Needless to say, crypto has a way of mixing politics and profit, and the Trump name is now stamped on another token. This week, World Liberty Financial (WLFI) finally went live.

The idea came from a community proposal, and the launch unlocked 24.6 billion tokens out of a 100 billion supply. That’s a far smaller float than the 550 billion handed out when Trump’s meme coin dropped, but the comparisons are hard to avoid.

Who got what, and why it matters

People don’t just buy into a token because of the name on it. They want to know how it’s set up, who’s getting what, and whether the structure gives them a fair shot. That’s why tokenomics matter; it tells you where the money flows.

For WLFI, the breakdown is straightforward, with World Liberty Financial, Inc. keeping 10 billion tokens. Another 7.7 billion sits with Alt5 Sigma Corporation. About 2.8 billion is reserved for liquidity and marketing, and public sale buyers share 4 billion. Those early buyers were given 20% of their tokens right away, with the rest locked until the community decides when to release them.

There’s also a built-in safeguard to prevent insiders from dumping on retail right out of the gate. Team, founder, and adviser tokens are staying locked for now. Anyone who’s been around crypto knows how often that play gets abused, so the lockup looks good, but whether the community actually sticks to it when the pressure builds is the real test.

Speculation doesn’t equal stability.

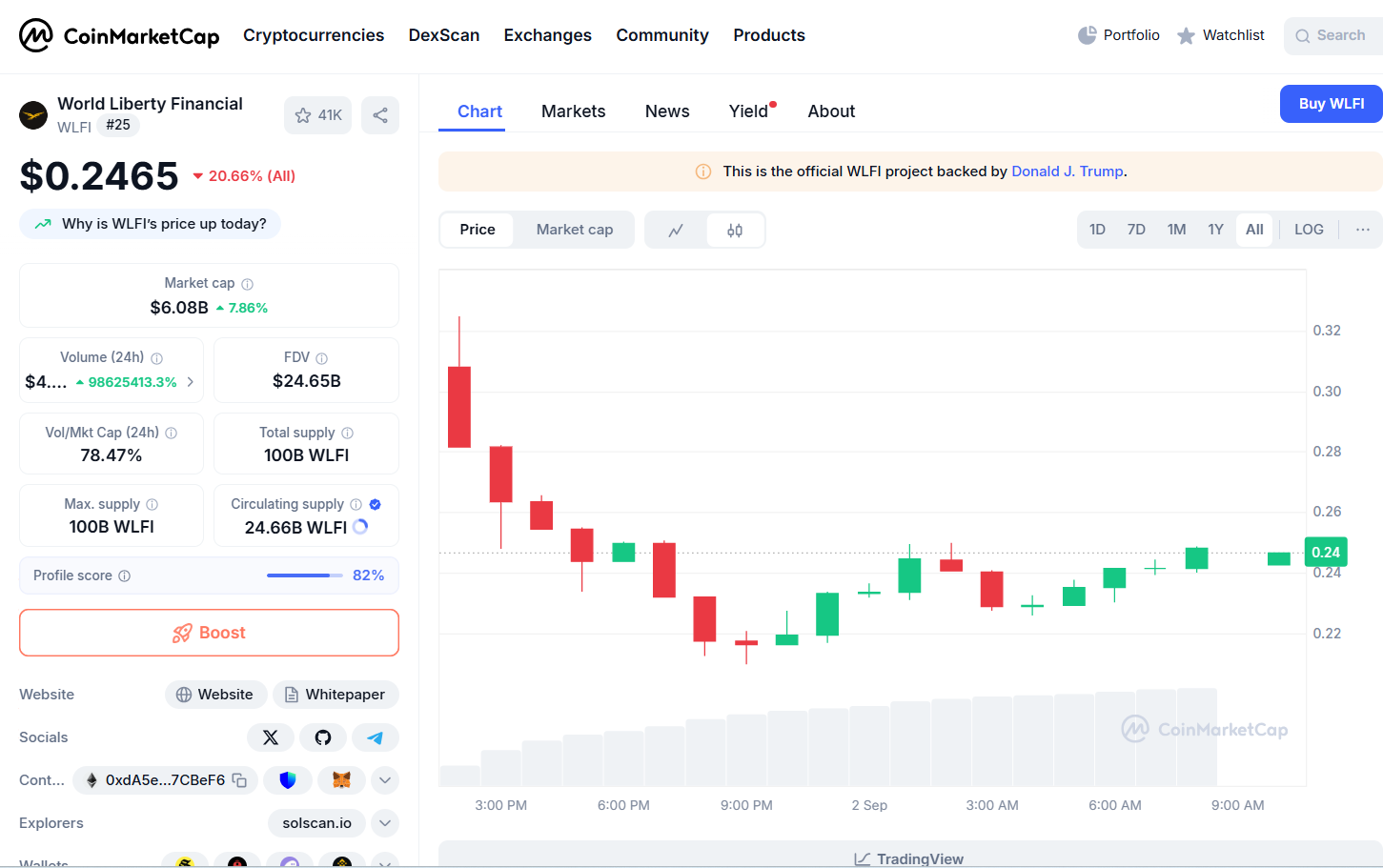

Before trading even picked up, WLFI derivatives nearly hit $950 million in open interest, before cooling a bit to $887 million. That kind of demand shows traders were circling, waiting to place their bets.

Right now, WLFI feels like a trader’s playground, not a long-term conviction play. WLFI fell about 36%, from a peak of $0.331 down to $0.210, before clawing back to around $0.24. Short sellers jumped in fast, and the project’s promised burn mechanism is already being leaned on to manage supply.

Hype or staying power?

The launch checked the box for hype, no question. Billions in open interest, the Trump name attached, and a governance-heavy token model. But hype is the easy part. The real challenge is whether WLFI can avoid being seen as just another branded token with a fast pump and quicker dump.

If you’re watching this one, the key things to track are the community unlock votes, how effective the burn strategy is, and whether exchanges give it deeper liquidity.

Conclusion

The bottom line is that WLFI has the volume, the volatility, and the Trump brand stamped on it. What it doesn’t have yet is trust. For now, it feels more like a trader’s playground than a conviction hold. And with so many tokens built on hype alone, WLFI is already under pressure to show it’s not just another meme dressed up with better DeFi packaging. Whether it can hold that line comes down to how the community handles unlocks, keeps supply tight, and proves there’s more here than just a name.