What seemed like tens of billions just eight years ago has now grown into a market worth trillions of dollars, with Bitcoin competing directly with the world’s biggest companies in terms of market value.

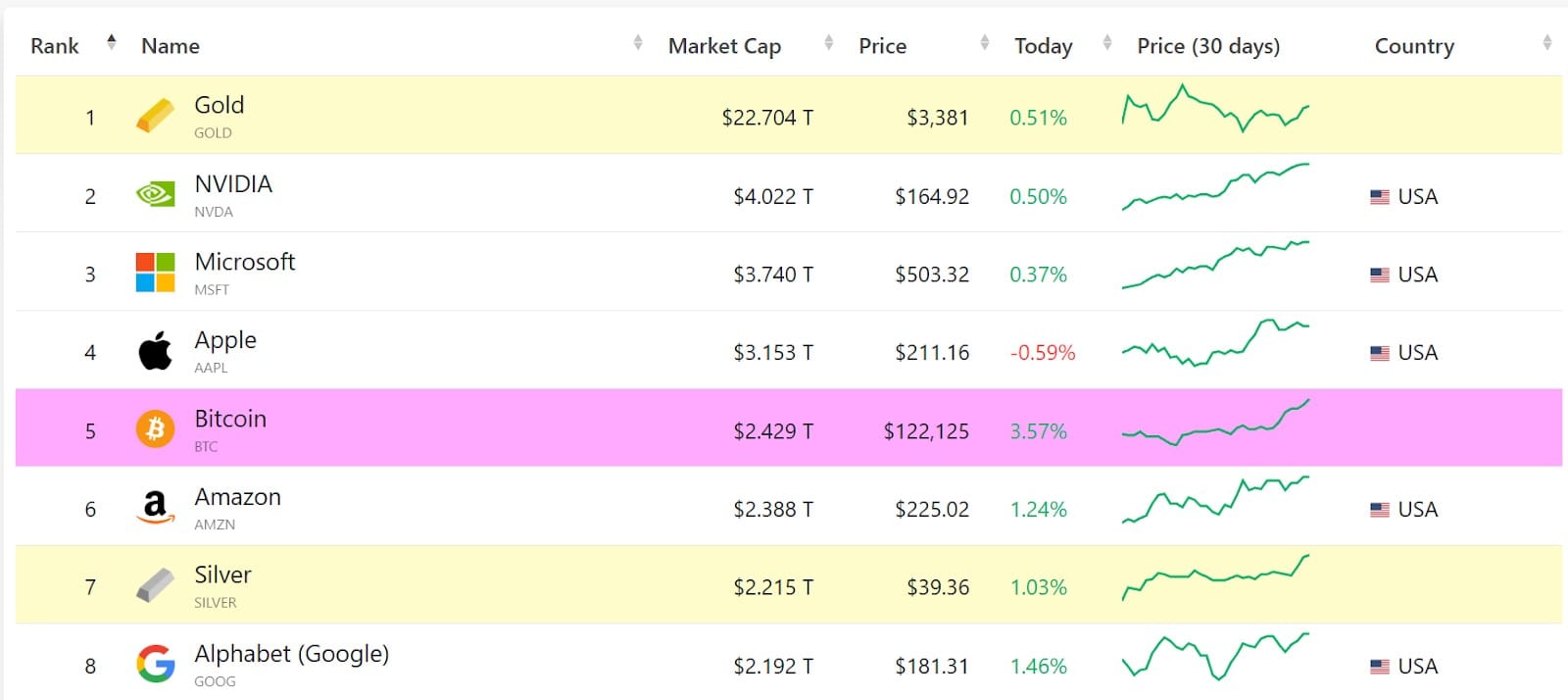

Earlier this week, Bitcoin surged to a new all-time high of $122,600 from $112,000, pushing its total market capitalization to over $2.4 trillion. To put that into perspective, Bitcoin is now officially the fifth-largest asset in the world, overtaking giants like Amazon ($2.3 trillion), Silver ($2.2 trillion), and even Alphabet (Google) at $2.19 trillion.

The key driver of this surge remains the same force that ignited the bull run this season: sustained institutional interest, especially from US spot Bitcoin exchange-traded funds (ETFs).

