystem integration, allowing users to link directly to PayPal and Western Union to receive funds from abroad and spend them instantly at local merchants. It is the definition of "liquid cash" in the region; if you have M-PESA, you have money.

However, users often cite transaction limits and tiered fees as a drawback. Unlike newer apps that offer flat fees, M-PESA Global’s pricing structure can become expensive for higher-value transfers, and the interface, while functional, is utilitarian compared to other cross-border payment apps.

Why it stands out: The undisputed king of mobile money that powers the entire East African economy.

6. Accrue

The strength of Accrue lies in its specificity. In an industry where having many options is often seen as an advantage, Accrue chooses focus, offering payments specifically from the United States to Africa. It also provides users outside the US with a dollar account that can receive payments.

True to its name, Accrue is also focused on helping users grow their money. The app offers investment options, including gift cards and top-performing assets.

Where it truly excels is its interest programme. Users who hold money on the app earn daily interest, making it an attractive option for those looking to preserve value while keeping funds accessible.

Why it stands out: Users receive daily interests.

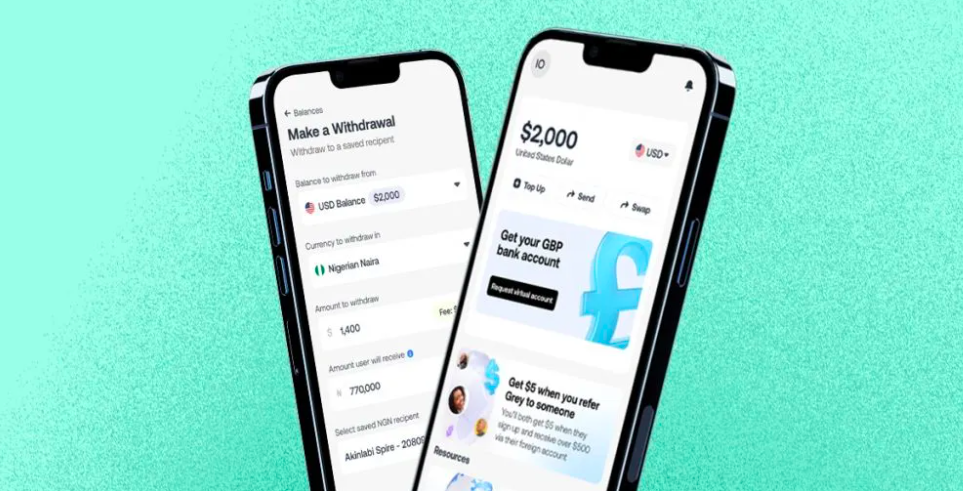

7. Grey

Grey has fast become the primary banking option for African freelancers and remote workers. Backed by Y Combinator, the app addresses a specific pain point: the difficulty of receiving international payments for work abroad in Africa. It acts as both a remittance app and a neobank, bridging the gap between Western employers and African talent.

Grey is particularly popular for providing virtual foreign bank accounts (IBANs) in the US, UK, and Europe. This allows users to receive salaries directly in foreign currency and hold funds in their wallet to shield against local currency devaluation, converting only what they need for daily spending.

Why it stands out: It has an actual, sleek interface that makes sense.

8. Taptap Send

Taptap Send operates in over 40 countries worldwide, including major sending markets like the UK, Europe, the US, Canada, Australia, and the UAE, with strong support for transfers into African destinations such as Kenya, Ghana, Nigeria, Uganda, and Zimbabwe.

Users praise Taptap Send for its transparent fees and competitive exchange rates, which are often more favourable than traditional banks and legacy remittance services. Transfers typically arrive within minutes, especially when sent to mobile wallets or bank accounts, making it ideal for urgent support to family or friends.

However, regulatory hiccups can occasionally impact service continuity in some markets. For example, in 2025, the Bank of Ghana temporarily suspended remittance partnerships with TapTap Send due to compliance reviews, though its services were later restored after engagement with the regulators.

Why it stands out: Supports one of the widest ranges of foreign currencies for transfers into Africa.

9. Afriex

Afriex has rapidly established itself as one of the most cost‑effective ways to send money to Africa. It allows senders to fund transfers in USD, EUR, GBP and deliver funds into local bank accounts, mobile wallets, or even directly into Afriex wallets, depending on the destination.

A major pillar of Afriex’s appeal is its real‑time exchange rates and low to zero fees on transfers, making it competitive with, or cheaper than, traditional remittance services and banks. Most transfers are completed within minutes, and the platform automatically handles currency conversion at transparent rates before payout.

Afriex continues to scale its reach: the service supports transfers from key sending countries into over 30 African destinations, and it has recently expanded into new markets such as Benin and Congo‑Brazzaville, while also facilitating payouts in countries like Mozambique, Madagascar, Tanzania, and Zambia.

Why it stands out: Has one of the lowest fees on transactions.

10. Kredete

Offering transfers to over 40 African countries, Kredete has become a preferred option for many Africans, particularly immigrants looking to send money back home.

With every transaction, users build their credit score on Kredete, unlocking a feature that is only just gaining traction across Africa. This gives Africans a pathway into the global credit market, an area many have historically been excluded from.

Kredete also provides a virtual credit card, further empowering users to participate in global commerce and online markets.

Why it stands out: Allows users to build a credit score with every transaction.