The Fed’s quarter-point rate cut on December 10 lowered the benchmark rate to a range between 3.5% and 3.75%. In previous cycles, a move like this often sent crypto into a breakout, but this week the market barely reacted. Instead of the usual “buy the rumor, sell the news” surge, traders mostly stayed cautious.

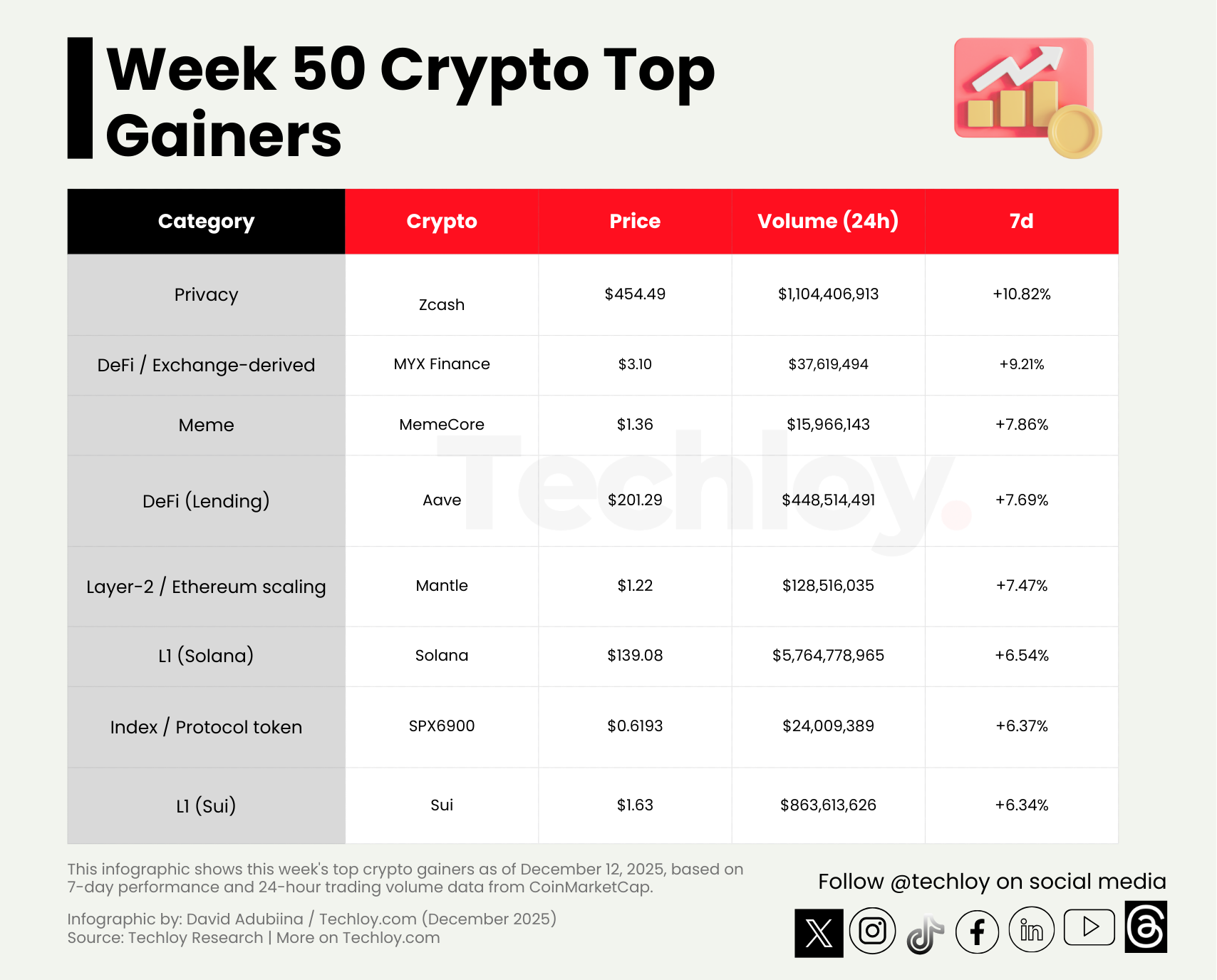

Even in this quiet environment, a few tokens still posted notable gains. Zcash led the week with a rise of 10.82% as liquidity returned to older privacy-focused assets. MYX Finance followed with a 9.21% climb on steady volume, despite limited movement across the broader DeFi space. MemeCore added 7.86%, driven by typical meme-coin volatility but holding firmer than expected.

Aave rose 7.69% as lending activity improved across major chains. Mantle was next at 7.47% as interest in its ecosystem picked up. Solana gained 6.54%, continuing to prove its ability to stay relevant even when sentiment is flat.

