Nigeria is tightening its tax system, and from January 1, 2026, having a Tax Identification Number (TIN) will no longer be optional. Under the new tax law, individuals and businesses will need a TIN to access a wide range of services, from banking and government transactions to business registration. Even everyday financial activities may soon require one.

Whether you’re a first-time taxpayer, a freelancer, or someone who has never needed a TIN before, getting registered now can save you a lot of stress later. It keeps you compliant with Nigeria’s changing tax rules and helps you avoid fines or administrative delays. The good news is that registration is now digital and straightforward, often taking just a few minutes using your BVN or NIN, all without leaving home.

5 steps to create your tax identification number in Nigeria

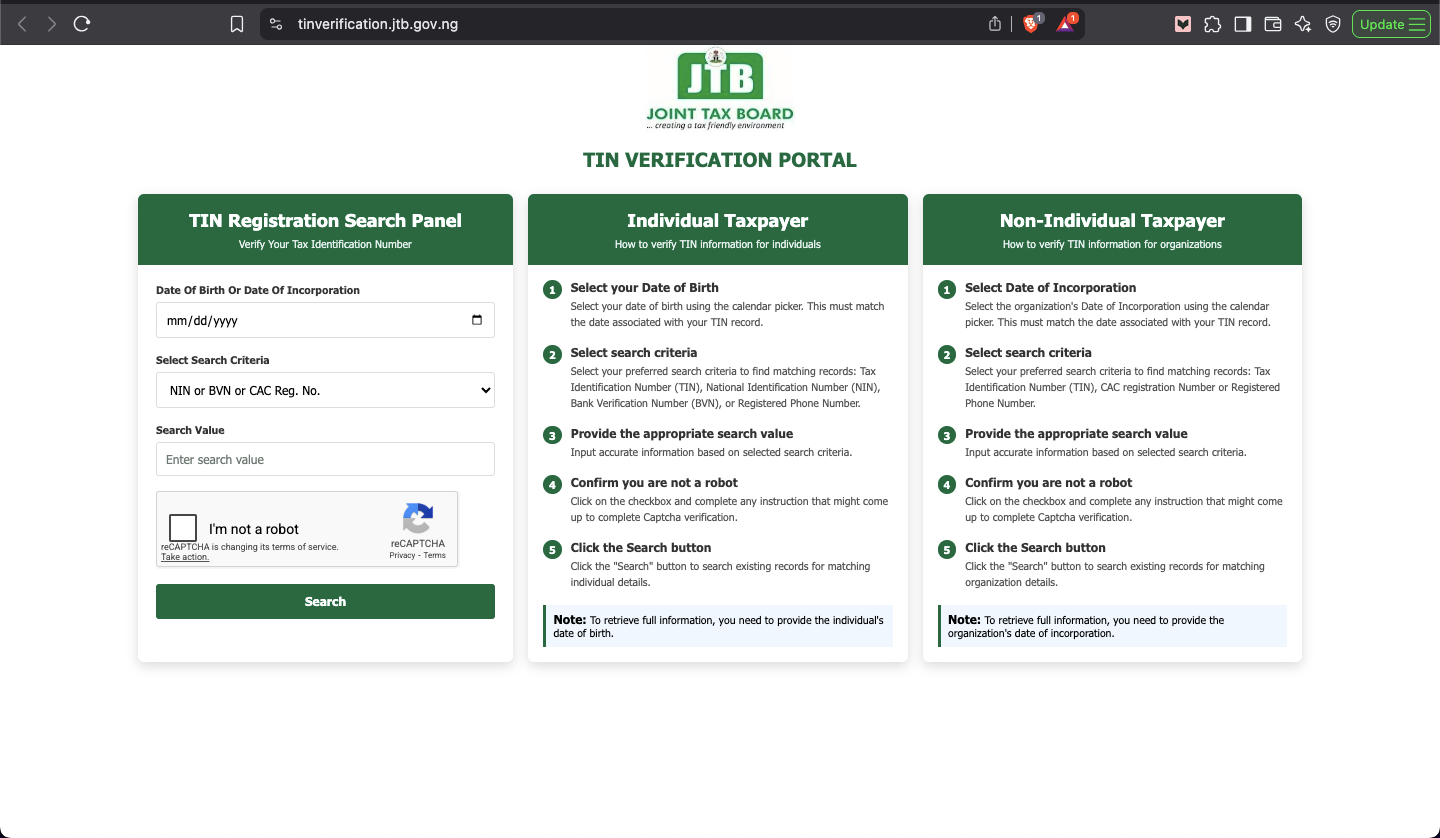

Step 1: Start by confirming whether you already have a TIN.

