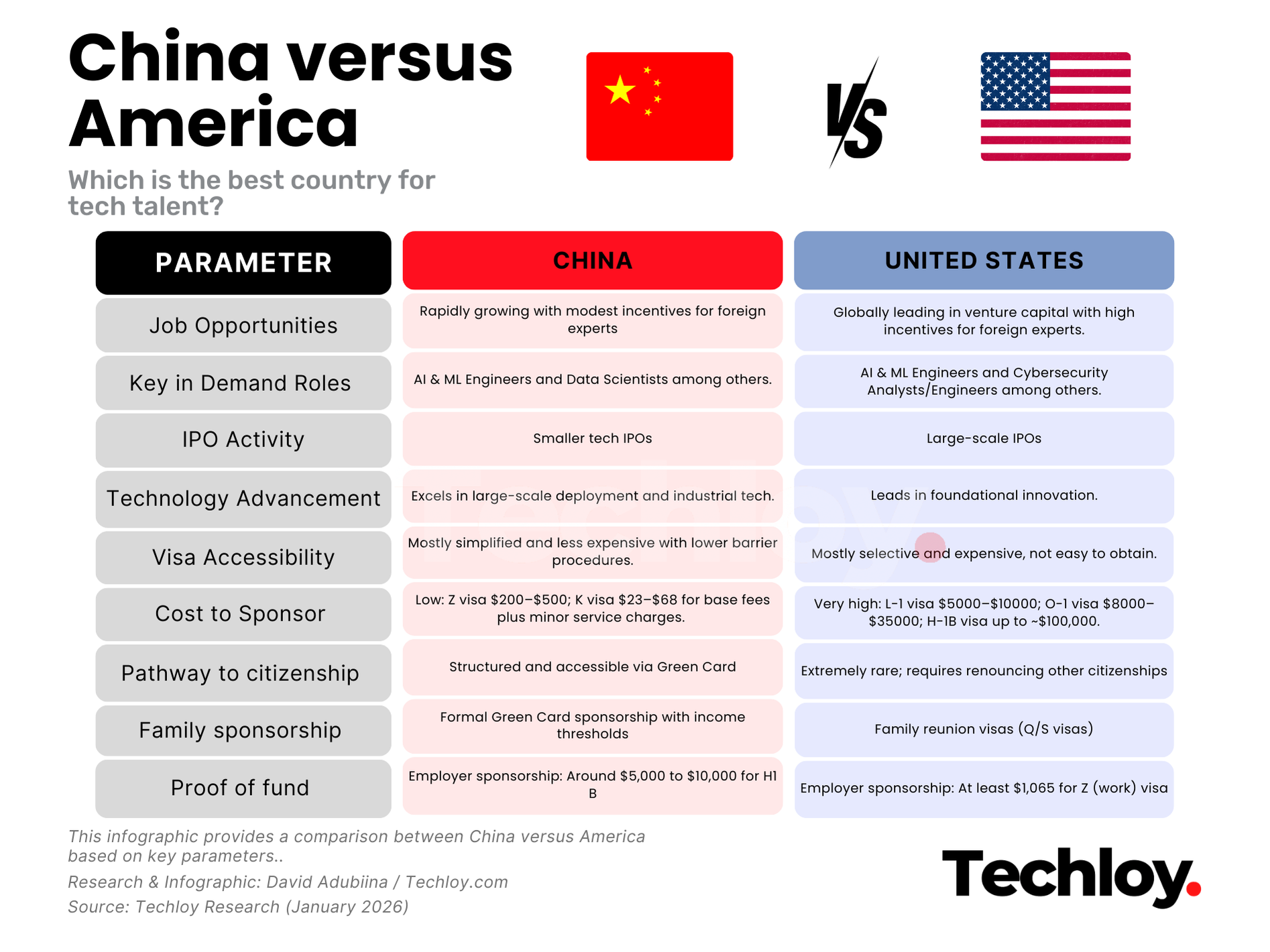

It might sound like a cliché to compare the U.S. and China, two of the world’s biggest economies, but recent tensions over tariffs—and, most of all, immigration policies—make the comparison more relevant than ever.

For tech professionals, factors like accessibility, cost, and long-term opportunities often determine where they build their careers. Take the U.S. H-1B visa, for example, which, under President Donald Trump, now costs companies up to $100,000 in fees to hire tech talent, creating a significant barrier for both employers and foreign talent.

