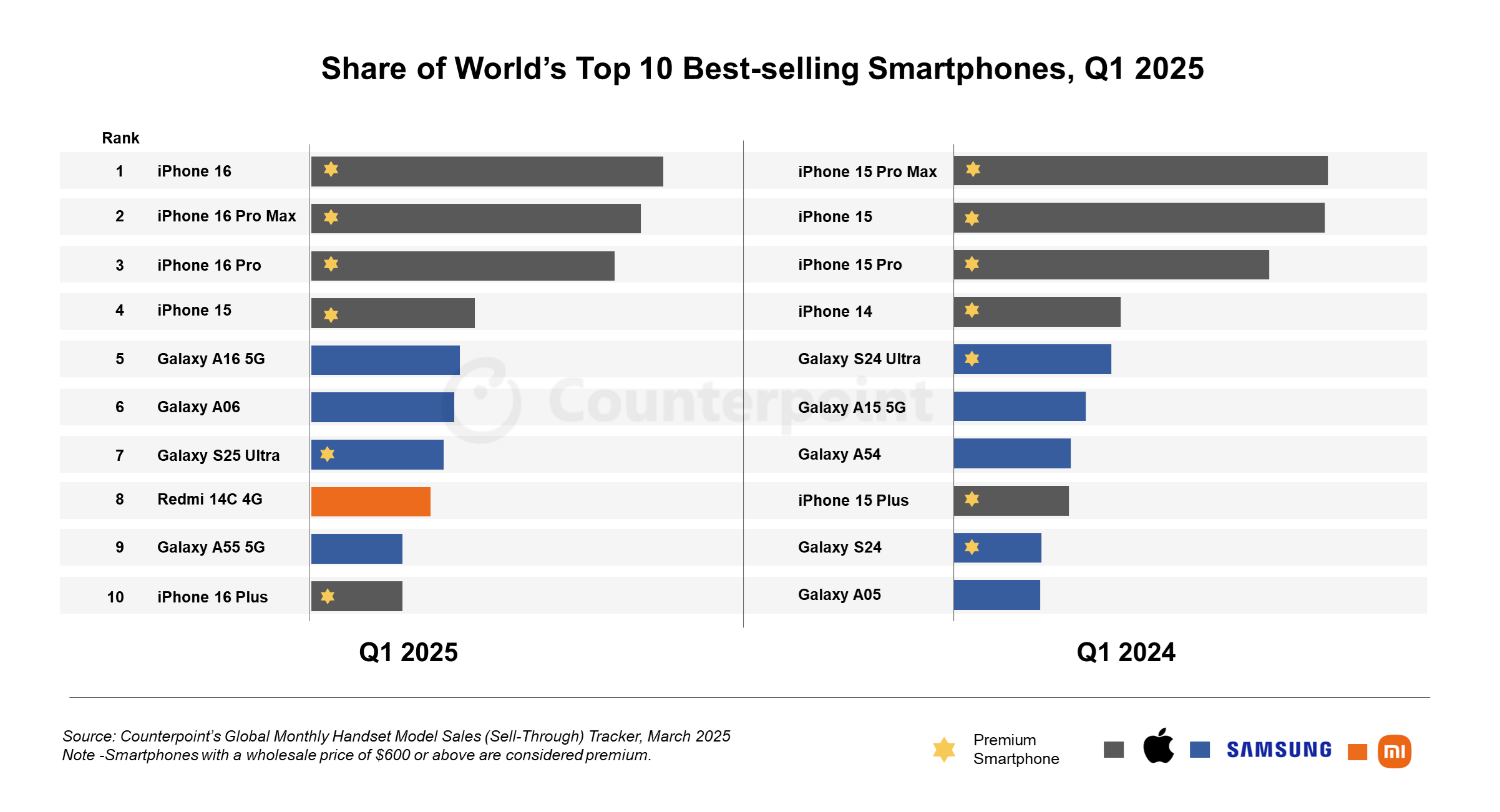

If it feels like you’re seeing more people with an iPhone 16 in their hands lately, you’re not imagining it. Apple’s latest base model was the world’s best-selling smartphone in the first quarter of 2025, according to Counterpoint Research. And here’s the kicker: it’s the first time in two years that the “regular” iPhone, not the Pro or Max, has sat at the very top.

Part of the buzz might simply come down to how the thing looks. After three generations of iPhones with virtually the same shell, Apple finally gave the 16 a refresh. That subtle but noticeable shift seems to have reignited demand. Maybe it’s just the novelty factor, maybe it’s the itch for change after years of sameness, but either way, it’s working.

Of course, that’s speculative. The official reasons tie back to subsidies, pricing strategies, and Apple’s tight ecosystem. But design still matters, and Apple seems to have reminded people of that.

Apart from the 16 models topping the list, Apple dominated, placing five different models in the global top 10 for the fifth March quarter in a row. Samsung, meanwhile, slipped slightly with one fewer model making the cut compared to last year. And while the top-10’s overall share of sales held steady, a new trend bubbled up from the other end of the market: ultra-cheap phones under $100 surged to nearly one-fifth of global sales.

Apple’s Big Win: Back to the Norm

The iPhone 16’s rise wasn’t random. In Japan, improved economic conditions and favorable subsidy rules made Apple’s pricing strategy click. Japan alone recorded the strongest growth for the base model, thanks to the right mix of affordability and brand pull.

At the same time, Apple’s premium devices continued to perform. The iPhone 16 Pro Max and 16 Pro claimed the second and third spots worldwide. In China, though, they ran into obstacles. Government subsidies pushed consumers toward devices priced under CNY 6,000 (~$833), while Huawei ramped up pressure in the premium segment. Still, Apple’s Pro series held steady, making up nearly half of all iPhone sales for the third straight quarter.

And then came the new player: the iPhone 16e. Landing sixth on the list in just its first full month of sales, the mid-tier model is shaping up to outpace the older iPhone SE 2022. Packed with modern features at a still-accessible price, the 16e is Apple’s quiet ace in markets where consumers want a balance between performance and affordability.

Samsung’s Shifting Position

Samsung’s flagship Galaxy S25 Ultra landed at number seven—a slip from the fifth spot held by its predecessor, the S24 Ultra, a year earlier. The drop was more about timing than demand. The S25 Ultra had less time in the market during the quarter. Still, the S25 series made an impact, accounting for a quarter of Samsung’s total smartphone sales during its launch month.

In the budget arena, Samsung had better news. The Galaxy A16 5G rose to fifth place with 17% year-over-year growth, thanks to a big push in North America—where it accounted for a third of its global sales—and strong traction across APAC, LATAM, and MEA. The Galaxy A06, meanwhile, became one of the stars of the low-end segment, climbing four spots compared to its predecessor as sub-$100 phones soared in popularity.

Xiaomi's Breaks Through

There was only one non-Apple, non-Samsung phone in the top 10: Xiaomi’s Redmi 14C 4G. And it didn’t just sneak in—it thrived, posting a 43% year-over-year jump over the Redmi 13C 4G. Its success came almost entirely from emerging markets like MEA and LATAM, proving once again that Xiaomi owns the value-driven segment.

The Bigger Picture

Despite global uncertainty, tariffs, trade tensions, and shifting subsidies, the smartphone leaderboard hasn’t budged much. At the top end, premium flagships are still in demand, driven by ecosystems, AI features, and brand loyalty. At the other end, ultra-affordable models are booming in emerging markets.

And maybe that’s the real story of Q1 2025: people either want the very best, or they just want something that works. Apple knows how to sell the “best.” Xiaomi knows how to sell the “works.”

Samsung is trying to be both.