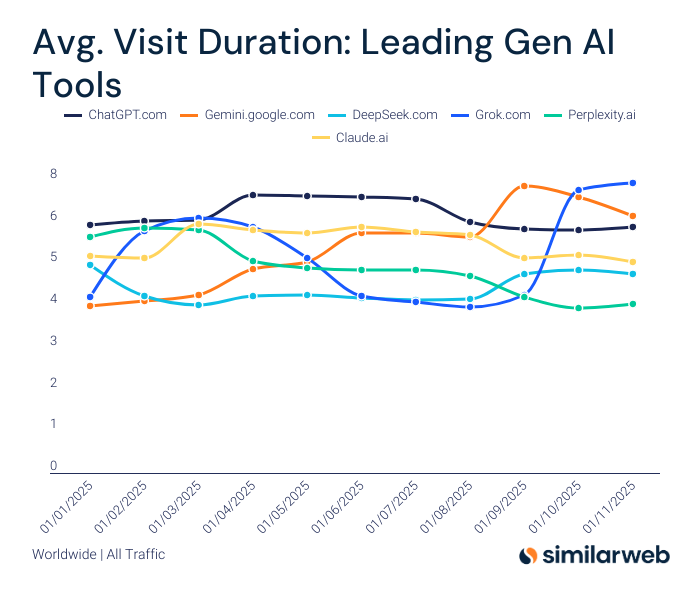

Users are now spending more time on Grok than any other AI platform. According to new data from Similarweb, xAI’s chatbot clocked nearly 8 minutes per session in November, roughly 33% longer than ChatGPT’s 6 minutes and ahead of every competitor in the space.

That shift happened fast. In September, Google Gemini briefly overtook ChatGPT in engagement time. Then, in October, Grok surged past both and has held the top spot for two consecutive months. The trend matters because how long people stay on a platform increasingly determines which AI tools become daily habits versus occasional experiments.

The overall market is also booming. Total visits to GenAI websites jumped 76% year-over-year, as these tools moved from tech curiosity to everyday necessity. More people are asking AI for help with everything from drafting emails to solving work problems, and that surge shows no signs of slowing. But the growth isn’t evenly distributed, and the competitive picture is more complicated than headlines suggest.

ChatGPT’s share has dropped from 87% to 68% over the past 12 months. Before anyone declares this a crisis for OpenAI, here’s the context: ChatGPT isn’t shrinking. The market is expanding so fast that competitors are capturing most of the new growth. It’s the difference between falling behind and watching the entire landscape expand.

Google’s Gemini is the perfect example of this shift, skyrocketing from 5% to 18% market share in just one year. What drove that growth? The launch of Gemini 3 and Gemini 3 Flash. These models put AI right where people were already looking for answers—inside Chrome, Android, Search, and Google WorkspaceWhen AI doesn’t require opening a separate app or remembering a new website, people use it more. That built-in advantage gives Gemini a structural edge that standalone platforms can’t easily match.

Grok operates differently. With just 3% market share, it’s nowhere near ChatGPT’s volume. But those 8-minute sessions reveal something critical: deep integration with X (formerly Twitter), real-time features, and conversational access to trending topics keep users engaged far longer. Grok isn’t trying to be everything to everyone—it’s building sticky, high-value interactions for a specific audience who want AI that feels wired into the flow of current events.

Here’s where the mobile picture complicates the narrative: ChatGPT has accumulated roughly 940 million lifetime app downloads compared to Gemini’s 200 million. That massive mobile footprint doesn’t show up in browser-based traffic reports, meaning ChatGPT’s actual reach remains far larger than web metrics suggest. Similarweb’s data captures desktop and mobile web usage but misses the in-app activity that defines how millions of people actually use ChatGPT daily.

Claude and Perplexity continue carving distinct niches—Claude for complex reasoning and document analysis, Perplexity for citation-based search—each maintaining steady 4-5 minute average sessions. They’re not competing for volume; they’re competing for specific use cases where depth matters more than reach.

What we’re watching isn’t a winner-take-all race anymore. The AI market is maturing into something more nuanced, where different platforms excel at different tasks and users are learning which tool fits which need. ChatGPT still dominates in raw numbers, Gemini wins on convenience, Grok wins on engagement, Claude wins on complexity and Perplexity still wins on research.

The real competition now: which platforms can convert casual users into daily dependencies? That 76% growth in overall traffic means millions of new people are forming AI habits right now. Where those habits solidify will determine who leads the next phase of this race. And if recent trends hold, the answer won’t be as simple as “whoever got there first.”