China, on the other hand, saw this as an opportunity and introduced alternatives like the K visa, designed to attract skilled professionals more easily and signal a strategic push to bring global tech workers into its growing ecosystem.

With this context in mind, the real question becomes which country offers more opportunities for tech professionals today.

Looking at job access, IPO in the leading tech industry, technology advancement, ease of getting a visa, and the costs, we decided which country was best for tech talent.

U.S. vs China: Where Tech Careers Really Pay

Both the U.S. and China offer similar but distinct job opportunities for tech talent, with both countries prioritising specialised skills in artificial intelligence (AI), cybersecurity, and advanced technologies.

According to Glassdoor, top US companies like Meta, Google, Apple, and Nvidia pay roughly around $200,000 to over $400,000 annually to AI engineers and cybersecurity experts, and around $200,000 to $300,000 in total compensation for data scientists/analysts annually. However final package varies based on location and experience.

As for China, top companies like Baidu, Alibaba, Tencent, ByteDance (BAT+B), and NVIDIA pay AI Engineers and Specialists significantly, with annual salaries often ranging from CN¥300,000 to over CN¥1,000,000 (roughly $42,000 - $140,000+), which varies greatly by role and experience.

Specialized positions such as research and development(R&D) engineering managers in new electric vehicles (EV), semiconductors, and advanced manufacturing sectors earn from approximately CN¥500,000 to over CN¥2,000,000 ($71,600 to $286,000), with top total compensation packages reaching even higher amounts.

In essence, the U.S. leads in pay scale and established roles, while China offers competitive compensation in niche areas and the chance to work on innovative projects. For tech talent, the choice often comes down to whether they prioritize higher salaries or the opportunity to shape the future of emerging technologies.

Follow the Money: IPOs and the Strength of Each Tech Ecosystem

In terms of raw numbers, some of the largest IPOs in the U.S. include Alibaba’s $21.8 billion debut, Visa’s $17.4 billion, Meta’s $16 billion, and General Motors’ $15.8 billion offering.

In China, the scale hasn’t quite matched the biggest U.S. deals in recent years, but it has also seen its share of growth. The world’s largest electric vehicle battery maker, Contemporary Amperex Technology Co. Ltd. (CATL), raised about $4.6 billion in its Hong Kong IPO, drawing strong global investor interest.

Chinese AI and semiconductor companies are also hitting the public markets, with MiniMax Group raising roughly $620 million and Zhipu AI around $558 million in their Hong Kong listings, reflecting surging capital flows into next‑generation tech.

Generally, looking at the numbers, the U.S. by far has the largest IPOs, which translates into more capital for scaling operations and aggressive hiring, ultimately leading to higher-paying job opportunities than China currently offers.

Who’s Winning the Innovation Race?

When it comes to technology advancement, aside from Japan and South Korea, China increasingly holds the edge in overall tech innovation across the board, particularly in areas like AI software, cloud computing, advanced manufacturing, and applied research.

According to reports from U.S. News, China now leads or competes strongly in the majority of emerging technology fields, driven by scale, speed, and sustained investment.

Meanwhile, the U.S. remains a dominant force in foundational innovation and early-stage research. American tech advancement is fuelled by deep private-sector R&D, venture capital, and world-class institutions like MIT, Stanford, and Berkeley.

The U.S. continues to lead in core AI research, software platforms, cloud services, biotech, cybersecurity, and emerging fields such as quantum computing and advanced robotics.

Rather than a clear winner, the landscape now reflects a competitive race, with China excelling in large-scale deployment and industrial tech, while the U.S. maintains strength in breakthrough research and platform-level innovation. Both markets are sure to challenge tech talent looking for opportunities to be part of cutting-edge technological advancements. However, it is in China that your work is most likely to hit the streets quicker.

Getting In the Door: Visa Costs and Accessibility Compared

Looking at the U.S L-1, O-1, and H-1B visas in comparison to China’s Z and K visas as reference points, the contrast in visa accessibility is very clear. China has moved quickly in recent years to lower entry barriers, expanding visa-free transit options, and easing short-term access for many nationalities, including U.S. citizens. These changes support a broader push to revive tourism while positioning China as a more welcoming destination for foreign professionals and skilled tech workers.

