If there's one thing about recurring trends, it’s that they are like a map that shows you where the big money is, and this is similar to what Argentina is currently doing.

According to recent reports, Argentina pulled ahead as Latin America’s top crypto hub, edging past Brazil and even El Salvador (the Latin American country that made Bitcoin legal tender).

Now, nearly 1 in 5 Argentinians owns some form of cryptocurrency. That’s roughly 20% of the population, higher than Brazil’s 18.6% and El Salvador’s 14.6%. Going by the total population of 46.2 million people across the country, around 10 million people are now holding crypto.

The Recurring Trend

You could call it a recurring trend because this isn’t the first time Argentina has pulled ahead of other LATAM countries.

Between July 2023 and June 2024, the country saw about $91 billion in crypto inflows, slightly above Brazil’s $90 billion, according to Chainalysis.

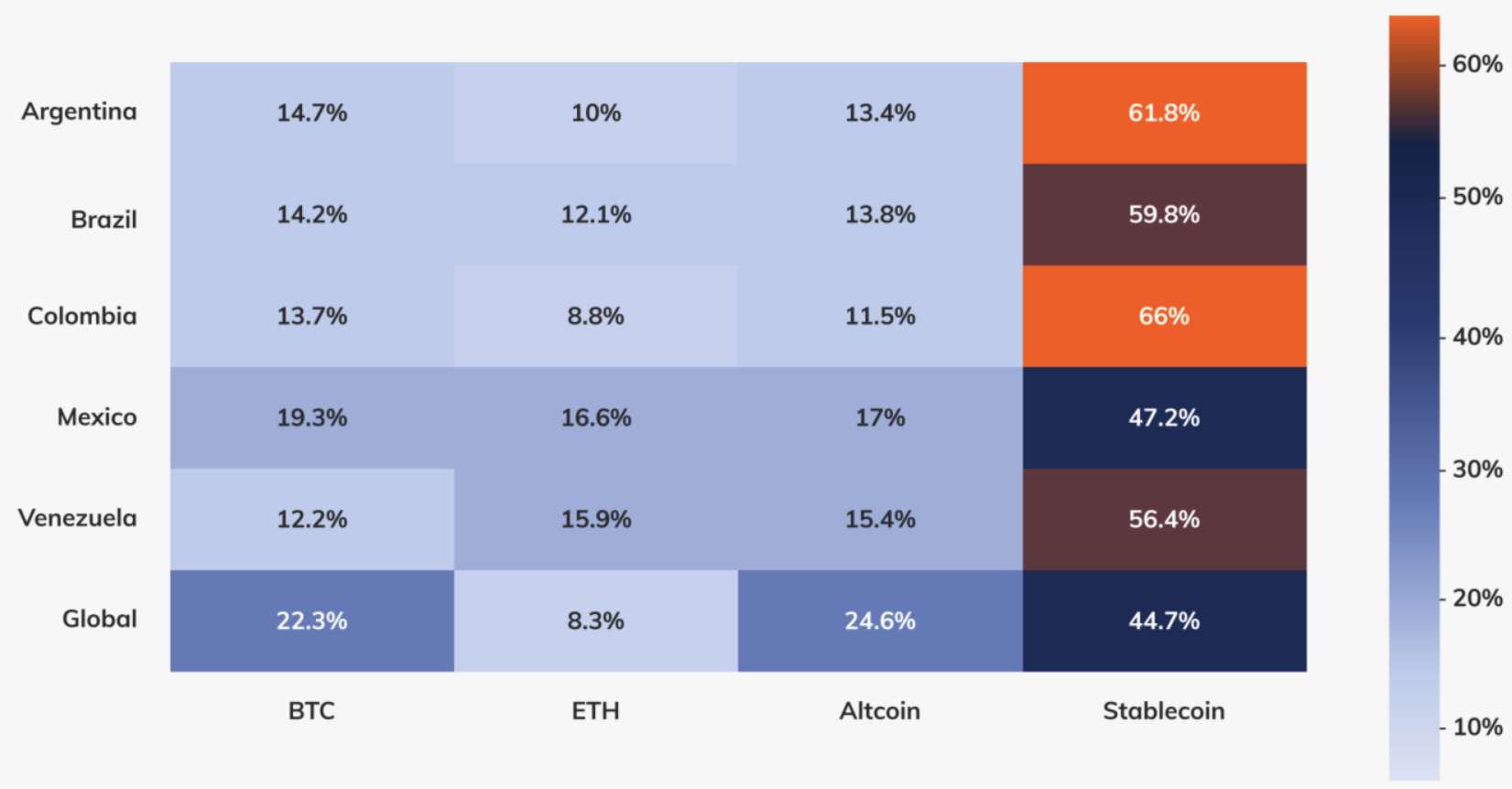

And that is just on stablecoins alone. You can imagine what the numbers would be like for digital assets in total. More so, over 61.8% of Argentina’s crypto activity involves assets pegged to the U.S. dollar, compared to 59.8% in Brazil and just 44.7% globally.

Why Argentina?

The South American country overtaking others is not surprising. Years of hyperinflation, a rapidly devaluing peso, and strict capital controls have made crypto, especially stablecoins, a practical way for Argentinians to protect their savings and make cross-border payments.

So, if you are holding USDT or USDC, you are practically hedging over inflation as a means of financial survival.

A Hotbed for Fintech Innovation

This growing crypto adoption is also fueling fintech growth in Latin America, with Brazil seeing the highest number.

Local startups and international exchanges are rolling out new wallets, payment platforms, and DeFi tools tailored to a market that’s already comfortable with digital assets.

Aside from local and international businesses doing their part, regulators are starting to catch up too, introducing virtual asset service provider (VASP) registration and clearer crypto guidelines.

Conclusion

It is clear that crypto adoption in these countries indicates a turning point in Latin America’s financial space, one where digital assets are becoming a mainstream alternative to traditional banking.

If this pace continues, the country could remain the region’s crypto trendsetter for years to come, shaping how the rest of the continent approaches digital finance.