Sending money across borders used to mean bank transfers that take several days and charge high fees. Now, stablecoins —digital tokens tied to real currencies like the US dollar — offer a new way to move money internationally. People and businesses are increasingly comparing the two methods to see which one costs less and works faster.

A bank transfer is a traditional way to send money overseas using your bank’s payment system, often through networks like SWIFT. These transfers typically involve your bank, one or more intermediary banks, and the receiving bank, which adds time and fees. Traditional transfers can cost several percents of the total amount sent because each bank and service provider charges a fee or markup.

A stablecoin transfer uses blockchain technology to move digital money that is pegged to a real-world currency like the US dollar. The sender converts their money into stablecoins, sends them over the blockchain to the recipient, and then the recipient converts the stablecoins back into local currency. Because blockchain transactions cut out many middlemen, fees tend to be much lower.

But ultimately which one is cheaper? We got busy comparing both of them and this is what we discovered:

/1. How They Work

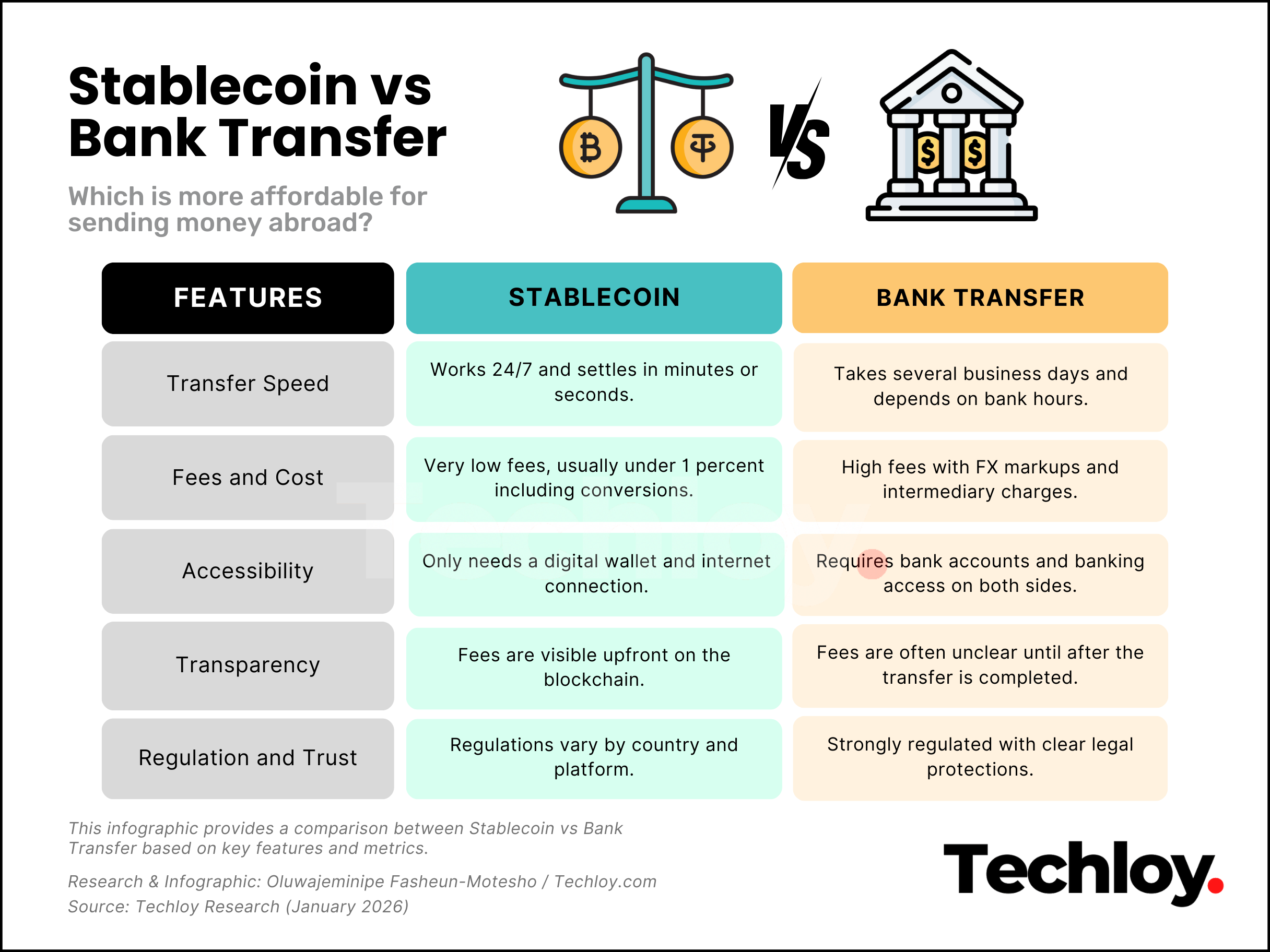

How money is moved from one person to another affects speed, reliability, and overall experience, especially for international transfers.

Bank transfers send money through a chain of banks and payment systems that operate in business hours. Transfers may take two to five business days or more to complete, especially across time zones, because banks must settle accounts and comply with regulations.

Stablecoin transfers operate on blockchain networks that run 24/7. Once the sender and recipient have wallets and the fiat-to-stablecoin conversion is done, the transfer can settle in minutes or even seconds, regardless of the day or time.

/2. Fees and Cost

The cost of sending money abroad is often the biggest concern for users, especially for frequent or large transfers.

