Latin American startups raised over $793 million this week, led by a surge of fintech, clean energy, and cross-border payment deals that continue to shape the region’s innovation landscape. While Brazil dominated the headlines thanks to a single mega-transaction, early-stage activity in Mexico and Colombia highlighted steady investor confidence across emerging tech sectors.

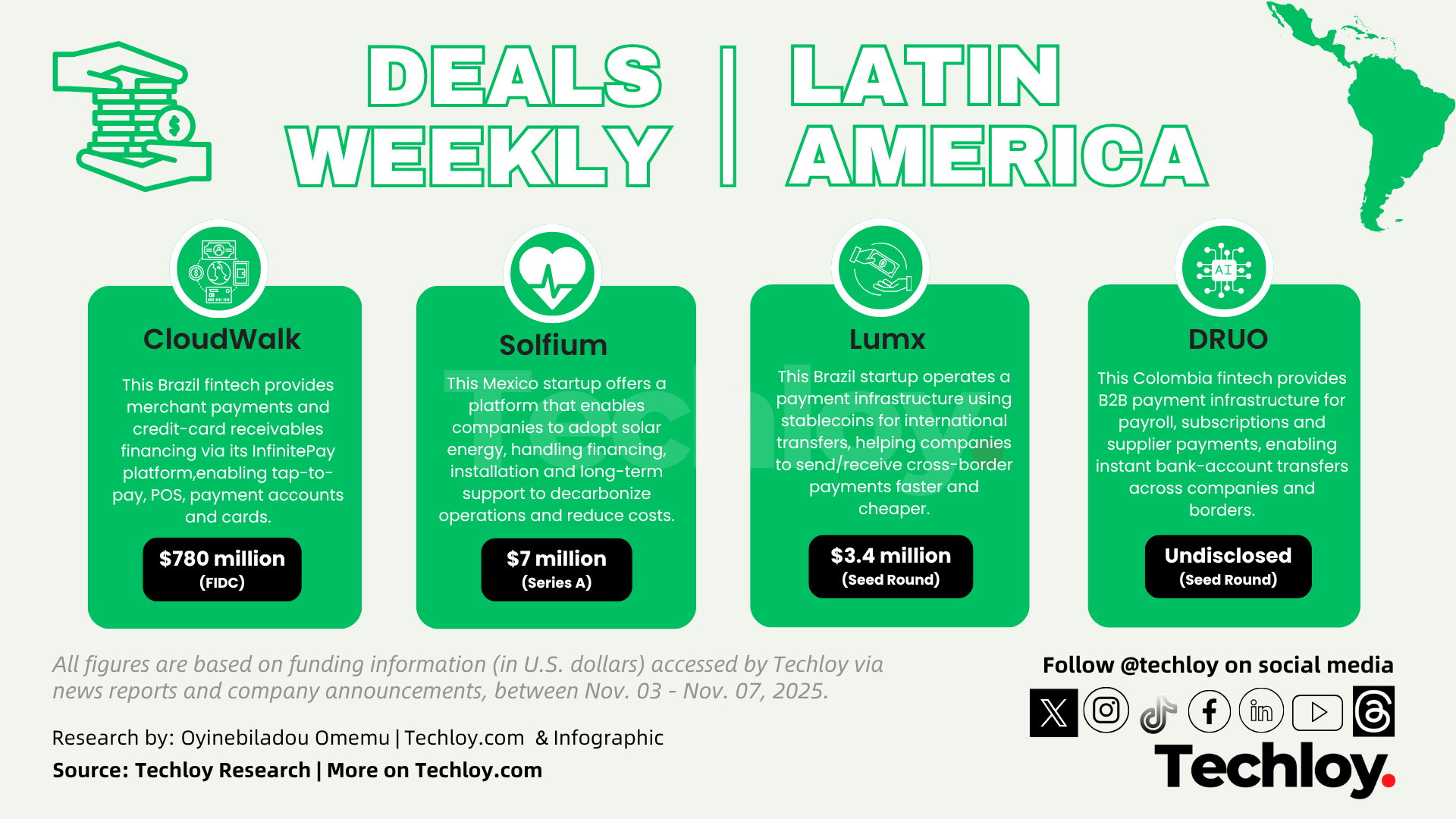

In Brazil, fintech unicorn CloudWalk led the week with a massive $780 million FIDC, one of the largest structured debt operations in the country’s startup ecosystem. The fund drew participation from 87 institutional investors, including Itaú BBA, Bradesco BBI, UBS BB, BTG Pactual, Santander, Safra, and Banco Votorantim. Known for its payments platform InfinitePay, CloudWalk provides merchants with tap-to-pay features, payment accounts, POS terminals, and card infrastructure.

The new funds will be used to finance credit card receivables for small businesses across Brazil, a critical part of its growth strategy as it competes in the country’s crowded payments market. Founded in 2013, the company has now raised $2.7 billion through 11 FIDCs, underscoring both investor confidence and the rising importance of alternative funding structures in Brazilian fintech.

In Mexico, solar energy startup Solfium closed $7 million of its planned $10 million Series A, backed by Accion, ALIVE Ventures, and Kamay Ventures. The company helps businesses decarbonise their supply chains by simplifying solar adoption, offering financing, installation, and long-term support through its digital platform. With partnerships that include Coca-Cola and several leading Mexican banks, Solfium already enables thousands of MSMEs to adopt clean-energy solutions. The new capital will allow the company to scale its reach nationwide, extend financing to underserved businesses, and strengthen collaborations with financial institutions to make solar more accessible and affordable across Latin America.

Also in Brazil, blockchain-driven payments company Lumx raised $3.4 million in a round co-led by Indicator Capital and CMT Digital, with participation from Nomad, Bitso, Antler, and Honey Island. Originally launched as a tokenisation platform, Lumx pivoted to focus on stablecoin-based international transfers powered by USDC, allowing banks and businesses to move money faster and more cheaply than through traditional rails like SWIFT. The company currently serves over 20 corporate clients and plans to use the new funding to expand its regulatory footprint in Brazil, the U.S., and Europe. As cross-border payments become increasingly critical for global commerce, Lumx aims to establish itself as a key infrastructure provider in the stablecoin ecosystem.

In Colombia, fintech DRUO announced an undisclosed seed round led by Global PayTech Ventures (GPT), shortly after revealing a partnership with Kushki to strengthen its regional payments network. DRUO provides API-based solutions that let companies send and receive funds directly from bank accounts, supporting instant payroll, subscription, and supplier payments across borders. Backed by GPT founder and former Mastercard Europe and LATAM president Javier Perez, the company plans to expand into Europe by 2026. It currently connects more than 10,000 financial institutions and serves nearly one million users across the U.S. and Latin America, positioning itself as an emerging player in global account-to-account payments infrastructure.

From Brazil’s record-breaking fintech raise to Mexico’s clean-energy momentum and Colombia’s expanding payments infrastructure, the week showcased Latin America’s continued resilience amid a quieter global funding climate. Startups across the region are not just attracting capital, they’re laying the digital and sustainable foundations for the next wave of growth in fintech, energy, and cross-border commerce.