In Latin America, people aren’t just using stablecoins to transact anymore as they’re now holding them as a store of value. And it’s not hard to see why. For a region battered by inflation, unstable currencies, and governments that can change the rules overnight, a digital dollar is starting to feel more reliable than the real thing.

Most recently, media reports suggest that Nubank, the region’s largest digital bank, plans to integrate dollar-pegged stablecoins into its payment system, even linking them to credit cards.

That’s not a small move. It’s one of Latin America’s biggest financial institutions acknowledging that stablecoins aren’t just some passing trend but a tool its customers are already relying on. Dollars have long been in demand, but they’re hard to get and often traded in backdoor markets. Stablecoins make it easier and safer to store value digitally and spend when needed.

Brazil shows just how widespread the shift has become

Earlier this year, the president of Brazil's central bank said 90% of all crypto activity in the country is tied to stablecoins. In Argentina, the trend is even starker: with inflation running above 100% in recent years, locals don’t just prefer dollars; they need them.

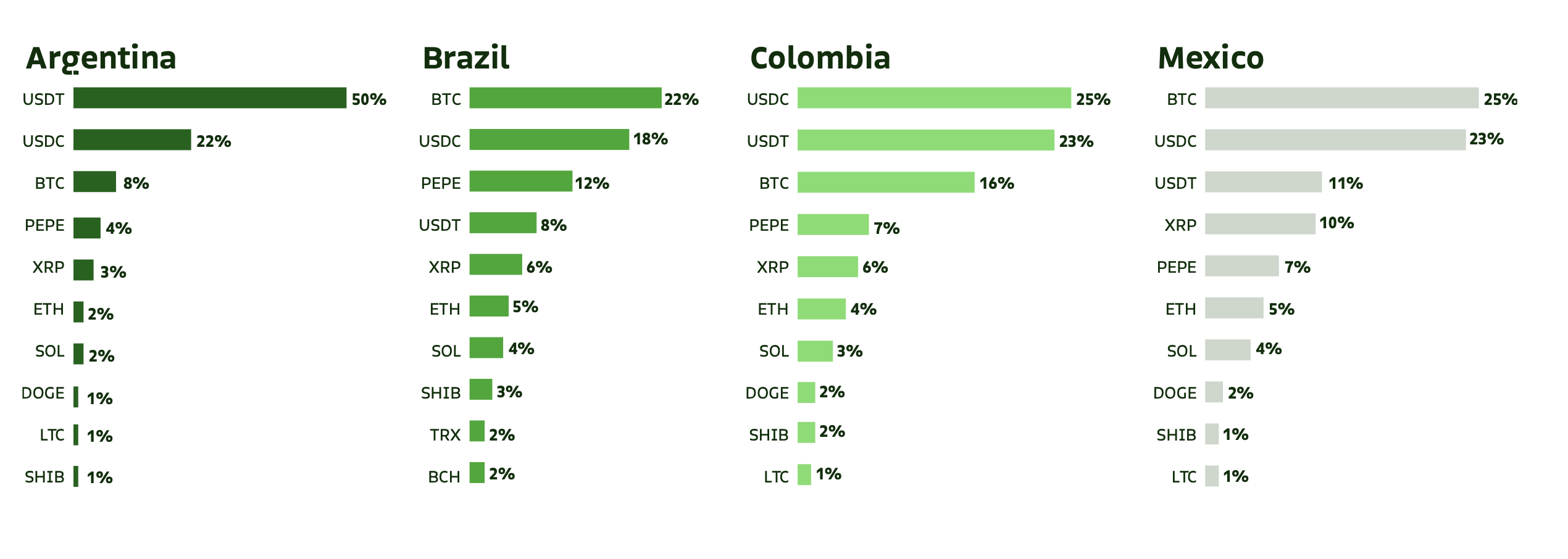

A 2025 Bitso report also found stablecoins made up nearly half of all crypto purchases in Argentina in 2024, and across the platform, they accounted for 39% of transactions region-wide. That helps explain why 1 in 5 Argentinians now owns cryptocurrency, mostly in the form of stablecoins.

Other countries, too, are catching up pretty fast. Bolivia, for example, lifted its crypto ban just last year, and now stablecoins are everywhere. Carmakers in the country, like Toyota, Yamaha, and BYD even accept USDT payments.

The central bank of Bolivia has even gone a step further, signing an agreement with El Salvador to promote crypto as a “viable and reliable alternative” to fiat. Venezuela tells its own story: after the Venezuelan bolívar (currency) collapsed under 229% inflation, digital dollars began quietly replacing it in everyday life. Chainalysis data shows that in 2024, 47% of crypto transactions under $10,000 were stablecoins—covering groceries, rent, and salaries.

What does this all mean?

When you put the pieces together, the role of stablecoins in Latin America is becoming clearer: they’re filling the gaps left by broken local currencies, unstable policies, and weak banking systems. Whether it’s Brazil’s massive crypto activity, Argentina’s flight from inflation, Bolivia’s adoption of car sales, or Venezuela’s digital dollarization, the trend is hard to miss.

And while the U.S. and Europe still debate regulation and risks, Latin America is already living out the real experiment.

The question now is whether this remains a regional fix for unstable economies, or an early preview of how stablecoins could reshape global finance. Overall, I think Latin America is showing us the future in real time. Do you think differently? Let us know your thoughts in the comments.