Bank transfers can be expensive. Typical fees include a fixed transfer cost, percentage-based foreign exchange markups, and charges from intermediary banks. On a $1,000 transfer, total costs through a bank can range from about 3 percent to 8 percent of the amount sent, depending on providers and corridors.

Stablecoin transfers reduce costs by removing many intermediaries. Blockchain network fees are often only a few cents or dollars, though users also pay small fees to convert between fiat and stablecoins at each end. Even with these conversion costs, total fees can be well under 1 percent of the amount sent.

/3. Accessibility and Requirements

Accessibility matters because not everyone has the same access to banking services or financial infrastructure.

To send money via a bank transfer, both the sender and recipient usually need bank accounts, and some countries require extra forms, verification, or local banking access. This can slow down the process or exclude some users.

With stablecoins, users need a digital wallet and access to a platform that supports buying and selling stablecoins. These transfers can reach people without bank accounts, as they only require internet access and a wallet.

/4. Transparency and Control

Transparency and control refer to how clearly users can see fees and understand what happens to their money.

Bank transfer fees and exchange rate markups can be difficult to predict because each bank and intermediary may apply hidden charges along the way. Users often only see the final amount after the transfer is completed.

Stablecoin transactions are recorded on public blockchains, and fees are usually visible before the transfer is made. This allows users to know exactly how much they are paying upfront.

/5. Regulation and Trust

Regulation and trust are important because they determine how protected users are if something goes wrong.

Bank transfers operate under strict banking laws and government oversight. This provides clear consumer protections, dispute processes, and legal accountability.

Stablecoin transfers depend on the issuer and platform used, and regulations vary widely across countries. While many stablecoins are reliable, they generally offer less formal protection than traditional banks.

