As the week finally draws to a close, recent data shows that over $6–8 billion in realized profits were taken off the table in July 2025, mostly by new whale wallets cashing out around Bitcoin’s local highs. That, paired with Trump’s renewed tariff threats, has deepened the ongoing consolidation phase. However, this is not without a positive outlook, as Bitcoin held its footing just below $116K, but the implications are clear: some capital is rotating out of majors and trickling into select altcoins. This week’s top gainers feature a few names like Ethena and Story (IP) sticking around for a second week, showing they might still have legs. Let’s break down the top performers of the week and what might be fueling their moves.

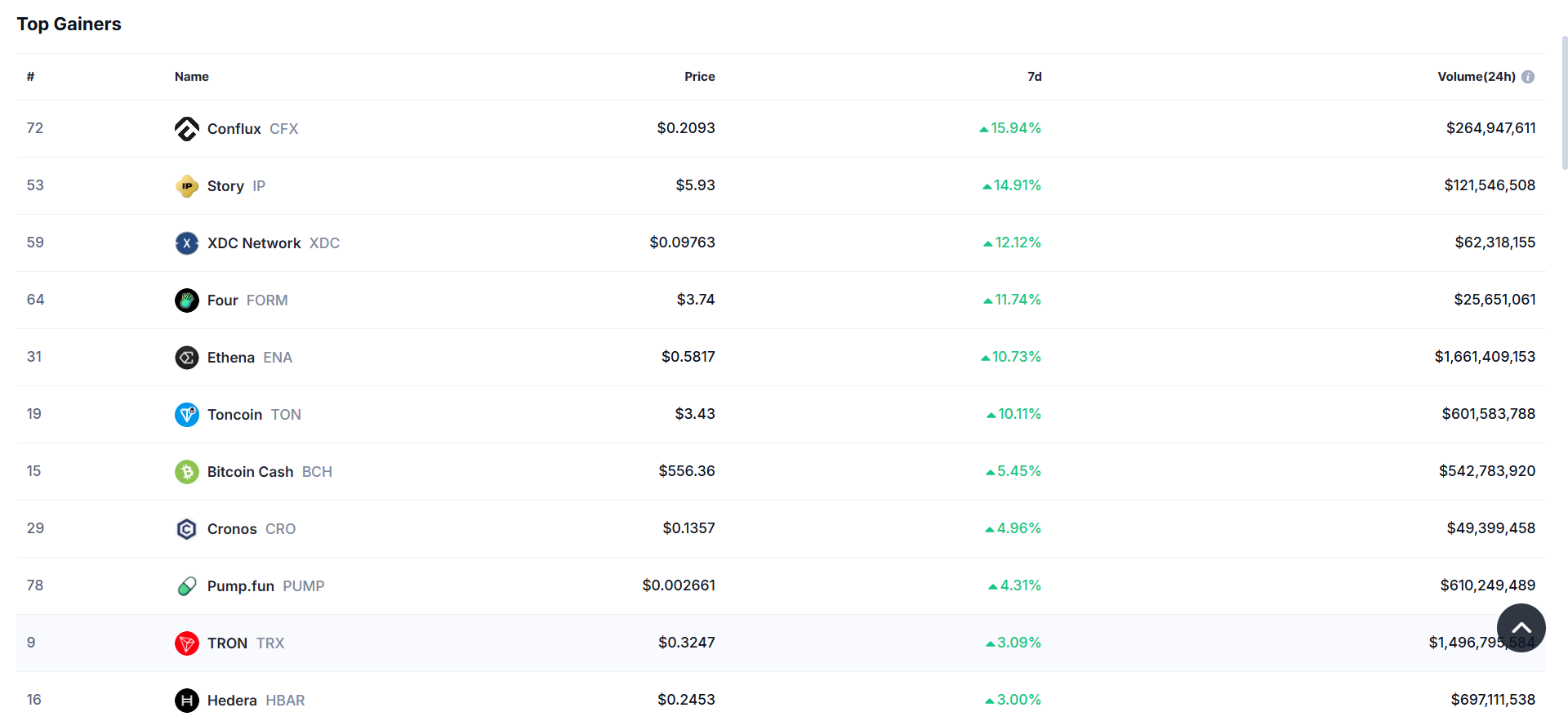

Top 10 Crypto Gainers of The Week

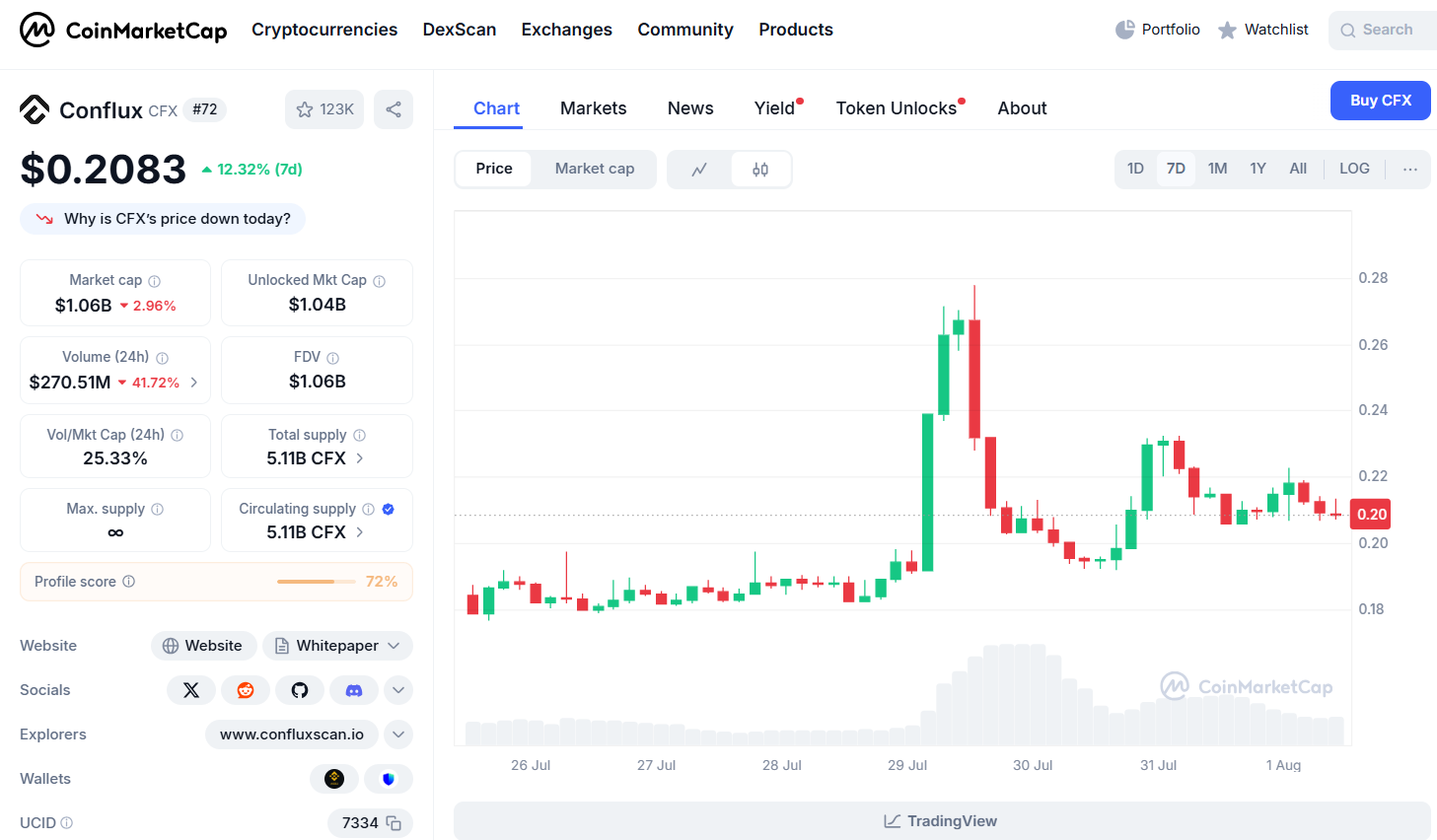

1. Conflux (CFX)—Up 15.94%

Conflux topped the charts this week with a 15.94% gain, trading at $0.2093. Often called China’s public blockchain, CFX is riding the momentum from the new RMB stablecoin pilot built on its network.

With over $264 million in daily volume, the surge is also being fueled by strong on-chain activity and technical setups. Its government ties and potential role in China’s Belt and Road cross-border payment ambitions are drawing renewed market interest.