Use the TIN Verification Portal and enter your BVN (Bank Verification Number) or registered phone number along with your date of birth. If your TIN exists, you can move straight to printing or downloading your certificate.

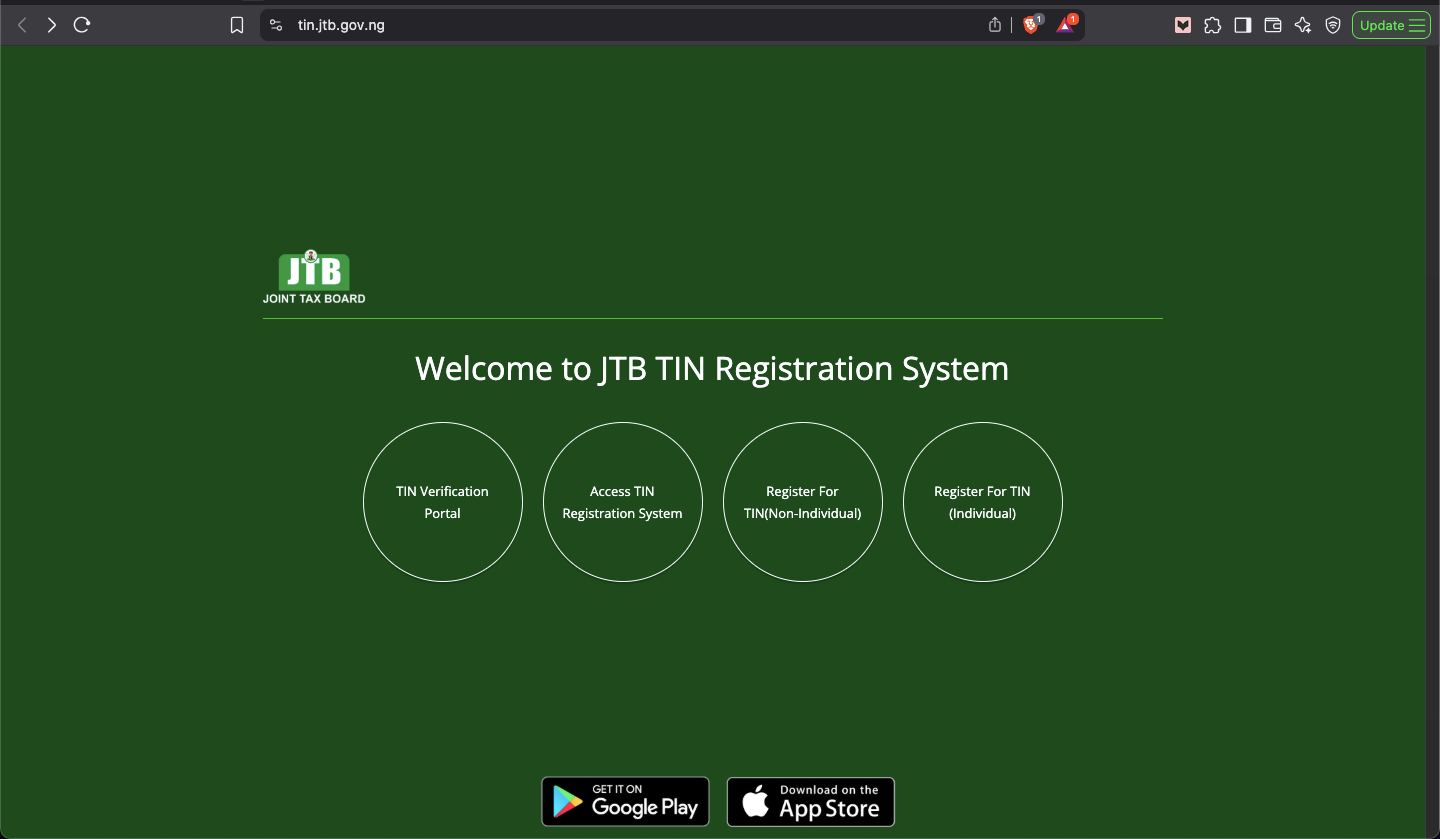

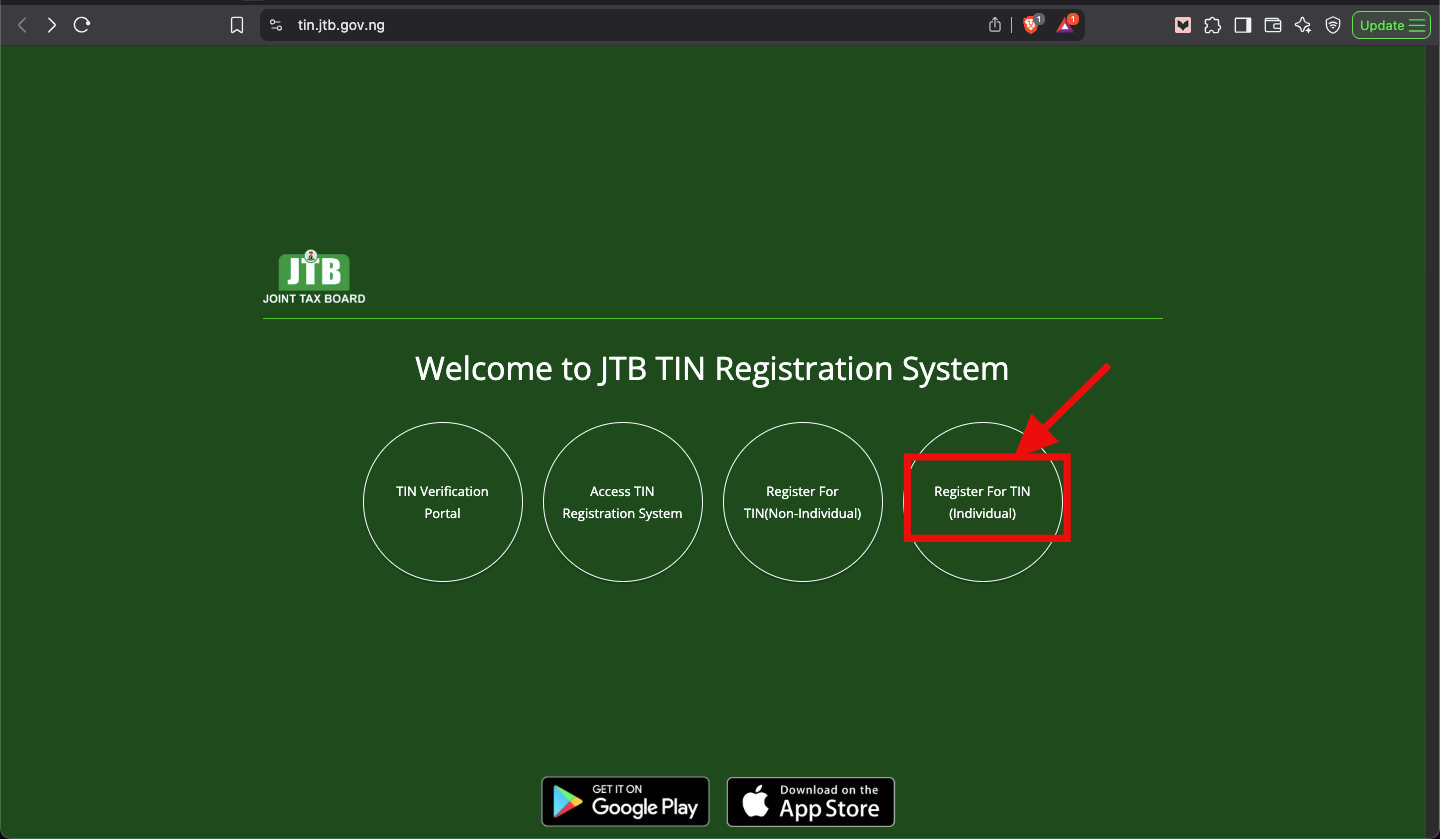

Step 2: If you don’t have a TIN, visit the JTB TIN Registration Portal or download the JTB mobile app. These platforms are designed to make registration straightforward and accessible.

Step 3: Choose “Individual TIN Registration” to begin the process tailored for personal taxpayers.

