If you’ve been in crypto for a while, hodling a few coins, you’ve probably caught yourself checking the charts time and time again, thinking: “How far am I from breaking even?” or “When is this coin going back to its peak?” It’s a common thought most crypto holders have, especially if you bought near the top or held through the market crash. And while nobody can predict when a coin will hit a new all-time high, one thing you can measure is how far it currently sits from that peak. That distance gives you perspective. It tells you whether you’re holding a coin that’s already bounced back, or one that’s still deep in recovery mode. It also helps you figure out if the hype matches the actual performance.

In this article, we will take a look at where some of the biggest names in crypto currently stand compared to their all-time highs, and how close (or painfully far) your favourite bags really are.

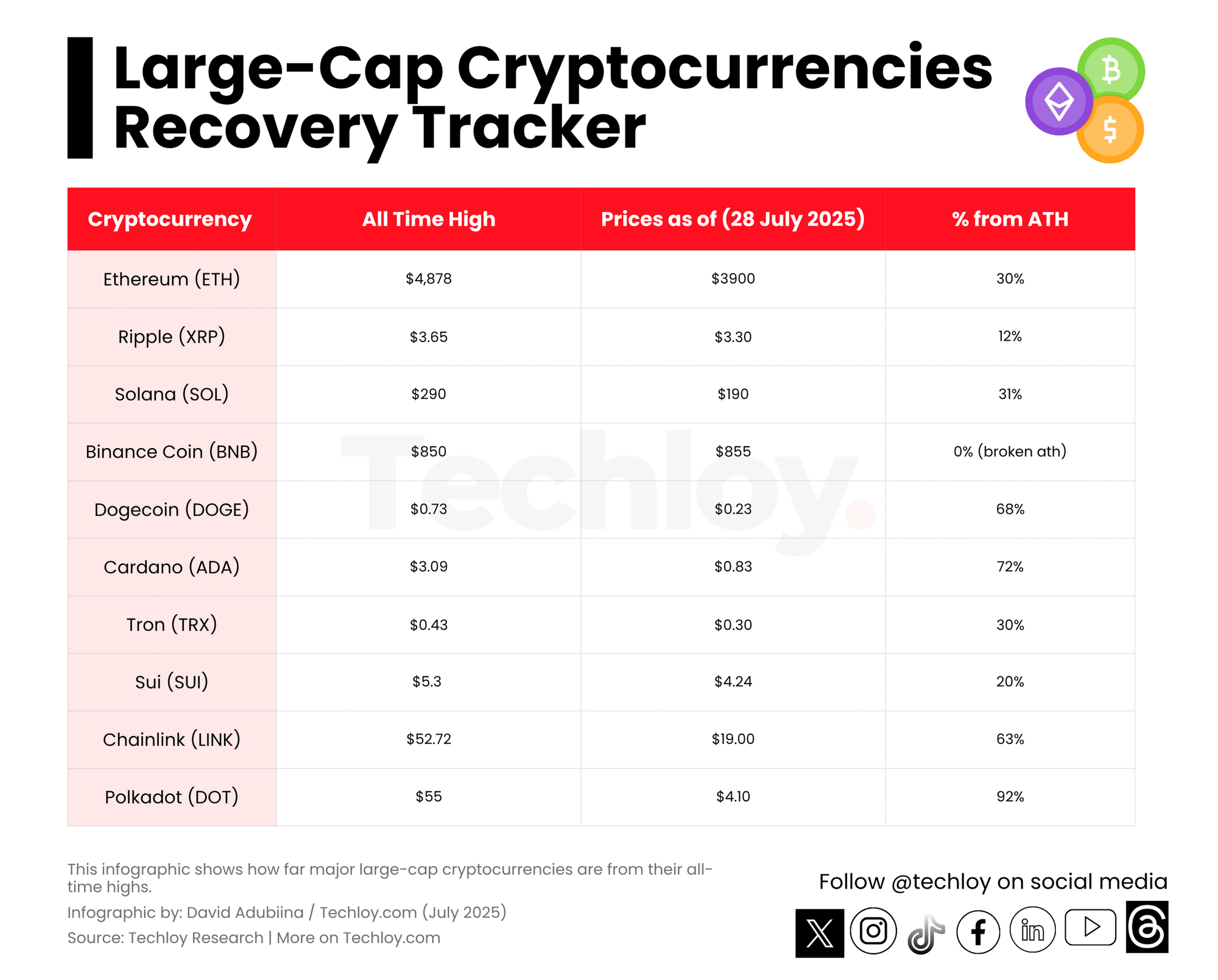

1. Ethereum (ETH)

Ethereum has come a long way from its post-FTX lows, thanks to inflows from ETFs, though it’s yet to see the kind of massive inflows we saw with Bitcoin. The buzz around spot ETH ETFs and staking has helped push it above $3K, but it’s still about 30% below the 2021 peak.

2. Ripple (XRP)

Despite its long legal battle with the SEC—which it mostly won—XRP finally broke past its 2018 high of $3.40, hitting a new all-time high of $3.65. Right now, it's trading around $3.20, which puts it roughly 12% below its ATH.

3. Solana (SOL)

As one of Ethereum’s top challengers, SOL has pulled off one of the strongest comebacks, thanks to product launches like its meme coin launchpad and the Solana Seeker mobile. While it still hasn’t broken its previous all-time high of $290, it’s not far off, currently pushing toward the $200 mark again.

4. Binance Coin (BNB)

BNB has proven to be one of the most stable major coins, recently breaking its previous all-time high of $720 and hitting a new peak at $855. This strength comes despite regulatory pressure across several countries. A big part of BNB’s momentum stems from surging activity on its chain, daily DEX volume recently hit $3.936 billion, surpassing Ethereum by over $1.5 billion. Institutional interest has also played a role, with Windtree Therapeutics establishing a $520 million BNB treasury fund. On top of that, network growth has been explosive, with over 180,000 new BNB addresses created in a single day, a 62% jump in wallet adoption.

5. Dogecoin (DOGE)

