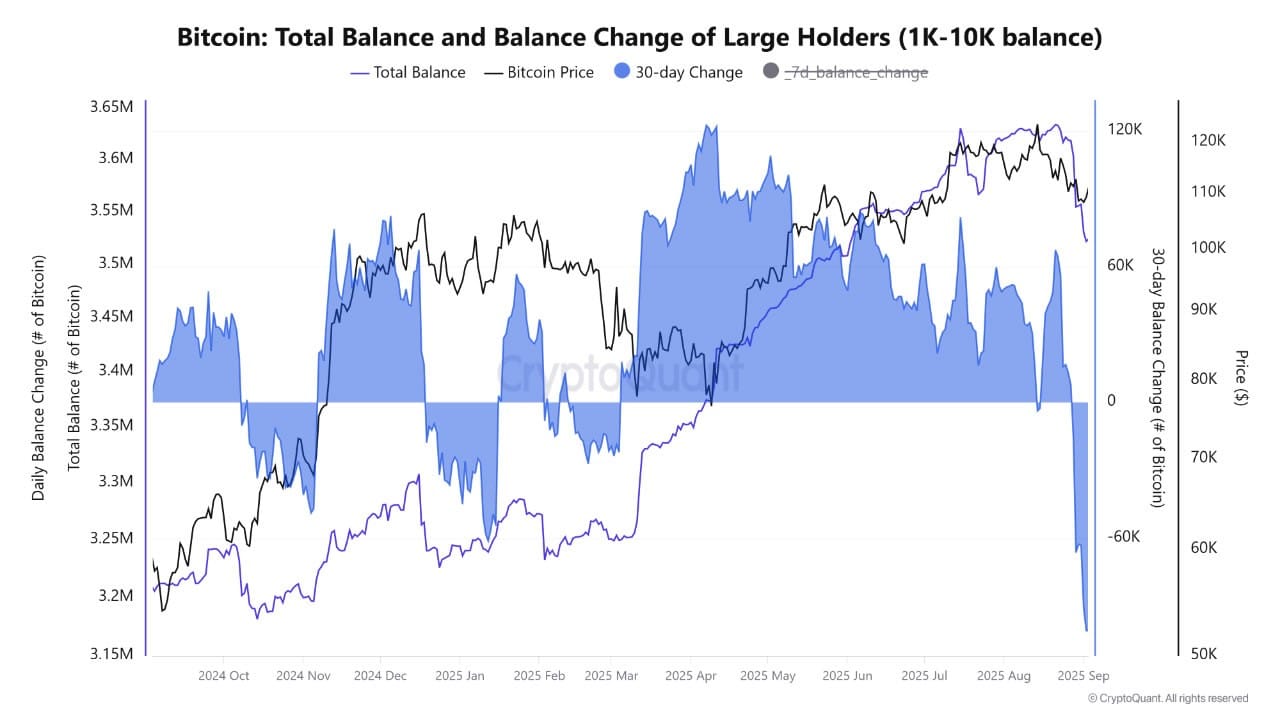

Bitcoin (BTC) pushing past $112,000 should feel like a win, but the vibe in the market says otherwise. The jump came right after whales unloaded a mountain of BTC, the heaviest selling since 2022, and it’s left traders more nervous than excited.

We’re talking about roughly 115,000 BTC offloaded in a month, worth around $12.7 billion. That kind of pressure cracked the price down to $108K before it clawed back. And if the selling keeps up, it’s hard to imagine BTC sprinting higher anytime soon. If you’ve been around crypto long enough, you know what heavy whale activity usually means: volatility.

At the same time, Bitcoin hasn’t kept pace with other risk assets. The S&P 500 and gold both hit fresh all-time highs of 6500 and $3600, respectively, while BTC lagged. Weak labor market data in the U.S. added another layer of uncertainty, reinforcing expectations of monetary easing but not necessarily fueling crypto in the way many traders hoped.

