This week, the crypto market’s been full of surprises. Bitcoin's dominance dipped just a notch—from 61.4% to 60.9%—giving Ethereum a chance to shine as it broke past $3,400 for the first time since January. It’s not the usual explosive rally, but it’s enough to stir things up. With the majors catching their breath to consolidate, a couple of altcoins are taking this chance to gain momentum. And while some were as expected. Others? Not so much. But either way, this week’s top gainers remind us that money doesn’t sit still in crypto; it moves fast and often sideways.

In this week’s roundup, we break down the top 10 altcoins that outpaced the market and why they’re worth paying attention to.

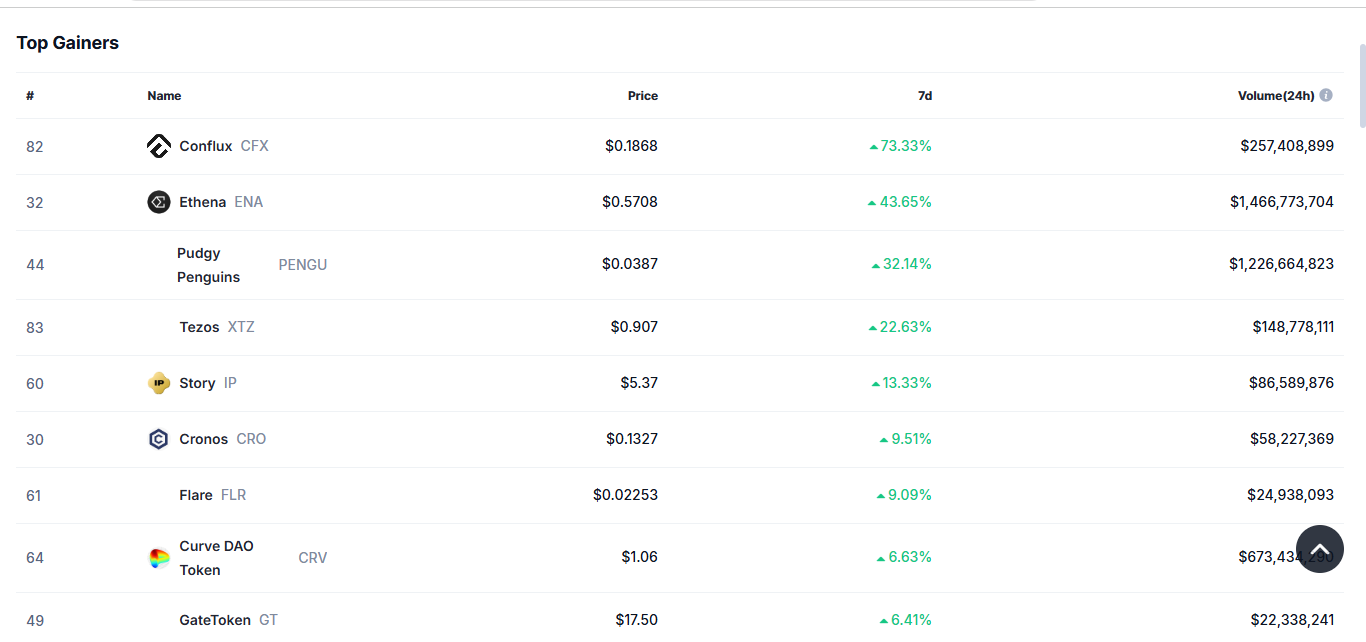

Top 10 Crypto Gainers Of The Week

1. Conflux (CFX): +52.89%

Leading the charge this week is Conflux, posting a massive 52.89% gain, bringing it to rank among the top 100. Currently trading at around $0.1735, CFX has always had its moments, especially when narratives around China-linked infrastructure resurface, with the main driver this time being a new RMB stablecoin pilot tied to Conflux.

In addition to that, a mix of news, on-chain activity, and strong chart setups seems to be fueling the rally, as $318M in 24-hour volume says it wasn’t just a fluke.

2. Maple Finance (SYRUP): +33.71%

Next up is Maple’s SYRUP, trading at $0.6193 after climbing more than 33%. It’s one of the few DeFi protocols in the top 100 still actively pushing on-chain lending for real-world borrowers, which already sets it apart. But what really fueled this week’s bounce was its recent listing on the Upbit exchange, unlocking access to the Korean market. The $452M in 24-hour trading volume suggests this was real momentum.

3. Ethena (ENA): +22.84%

Ethena’s rise this week is a testament to strong on-chain activity and steady user engagement, both helping to reinforce its momentum. Up 22.8%, ENA is inching toward the psychological $0.50 mark, backed by over $1B in weekly volume. Its synthetic dollar system and “Internet Bond” pitch seem to be resonating with users looking for stablecoin alternatives with upside.

4. Pudgy Penguins (PENGU): +18.18%

As one of the top gainers the previous week, Pudgy Penguins continues its surging price trend, currently trading at $0.03688. PENGU’s 18% jump came with over $1.2B in volume, which isn’t small change. The main spark is the SEC reviewing a new ETF proposal from Canary Capital, which is designed to hold mostly PENGU tokens (about 80–95%), with the rest in Pudgy Penguins NFTs. The filing went through the CBOE exchange under the 19B-4 rule.

5. Tezos (XTZ): +16.76%

Rising from its base price of $0.64 and breaking past the $0.8 key level, Tezos’ DeFi activity has seen a robust rebound, with Total Value Locked climbing 8% higher to $45.43 million after being fairly quiet in recent months. This week, it posted a 16.7% gain, which further aligns with the success of Etherlink (Tezos layer-2 solution) and Mida’s tokenized offerings.

6. Story Protocol (IP): +9.62%

Story Protocol’s IP token is starting to find its audience, with over $80M in 24-hour trading volume. And while its gains aren’t as pronounced compared to last week, its focus on protecting and monetizing intellectual property on-chain is slowly catching on. This week’s 9.6% gain reflects a growing interest in how blockchain can serve creators and traders alike, as Story Protocol makes IP programmable, open, and easier to manage.

7. Flare (FLR): +6.94%

Flare is an EVM-compatible blockchain built to bring smart contract functionality to assets like XRP, essentially bridging ecosystems that traditionally haven’t played well together. While its price action hasn’t been explosive, the 6.9% gain this week keeps it in the conversation for those looking to invest in crypto with potential.

8. GateToken (GT): +5.25%

With regulators tightening the screws on centralized exchanges, there’s renewed interest in decentralized exchange-native tokens, most especially those tied to platforms with strong on-chain activity. GT, the native token of Gate.io, managed a quiet 5.25% rise this week. While no major announcements stand out, smaller catalysts like trading incentives and new listings have nudged it upward.

9. BNB (BNB): +1.69%

Currently trading at $760.58, BNB's small but steady gain can be attributed to the major recovery of the market and a signal to the top 10 large-cap tokens holding the line with massive liquidity and a slow upward drift.

10. Litecoin (LTC): +0.85%

Finally, there’s Litecoin, presently trading at $110.13, rounding out the top 20 with a 0.85% gain. It’s not much, and to be honest, it’s probably more a reflection of market-wide recovery than any LTC-specific catalyst. Still, it’s green.

Conclusion

This week’s top gainers show how quickly things can turn when Bitcoin consolidates. While it wasn't an altseason blowout, capital rotated, and some of it went to names that most people had stopped watching. From NFTs to DeFi to creator tokens, the market showed a bit of everything. Not every move was loud, but enough of them hit to make week 30 feel like something just under the surface is starting to bubble.