China’s PC (desktop, notebook and workstation) shipments fell 13% in Q3 2022, while tablets were down 3% year on year as consumer demand weakens, Canalys reported.

Desktop (including desktop workstation) and notebook (including mobile workstation) shipments declined 31% and 3% respectively, as commercial demand was restricted by a slowdown in economic activity and weakened business confidence.

The consumer segment was also lacklustre ahead of the traditional peak season, and the channel’s outlook for “Double 11” sales in Q4 is pessimistic, with inventory levels elevated.

PC demand faltered as overall shipments fell 13% year on year, with the commercial segment down 17%. Consumer demand for PCs also remained weak, with shipments falling by 10%.

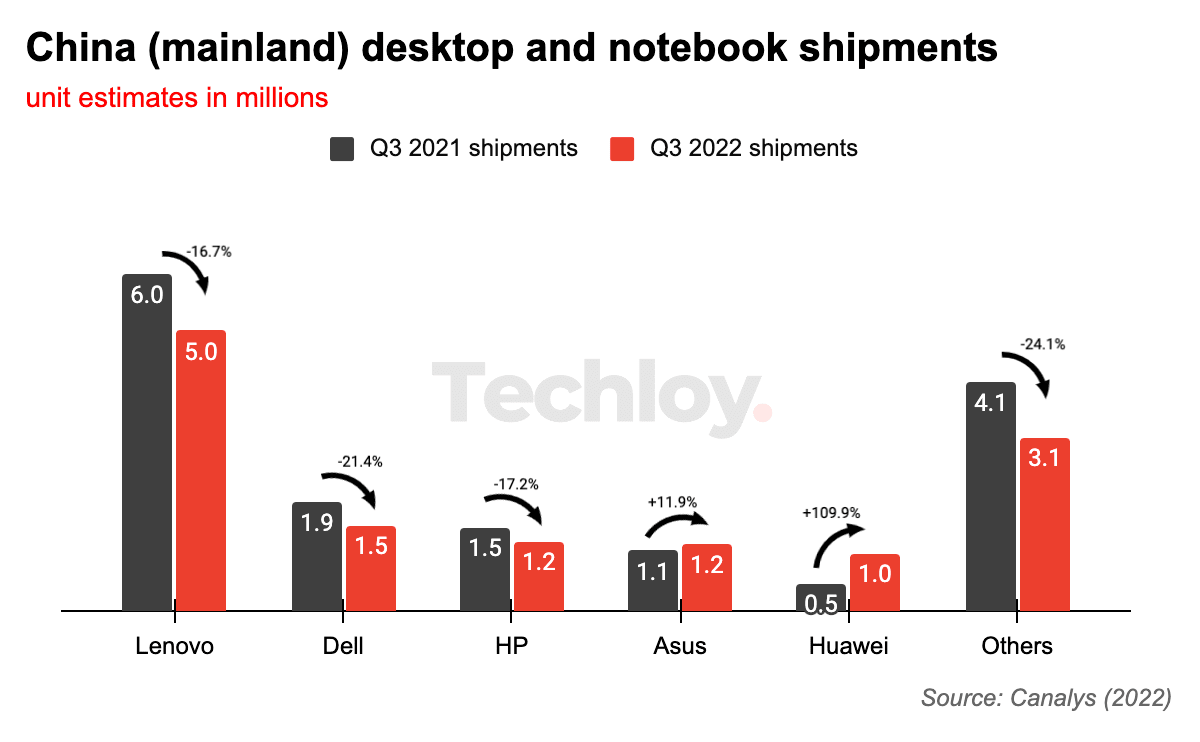

Lenovo topped the PC market in China, but its shipments dropped by 17%. Second-placed Dell experienced the worst year-on-year decrease among the top vendors, at 21%, due to its dependence on the commercial segment at a time when local businesses are still restructuring. HP took third place as it followed suit with a 17% decline in shipments. Asus and Huawei came fourth and fifth, growing both annually and sequentially, benefiting from strong promotions and marketing to consumers.

Meanwhile, in the tablet category, the consumer market was the only bright spot in Q3, with 18% year-on-year growth, saving the overall consumer segment from the massive decline seen in the commercial space.

Apple held onto first place in the tablet space with 33.6%, but its growth slowed to 7%, even as its iPad supply situation improved compared with Q2. Huawei came second with 15.7% and in third place was Lenovo with 9.7%. Both faced a comparatively difficult quarter, with double-digit declines as they were hampered by component constraints and a drop in commercial demand for tablets.

Fourth-placed HONOR enjoyed an astronomical 41% growth in Q3 to claim a 9.3% share. Xiaomi rounded out the top five tablet vendors, recording a 15% growth to a 7.9% market share.