The meme coin king still hasn’t reclaimed its Elon-fueled high of $0.73, a tough milestone to reach again, especially with stiff competition from newer tokens like Bonk, Pepe, and Shiba Inu. Right now, DOGE is trading around $0.23, which means if you bought anywhere near the top, you’re still sitting deep in the red.

6. Cardano (ADA)

Despite multiple upgrades and a loyal community behind it, ADA has yet to revisit its all-time high of $3, largely due to consistently low developer activity on the network. Still, strong technicals suggest ADA isn’t out of the race just yet. It’s currently trading around $0.83, which puts it roughly 72% below its ATH.

7. Tron (TRX)

TRX has been steady, though not exactly spectacular. Its role in stablecoin transfers gives it real utility and keeps it firmly in the top 10, but it hasn’t sparked much investor excitement lately. That said, it’s held up better than many older altcoins, currently trading at $0.30, which is about 30% below its all-time high of $0.43.

8. Sui (SUI)

As a Layer 1 contender often compared to Solana, Sui has caught the attention of both investors and users for its speed and developer-friendly infrastructure. Currently trading around $4, SUI is one of those coins many are watching closely as it eyes a potential break above its ATH of $5.30.

9. Chainlink (LINK)

LINK’s importance in DeFi as the leading oracle hasn’t changed, but price-wise, it’s yet to see the same love this cycle. While it’s up from its lows of $9, it is still a long way off that 2021 peak of $52.

10. Polkadot (DOT)

DOT’s drawdown is one of the deepest among large caps. It hasn’t benefited much from current market trends.

While Polkadot remains a leading blockchain for interoperability and has a strong developer community, its price has been impacted by broader cryptocurrency market trends and its own unique factors of parachain implementation and adoption.

Conclusion

Looking at these numbers, it’s clear that not all coins recover the same way, or at least the same pace. Some like BNB are already writing new records, while others like DOT and DOGE, are still trying to find their footing in this cycle. But that’s the nature of crypto: it moves in waves, and each coin has its own narrative, momentum, and moment.

If you’re holding bags from 2021, you’re probably still underwater on a few. If you’re just entering now, the question becomes, are these prices the dip… or just a pause before the next leg up? Regardless, It still boils down to understanding which projects are still building, which ones have real traction, and which ones are just riding hype.

Because in crypto, history rarely repeats, but it often rhymes.