Chinese technology companies have ordered more than 2 million of Nvidia’s H200 AI chips at roughly $27,000 each, according to sources briefed on the matter who spoke to Reuters. That’s over $54 billion in orders for chips that may never arrive, depending on whether Chinese regulators approve the imports. And now, those buyers are carrying the entire burden.

The new payment terms mark a dramatic shift from Nvidia’s standard China business practices. Previously, Chinese customers could place deposits rather than paying the full amount upfront, and they had flexibility to modify or cancel orders. Not anymore. For the H200, Nvidia has imposed unusually stringent conditions: full payment in advance, with no option to ask for refunds or change configurations after placement.

The policy reveals just how much regulatory uncertainty has reshaped the semiconductor trade. Nvidia is protecting itself from a repeat of last year’s disaster, when the Trump administration abruptly banned sales of the H20 chip to China. That move forced Nvidia to write down $5.5 billion in inventory—chips it had manufactured but could no longer legally deliver.

This time, Nvidia is transferring that financial exposure directly to its customers. In rare cases, buyers can substitute commercial insurance or asset collateral for cash, but the core message is clear: if you want access to the most powerful AI chips available, you’re betting your capital that Beijing will approve the purchase.

Why Chinese Buyers Are Taking the Risk

The demand is rooted in performance. Nvidia’s H200 delivers nearly six times the performance of the previously available H20 chip, which China has now banned. While domestic alternatives like Huawei’s Ascend 910C exist, they still lag behind Nvidia’s hardware for training cutting-edge AI models. For Chinese tech giants building competitive AI systems, the H200 represents a significant technological leap—one worth the financial gamble.

But there’s another complication. Beijing has recently asked some Chinese tech companies to temporarily pause their H200 chip orders as regulators decide how many domestically produced chips each customer will need to buy alongside each H200 order. That means even if buyers pay upfront and Beijing approves the shipments, companies may still be required to purchase additional domestic chips as a condition of receiving their Nvidia hardware.

Supply Meets Demand—Eventually

Nvidia currently has only 700,000 H200 chips in stock, meaning demand outstrips available inventory by roughly 3-to-1. To bridge the gap, the company has approached Taiwan Semiconductor Manufacturing Co. about ramping up H200 production, with additional manufacturing expected to begin in the second quarter of 2026.

That production increase isn’t simple. Nvidia is simultaneously transitioning from its current flagship Blackwell chips to the next-generation Rubin architecture, while competing with companies like Google for limited advanced chipmaking capacity at TSMC. Adding H200 capacity strains an already tight supply chain.

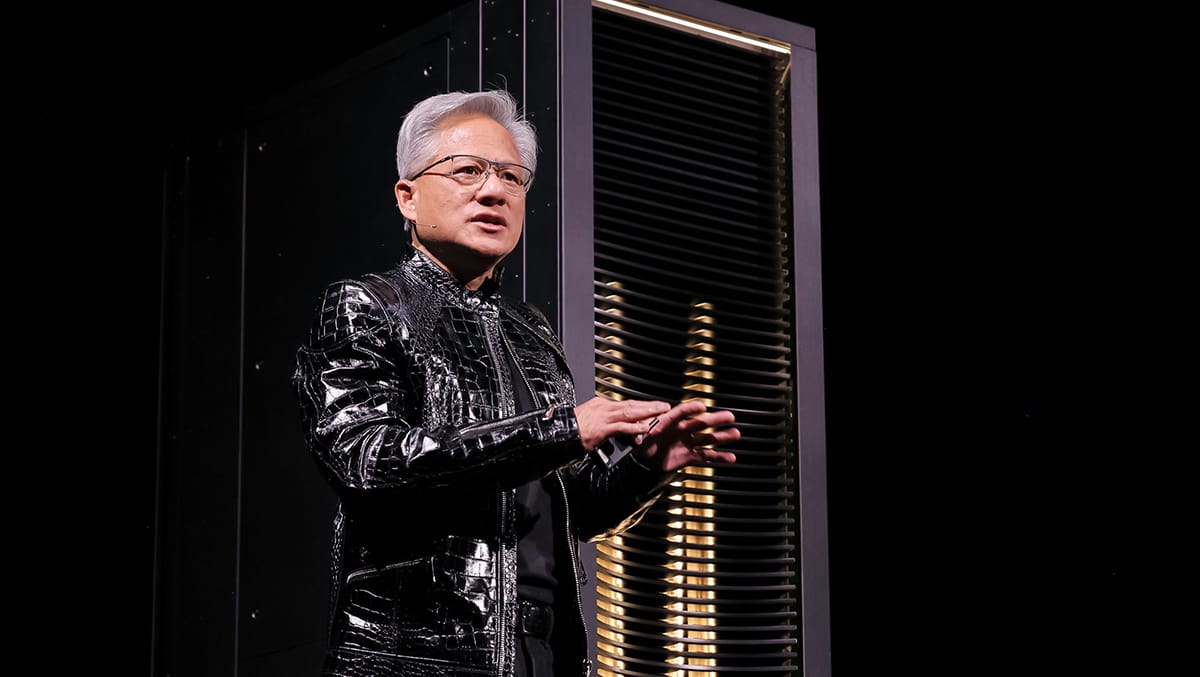

Nvidia CEO Jensen Huang said customer demand for H200 chips was “quite high” and that the company has “fired up our supply chain” to ramp up production. He added that he didn’t expect China’s government to issue a formal approval declaration, but suggested that orders coming through would signal implicit permission: “If the purchase orders come, it’s because they’re able to place purchase orders.”

The Bigger Picture

The strict payment structure exposes the tension at the heart of the global AI chip market. Nvidia needs access to China, one of the world’s largest AI markets, to maintain growth. Chinese companies need Nvidia’s hardware to stay competitive in the AI race. But with both the U.S. and Chinese governments wielding regulatory power over the trade, neither side can operate with certainty.

For now, the financial risk sits squarely with the buyers. And with tens of billions of dollars on the line, the stakes couldn’t be higher.