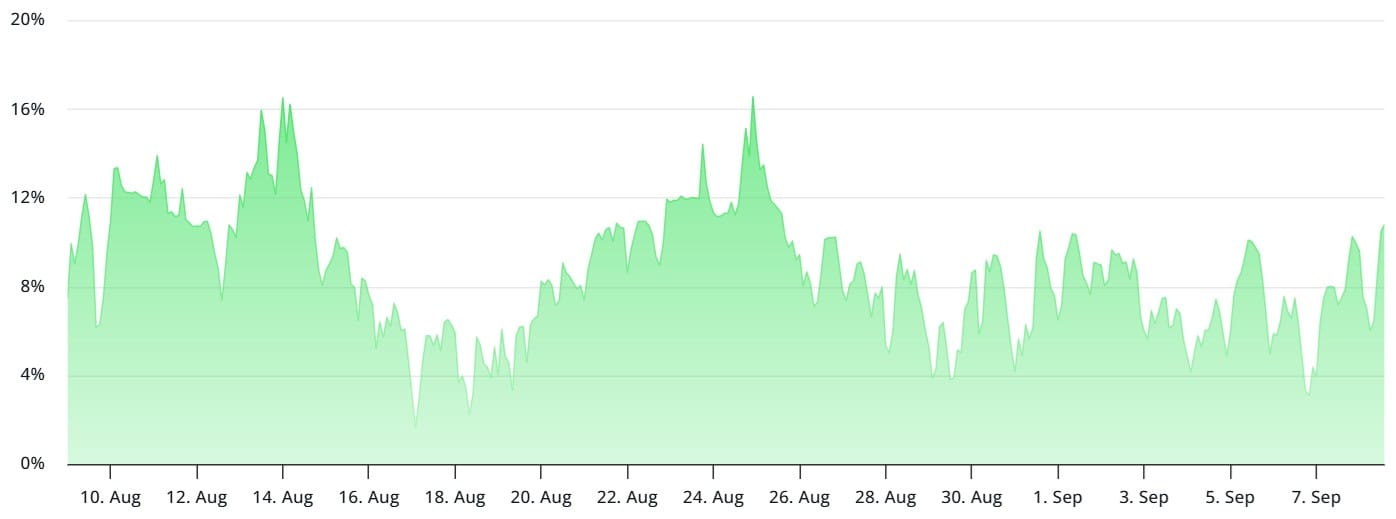

But the real story here and the reason traders are still hesitant is what’s happening with ETF flows. Between Thursday and Friday, spot Bitcoin ETFs recorded $383 million in outflows. For context, ETF flows have become one of the strongest gauges of institutional sentiment toward BTC. Outflows don’t just signal less demand; they also weigh on price because large-scale selling often follows redemptions. Meanwhile, Ethereum is stealing some of the spotlight. ETH ETFs saw around $200 million in inflows last week, with some companies even adding Ether to their corporate reserves, according to StrategicETHReserve data. That’s a subtle but important shift; capital isn’t leaving crypto altogether, it’s rotating. ETH is starting to look like a serious alternative reserve asset, and institutions are paying attention. Futures data isn’t giving much away either. Funding rates bounced back to 11%, a rebound from the bearish 4% level earlier in the week. which basically means traders are on pause. No one’s leaning bullish or bearish; they’re watching ETF flows and waiting to see whether BTC shakes this off or if ETH keeps eating into its dominance.

So where does that leave us? A clean break toward $120K feels unlikely until Bitcoin ETFs stop bleeding. But this market can flip fast. If whales ease off and ETFs turn green, BTC could recover its momentum. Until then, the safer read is that traders are keeping their powder dry (available capital in highly liquid assets like stablecoins or cash, ready to be deployed).

What about you? Do you see these ETF outflows as just noise before another leg up, or does it look like ETH is starting to steal the show? Drop your thoughts below.