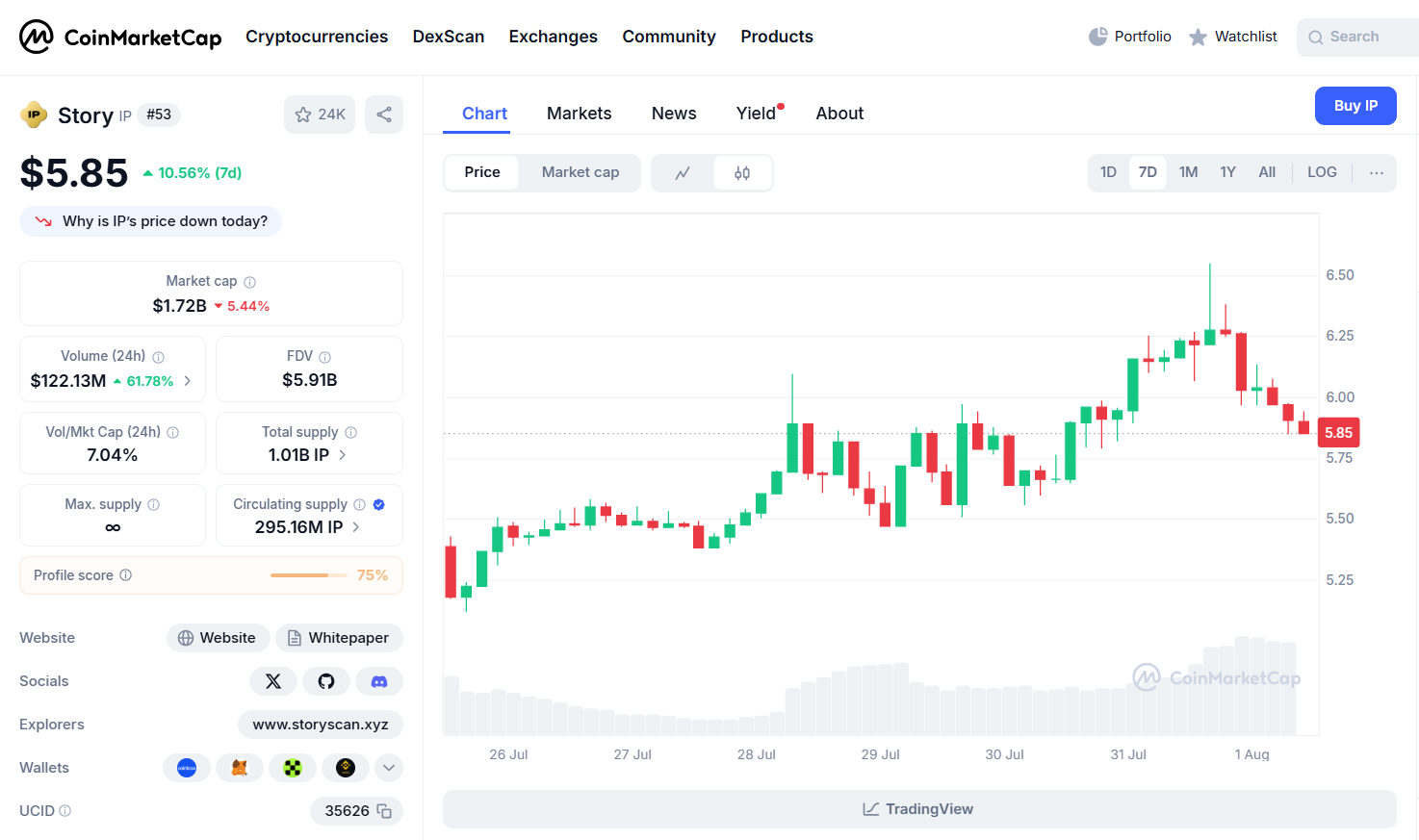

2. Story Protocol (IP)—Up 14.91%

Story Protocol has been quietly climbing for several weeks now, and it’s showing no signs of slowing down. This week, it added another 14.91%, bringing its price to around $6.00.

The project focuses on managing intellectual property rights in Web3, which is starting to catch on as more creators and builders look for decentralized ways to protect their work. Trading volume also crossed $121 million, which shows there’s growing conviction behind the move. All signs point to investors taking narrative-driven crypto seriously again.