SPX6900 and Sui added 6.37% and 6.34% respectively. Bonk rose 6.05% as meme traders remained active, and Ethena closed out the list with a 6% gain, suggesting demand for yield-based synthetic assets remains steady.

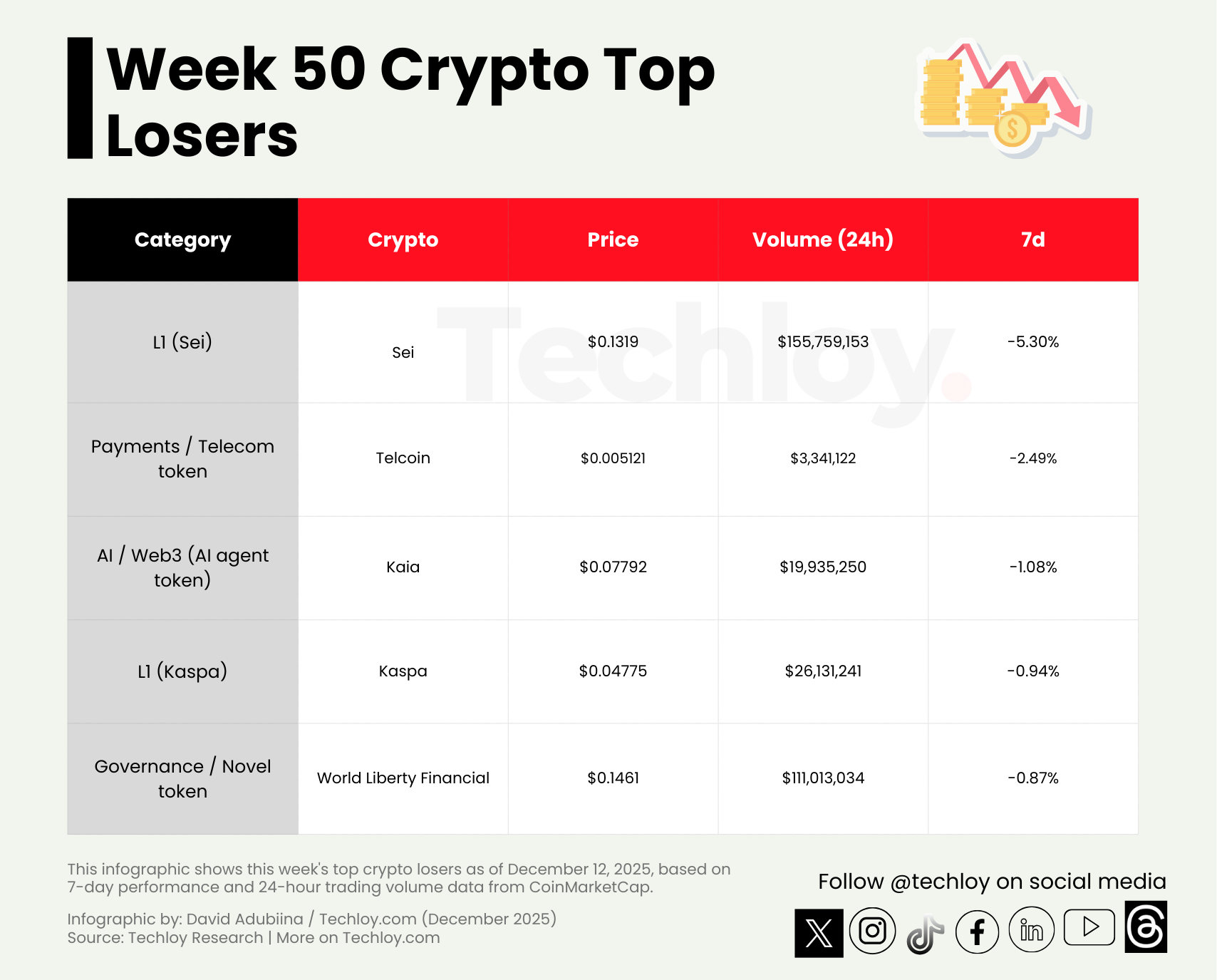

Losses were milder. Sei posted the biggest drop at 5.30% as its recent rally cooled. Telcoin fell 2.49%. Kaia and Kaspa slipped 1.08% and 0.94% in what looked more like natural consolidation than real sell pressure. World Liberty Financial dipped 0.87% without any significant shift in fundamentals.

Despite the market’s overall hesitation, the gap between this week’s top gainers and losers shows that pockets of momentum are still forming. Traders may not be rushing in, but the market is quietly rearranging itself around new narratives and smaller rotations.