These ETFs have seen a seven-day streak of inflows, with total spot Bitcoin ETF holdings (via RIAs, hedge funds, and pensions) now worth over $138 billion in assets, effectively pulling more Bitcoin into long-term holdings and tightening supply. Unlike past bull runs that leaned heavily on retail traders, this current surge feels different. Big money is now steering the ship.

Another factor contributing to the price spike is the proposed “Crypto Week” by US lawmakers, aimed at passing three key cryptocurrency bills expected to bolster the national crypto industry: the Guiding and Establishing National Innovation for US Stablecoins (GENIUS Act), the Digital Asset Market Clarity Act (CLARITY Act), and the Anti-CBDC Surveillance State Act, which seeks to prevent the creation of a central bank digital currency (CBDC).

But the question now is whether Bitcoin would reach $150,000 next.

Looking at past cycles, Bitcoin has a habit of pushing toward psychological milestones once it breaks a record. Many analysts believe $150,000 is within reach, especially with macro factors like potential US interest rate cuts, growing institutional adoption, and the post-halving supply shock all in play.

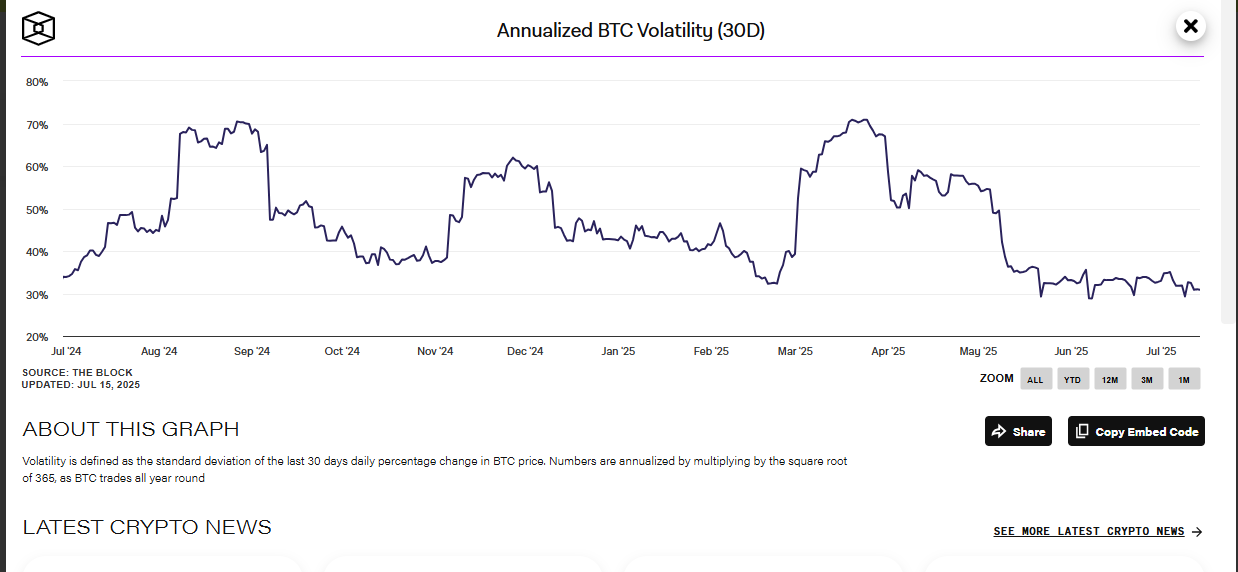

Of course, while Bitcoin volatility has dropped from 50% to 35% thanks to recent inflows, it hasn’t disappeared. Trade-offs like concentration risk, custodial risk, and creeping regulatory influence could eventually compromise the independence that gave Bitcoin its original appeal. The same forces fueling adoption may also test the boundaries of Bitcoin’s decentralization. While Bitcoin’s climb might look inevitable today, this market has never moved in straight lines. Sudden corrections remain part of the game.

Still, the bigger picture is clear: Bitcoin is no longer a speculative side bet. Bigger inflows bring more stability, just as we’ve seen with gold (16% volatility) and the S&P 500 (22% volatility). It’s now a multi-trillion-dollar asset, sitting at the same table as global giants.

Whether $150,000 happens next week, next month, or later this year, one thing’s certain — Bitcoin isn’t just trying to prove itself anymore. It already has.