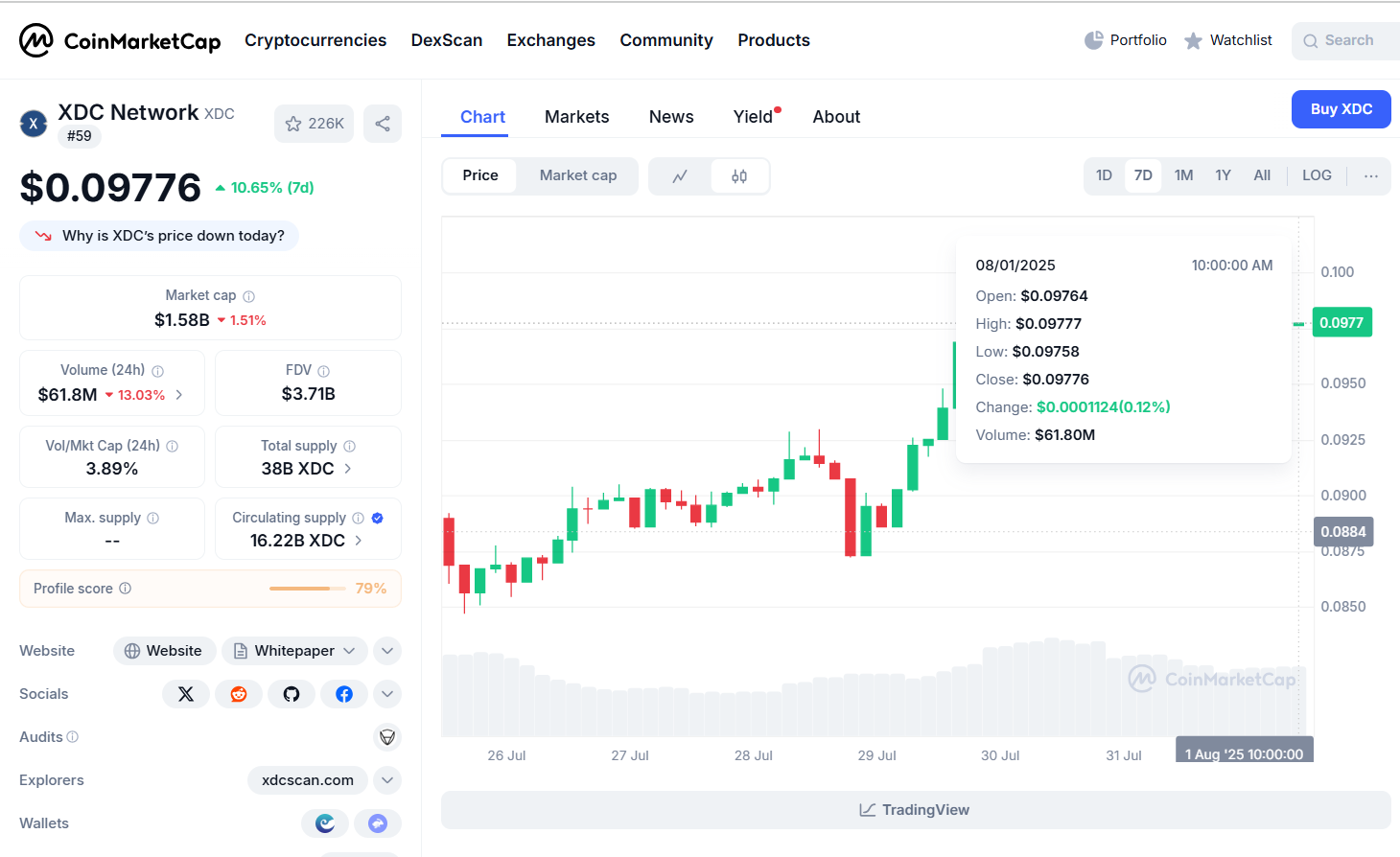

3. XDC Network (XDC)—Up 12.12%

Climbing 12.12% to $0.09763, XDC has had a strong week, and there’s a clear reason why. The enterprise-focused blockchain, known for bridging traditional finance with crypto through its hybrid model, just landed a fresh listing on Binance US.

The XDC/USDT pair officially went live on July 30, right after deposits opened the day before. This gave the token a major push, with Binance.US alone accounting for over 63% of XDC’s total $84 million trading volume during that period. For a network targeting global trade and institutional adoption, this kind of exchange visibility makes a big difference.