Meanwhile, the U.S. visa system remains more selective and costly, particularly for tech talent relying on the L‑1, O‑1, and H‑1B routes. The L‑1 visa, used for intra-company transfers, involves a base I‑129 petition fee of $1,385 (or $695 for small/nonprofit employers), a $500 fraud-prevention fee, a $600 asylum program fee (for larger employers), plus $4,500 for large employers under Public Law 114-113. DS‑160 consular processing costs add around $205, and optional premium processing is another $2,805.

The O‑1 visa—targeting individuals with extraordinary ability- carries a $1,055 I‑129 filing fee (reduced to $530 for small/nonprofits), a $205 DS‑160 fee, and the option of $2,805 premium processing. Legal fees often range from $5,000 to $15,000.

For the H‑1B visa, essentials include new entry fee of $100,000, a $215 registration fee, $780 principal filing fee (or $460 for small/nonprofits), training fees of $750–$1,500, a $4,000 Public Law 114-113 employer fee, a $600 asylum program fee (or $300 for small employers), a $500 fraud-prevention fee, plus a $2,805 premium processing option.

In comparison, China’s Z (work) visa usually costs around $200 and $500 in total government fees. And as for the new K visa, designed for young STEM professionals, it comes in at approximately $200 total.

How Hard Is It to Become a Citizen?

For both China and the United States, the pathway to citizenship is often through naturalization, but the requirements and accessibility differ significantly.

In China, naturalization is highly selective and rare for foreign nationals. Applicants must renounce any other nationality, as China does not recognize dual citizenship. Eligibility typically hinges on close family ties to Chinese nationals, long-term residence with proof of integration (such as stable income of about $1,065 per month, tax contributions, and Mandarin proficiency), or exceptional contributions in fields like science, culture, or economics.

Citizenship by descent is possible if at least one parent is Chinese, though conditions apply for children born abroad.

The United States, by contrast, offers a more structured and widely accessible process. Most immigrants pursue naturalization after becoming Lawful Permanent Residents (Green Card holders) for five years or three years if married to a U.S. citizen. The process involves filing Form N-400, passing English and civics tests, demonstrating good moral character, and taking the Oath of Allegiance. While other routes exist, such as birthright citizenship or military service provisions, naturalization remains the primary pathway for foreign-born residents.

Bringing Your Family Along: Sponsorship Rules Explained

In China, family sponsorship typically involves obtaining specific visas—Q1/Q2 for relatives of Chinese citizens and S1/S2 for family members of foreigners residing in China. These visas are designed for family reunions or visits and require an invitation letter from the sponsor in China, proof of relationship (such as birth or marriage certificates), and the sponsor’s ID or residence permit.

Q1 and S1 visas allow long-term stays of over 180 days, while Q2 and S2 visas are for short visits under 180 days. Applications are submitted through a Chinese Visa Application Service Centre, along with key documents like the inviter’s ID, kinship proof, and a detailed invitation letter.

In the United States, family sponsorship is more formalized and allows U.S. citizens or Lawful Permanent Residents (LPRs) to petition for eligible relatives to obtain a Green Card. This process falls under two main categories: Immediate Relative (with no wait time) and Family Preference (subject to visa caps and wait times).

It involves filing Form I-130, proving financial support of around $24,650 for a family of two through an Affidavit of Support (Form I-864), and completing either Consular Processing or Adjustment of Status, depending on the relative’s location.

The Money Question: Proof of Funds and Financial Barriers

If you’re applying for a U.S. work visa such as the H‑1B, there’s no fixed minimum bank balance requirement, but you must show you won’t become a public charge. Employer sponsorship covers most of this, yet applicants are expected to have enough savings for initial expenses like flights, housing deposits, and living costs, around $5,000 to $10,000 or more, depending on location and lifestyle. You’ll also need to provide evidence of your tech skills and a valid job offer, focusing on financial stability and ties to your home country rather than a set monetary threshold.

If, rather, you’re seeking a Z (work) visa in China, the financial requirement centres on employer sponsorship rather than personal funds. The key proof is a confirmed job offer with a salary of at least $1,065 and an employer-issued Work Permit Notification Letter. Unlike the U.S., there’s no formal personal bank balance requirement for the main applicant, making the process less financially demanding upfront.