Since earlier this year, investors have been waiting for the Fed to finally cut rates. The U.S. labor market has been cooling, and many felt it was only a matter of time before the central bank made a move.

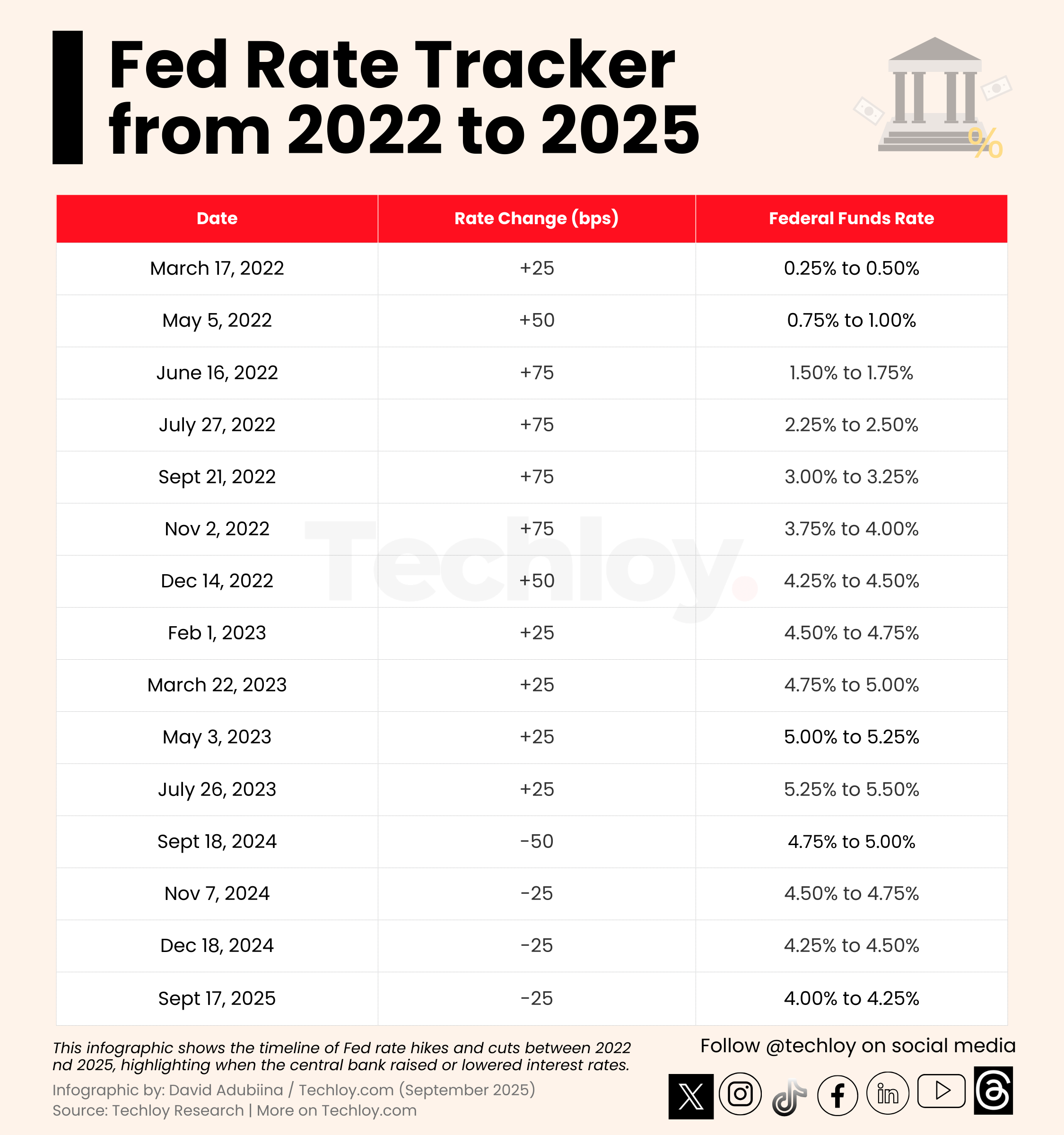

It happened recently: for the first time since December 2024, the Fed dropped its target interest rate to a range of 4% to 4.25%. The goal is to stimulate the economy and avoid a recession. It also happens to line up with President Trump’s push for cheaper borrowing.

You’d expect things to instantly stabilize, but in the long run, it usually does. However, the short-term impact on crypto is another story with potential for persistent inflation. To see why, we need to rewind a bit.

What’s a Fed Rate Cut?

Put simply, a Fed rate cut is when the central bank lowers the short-term rate banks use between themselves. Once that falls, loans get cheaper, and before long, you feel it in the broader economy too. Businesses can take loans at lower costs, consumers can spend more, and investors usually get a little braver with their money.

The Fed doesn’t do this for fun but to keep growth alive when the economy slows or looks like it might tip into a recession.

What Do Interest Rates Do to Crypto?

When rates go up, crypto tends to suffer. Here’s why:

1. Reduced risk appetite

When rates climb, people get less hungry for risk. Why throw money into Bitcoin if a government bond is paying you 10% with no drama? This makes investors pull money out of risk assets.

2. Higher opportunity cost

Holding crypto suddenly feels expensive when other assets start paying solid interest. Every dollar in Bitcoin is a dollar not earning elsewhere.

3. Margin calls and leverage pain

Crypto thrives on leverage. People borrow to buy more, chasing bigger gains. But when rates rise, loans get harder to service. If prices dip, margin calls kick in. Traders are forced to sell, which drives prices down even more.

We saw this play out in 2022. Rates climbed, Bitcoin dropped, and the knock-on effect led to collapses like Celsius and FTX.

So Why Do Rate Cuts Matter?

If higher rates impact crypto, making safe-haven assets like savings accounts and bonds more attractive, lower rates tend to do the opposite. Cheap money fuels risk-taking. When rates drop, Bitcoin suddenly looks a lot better. Cash isn’t paying much, bonds aren’t either, so money starts moving back into riskier plays. And since crypto trades 24/7, it usually reacts before everything else.

Historically, major rallies have lined up with periods of easier monetary policy. Think of 2020: stimulus checks, near-zero rates, and Bitcoin’s march from $10K to almost $70K.

How High Can Crypto Go This Time?

That’s the big question everyone’s asking. The Fed’s cut might be the fuel, but how far this rally runs depends on where investors decide to park their money.

If liquidity keeps flowing and ETFs continue pulling in billions, Bitcoin could make another run past its previous highs. Ethereum and altcoins would follow, riding the same wave. Some analysts argue a move to the $150K range for Bitcoin isn’t out of the question within this cycle.

Conversely, if the economy keeps weakening, even cheaper money might not be enough. Investors may stay cautious, holding cash instead of chasing crypto. In that case, we’d likely see sideways movement rather than real market rallies.

Then there’s also the middle lane, where a gradual rally occurs, with Bitcoin moving upward but without the insane parabolic moves of 2020–2021. This could still mean $120K+ Bitcoin, just with slower momentum.

Conclusion

Regardless, the Fed’s rate moves will keep playing a big role in where crypto heads next. In the short run, the effect might feel negative, but a steadier rate environment could open the door for long-term growth. Nobody can say for sure how this back-and-forth between the Fed and crypto will play out, but if you’re stepping into this space, it’s something you can’t ignore.

What do you think? Is this the start of something bigger, or just noise? Drop your thoughts in the comments.