Mobile gaming is still a major money-printing engine in the app economy, but the way revenue is being generated in 2025 looks very different from what it did even a few years ago. We can see the market is evolving, shaped less by sheer volume and more by smarter strategies to grow revenue.

On the surface, the topline figures look familiar: A Mobile Games in 2025 report by Appfigures shows that mobile gamers worldwide spent $65.7 billion in 2024, up 3.8% from the year before. But on a closer look, the story gets more interesting. Global downloads actually fell, from 46.2 billion in 2023 to 43.1 billion in 2024, yet the industry still grew. How? Game publishers are squeezing more value out of every player.

Globally, spending per download jumped 11.2%, hitting $1.52, and in the U.S., it soared to $6.43. So even though fewer games are being downloaded, the ones that stick are pulling in serious money. As such, game titles are also reaching profitability much faster. The average time for the top 1000 games to hit the first million dollars in revenue has collapsed from 273 days in 2022 to just 106 days in 2024.

Shifts Across the Map

This dynamic is also reshaping geography. The U.S. remains the top spender at $20.8 billion, followed by China at $13.4 billion, but India is the download factory of the world, topping 7.5 billion installs last year, more than double the 3.5 billion downloads from the U.S. In short, one market brings the scale, another brings the spending.

But, while established markets like the U.S., China, and Japan remain massive with some of the biggest spending, the fastest growth is happening elsewhere. Brazil (+47.3%), Mexico (+47.1%), and Poland (+42.4%) saw explosive spending increases in 2024. These emerging regions are proving that as smartphone access expands, so does the appetite, and wallet, for mobile entertainment.

At this pace, the next country dominating revenue surge might not come from the usual suspects but from emerging regions hungry for mobile-first entertainment.

On the flip side, some longtime heavyweights are slowing down. Japan’s spending fell 6.1%, Singapore dropped 19%, and Hong Kong slid nearly 16%. These aren’t collapses, but they’re signs that saturation is real, and new growth has to come from new places.

Still, when you look at spending per capita, Asia is unmatched: Hong Kong leads at $104 per capita, with Taiwan, South Korea, and Japan not far behind. Even with slowing growth, these markets remain incredibly lucrative.