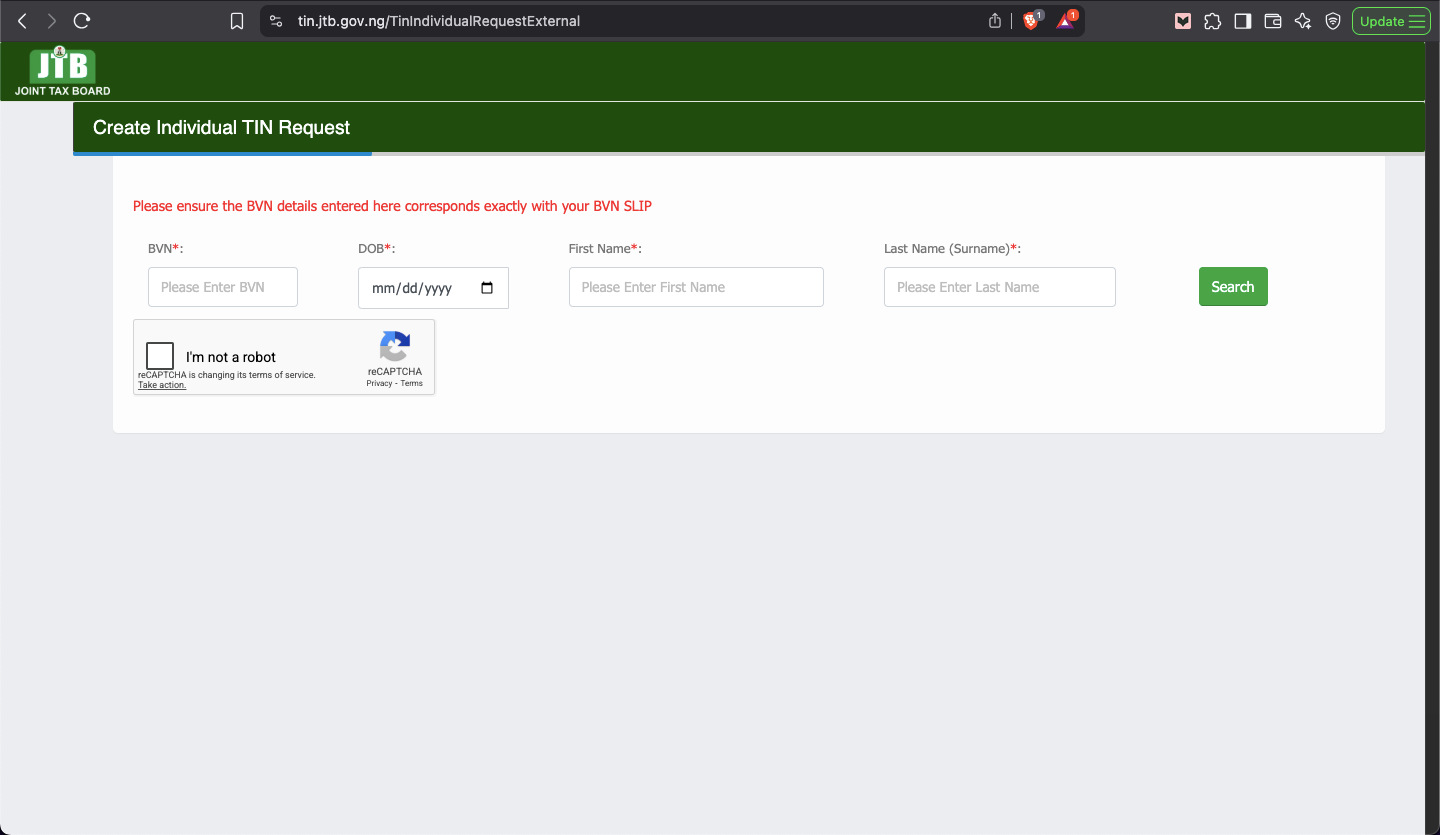

Step 4: Enter your personal details, which may include the following:

- BVN or NIN (National Identification Number)

- Date of birth

- First and last name

- Active email address

- Phone number

- Occupation

- Residential address

Step 5: Once submitted, your TIN certificate is typically sent to your registered email within minutes to a few days.

Step 6: Print or download your TIN certificate and submit it to the nearest Area Revenue Office for official documentation. This ensures your registration is formally recognised in the system.

Conclusion

With the new tax law on the horizon, securing your TIN is no longer just a formality, it’s a crucial step for financial compliance and peace of mind. The process is simple, fast, and now more important than ever. By following these steps, you’ll be ready for January 2026 and avoid unnecessary penalties or complications.