Conclusion

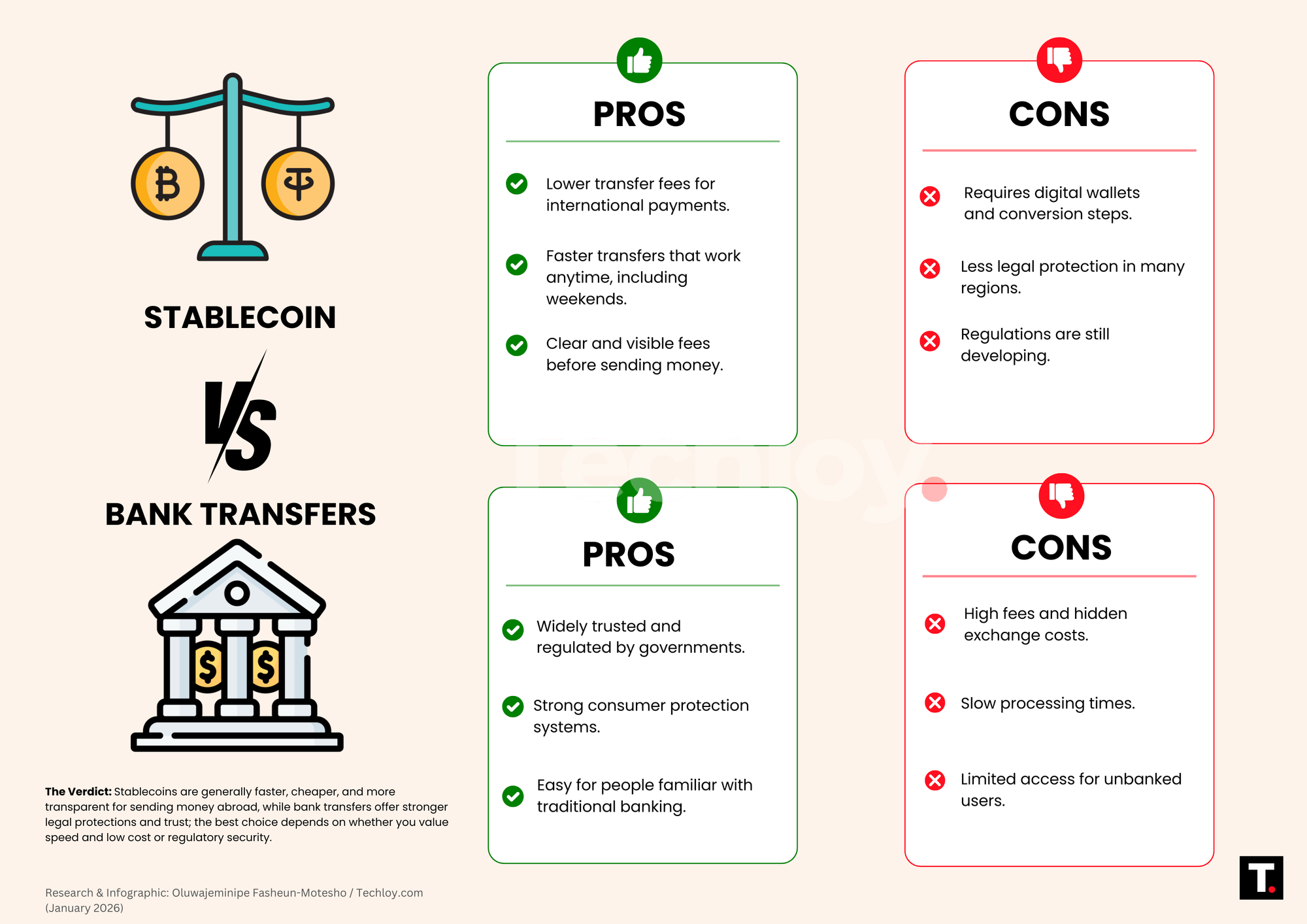

Stablecoin transfers are generally cheaper and faster than traditional bank transfers for sending money abroad. Because stablecoins move value on blockchain networks without many intermediaries, they cut out layered fees and deliver near-instant settlement. Even after small conversion costs at both ends, total fees tend to be much lower than the typical costs charged by banks.

However, stablecoins require users to understand digital wallets, conversion steps, and potentially local regulations. Bank transfers remain familiar, widely accepted, and supported by financial protections, but they are often slower and more expensive.

For most people and businesses looking to save on cost and time, stablecoin transfers offer a compelling advantage over traditional bank wiring systems, especially when sending money frequently or in larger amounts.