Popularity vs. Profitability: Downloads Don’t Equal Dollars

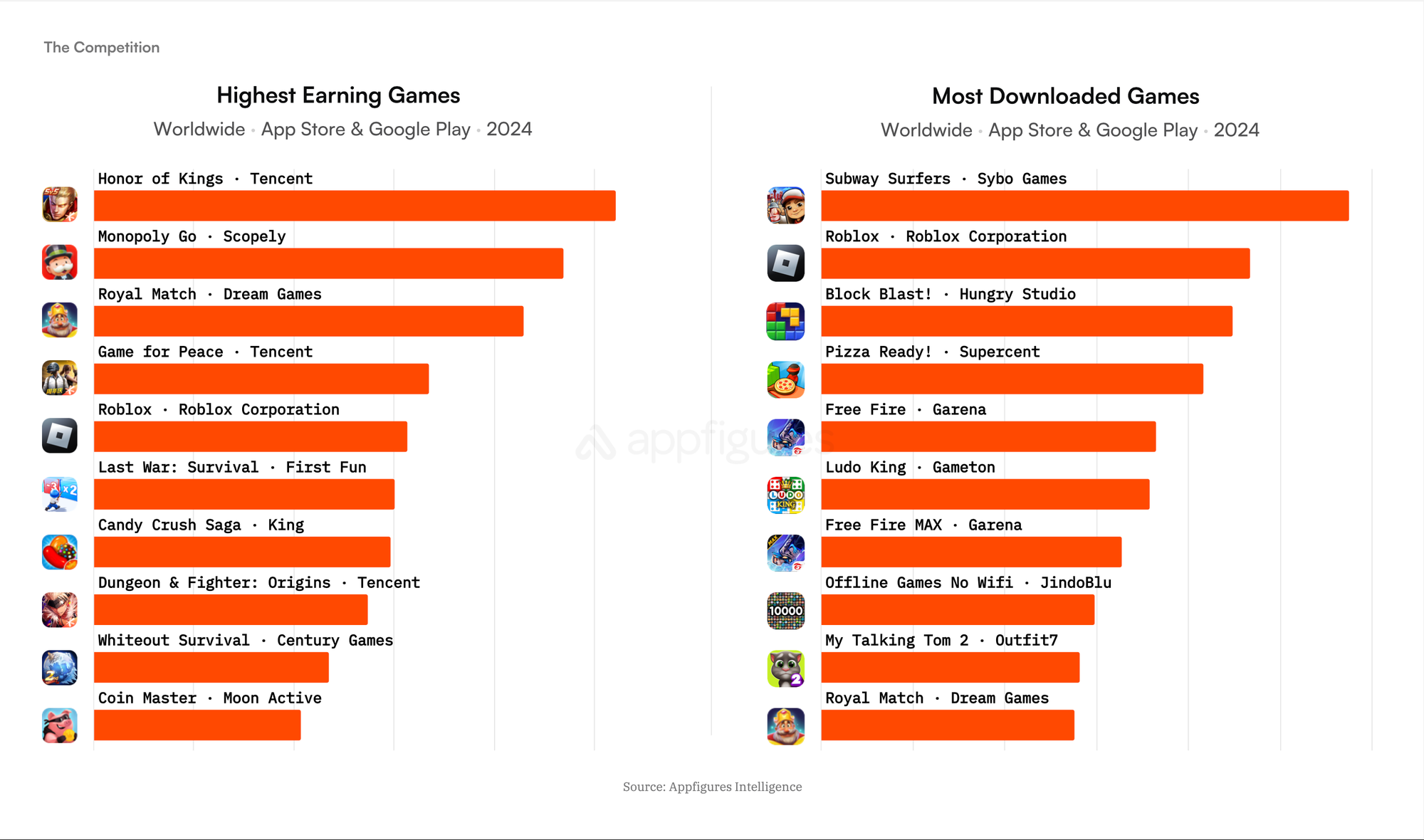

Meanwhile, the pattern of largest downloads not equating to the biggest revenue is also playing into which games are generating the most revenue. According to the report, the most downloaded games weren’t the most profitable.

Subway Surfers and Block Blast!, for example, racked up some of the biggest installs in the hundreds of millions, yet the biggest revenue pull was from strategy-heavy RPGs and social casino titles like Monopoly GO!, Honor of Kings, Candy Crush Saga, Roblox, and Royal Match.

These are games from popular publishing giants such as Tencent, Scopely, Activision-Blizzard-King, and NetEase that have refined their in-game monetisation and continue to crank out billion-dollar titles. At the end of the day, popularity alone doesn’t always pay; monetisation strategy does.

Asia as the Creative Engine

The creative engine behind many of these revenue leaders still lies in Asia. Of the top 10 new titles in 2024, eight came from China and two from Japan. Tencent’s Dungeon & Fighter: reached $1 billion in spending, mostly in APAC but with strong traction in the West. And then there’s Pokémon TCG Pocket, which upended expectations by earning more from the U.S. than Japan, with Europe close behind.

Where Players Spend Their Money

If you step back from individual titles, genre breakdown shows where the Mid-Core titles like RPGs, Strategy, and Shooters account for half of the top-earning games. RPGs alone make up 34% of the top 1,000, with Puzzle games holding strong at 16% and Casino titles contributing 11%.

Of course, revenue isn’t just about making a great game; it’s about putting that game in front of the right players. And in 2025, that means meeting gamers in the spaces they already spend time: YouTube, TikTok, and Discord. These platforms are the new storefronts for discovery.

But the real magic is happening with IP crossovers. In 2024, Brawl Stars ran collaborations with Godzilla, SpongeBob, and Toy Story — and every single one triggered a spike in spending. Godzilla drove an 86% lift, SpongeBob 68%, and Toy Story 22%. These aren’t side promotions; they’re core monetisation strategies that transform attention into revenue.

Conclusion

At the end of the day, the story of mobile gaming revenue is no longer about raw size; it’s about smart strategy. Downloads are down, but spending is up. Old markets are plateauing, while new ones are exploding. And monetisation requires a toolkit of tactics: consumables, limited-time offers, battle passes, cosmetics, ads, and IP events, all working together.

So success in mobile gaming today isn’t about chasing the biggest crowd. It’s about knowing your players, keeping them engaged, and giving them reasons, again and again, to spend.