Nvidia’s H200 AI chip sales to China are frozen. Two months after President Donald Trump approved exports, the U.S. State Department is blocking shipments while conducting a national security review, the Financial Times reported Tuesday. The Commerce Department finished its analysis, but the State Department is pushing for tougher restrictions before granting export licenses. The FT reported that someone familiar with the situation told it “State is making it very difficult.”

Chinese demand has also slowed. In mid-January, Chinese customs authorities instructed agents that H200 chips were not permitted to enter the country, and officials separately warned domestic firms against buying them unless necessary, according to Reuters. That position later softened, but only slightly. China has since given conditional approval for a first batch of imports for a limited set of companies, according to report.

AI startup DeepSeek joins other Chinese tech giants including Alibaba, ByteDance, and Tencent, who had sought approval for over 400,000 H200 chips, but the full pipeline remains uncertain while both US and China review their terms and conditions.

What’s holding up the licenses

Trump’s December deal came with strict conditions, including a 25% cut of sales going to the U.S. Treasury, mandatory third-party testing in U.S. labs before shipment, and a requirement that half of all H200 shipments go to American customers before any exports to China.

The State Department is examining whether Chinese companies can credibly guarantee the chips will not be used to support Chinese military or intelligence services. Chris McGuire, senior fellow for China and emerging technologies at the Council on Foreign Relations, defended the delay.

“The state department has deep expertise in whether and how Chinese companies could use these chips to support Chinese defence and intelligence services,” McGuire told the FT. “If state is raising concerns about the national security implications of approving the licences, that shows there are real and significant risks associated with these licences. It would be irresponsible to disregard these concerns.”

A $50 billion market on pause

CEO Jensen Huang has valued the China market at about $50 billion annually for Nvidia. The company ramped up H200 production expecting high demand. Some suppliers have since paused production of key components as approvals in Washington and Beijing remain unresolved.

AMD faces the same holdup. CEO Lisa Su confirmed during the company’s earnings call that AMD is still waiting on U.S. licenses to ship its MI325X chip under the same framework. Nvidia, AMD, and the State Department have not made public comments on the matter.

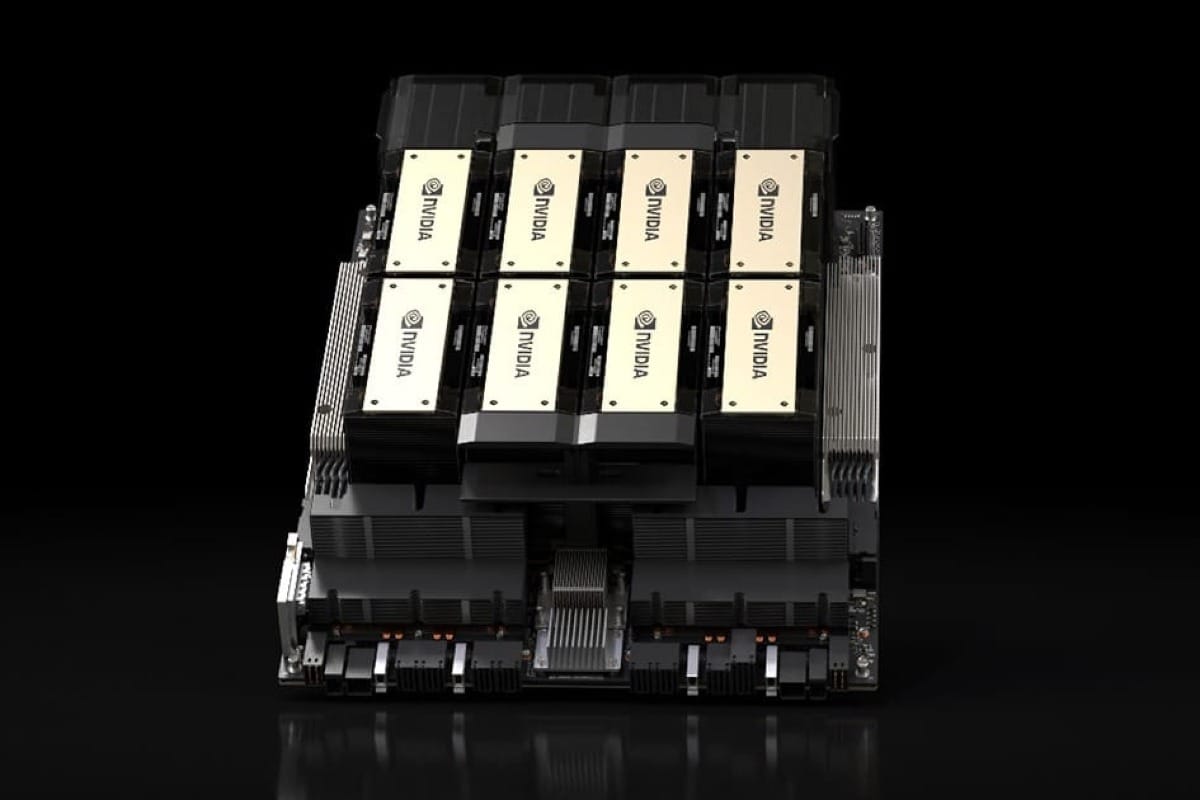

The H200 sits one generation behind Nvidia’s latest Blackwell hardware, which remains restricted from China. But it is far more powerful than the H20 chips Nvidia designed to comply with earlier export controls.

For now, the U.S. licensing process is still not complete, and China’s approvals are limited to select buyers under conditions. Until both sides finalize their terms, shipments remain stuck.