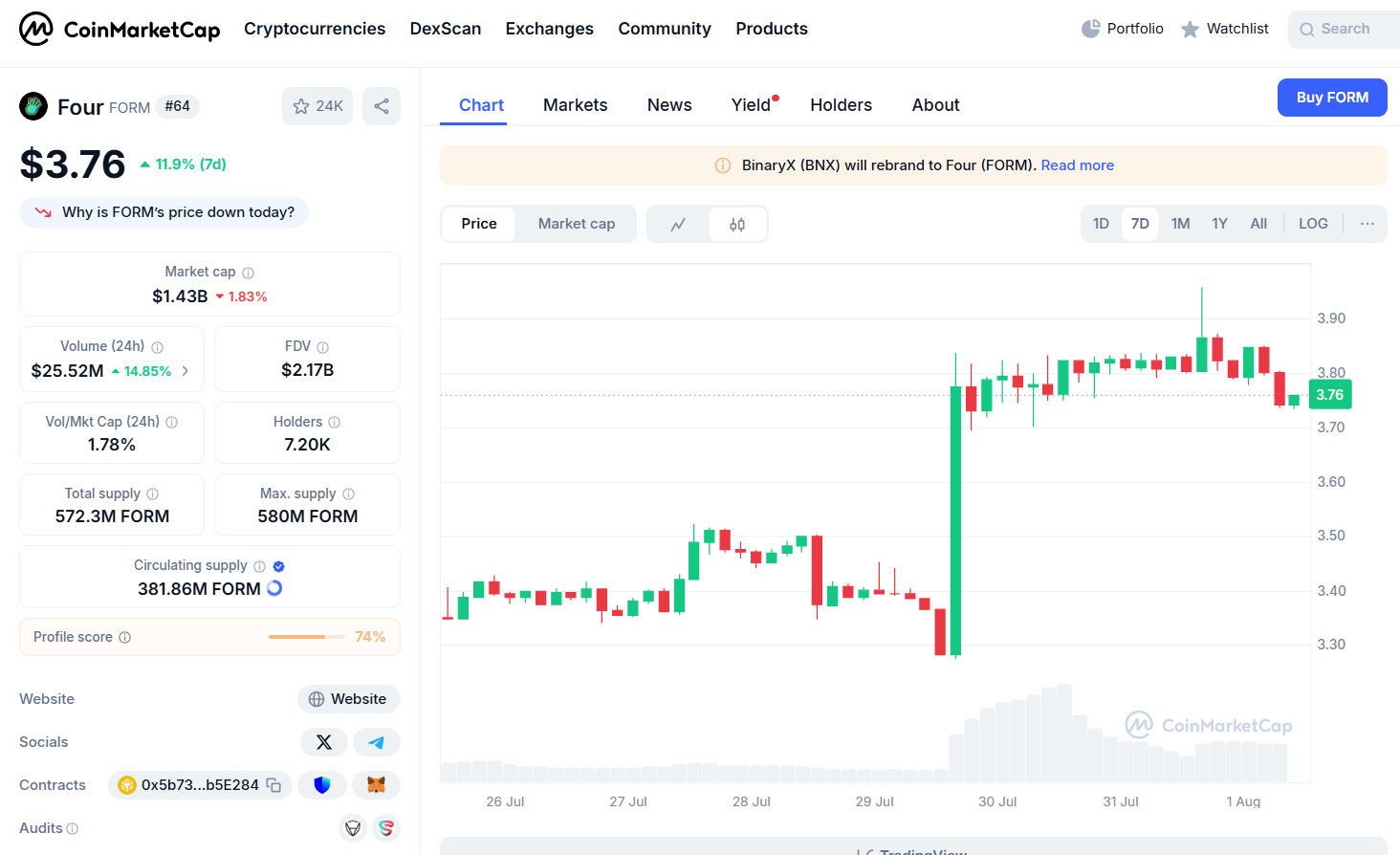

4. Four (FORM)—Up 11.74%

Previously known as BinaryX (BNX), Four climbed 11.74% this week to reach $3.74. The token’s recent rebranding, paired with a renewed focus on GameFi, has helped fuel its latest breakout. While still flying under the radar compared to bigger names, its $25 million in trading volume suggests growing interest in Web3 gaming narratives and early-stage ecosystem plays.

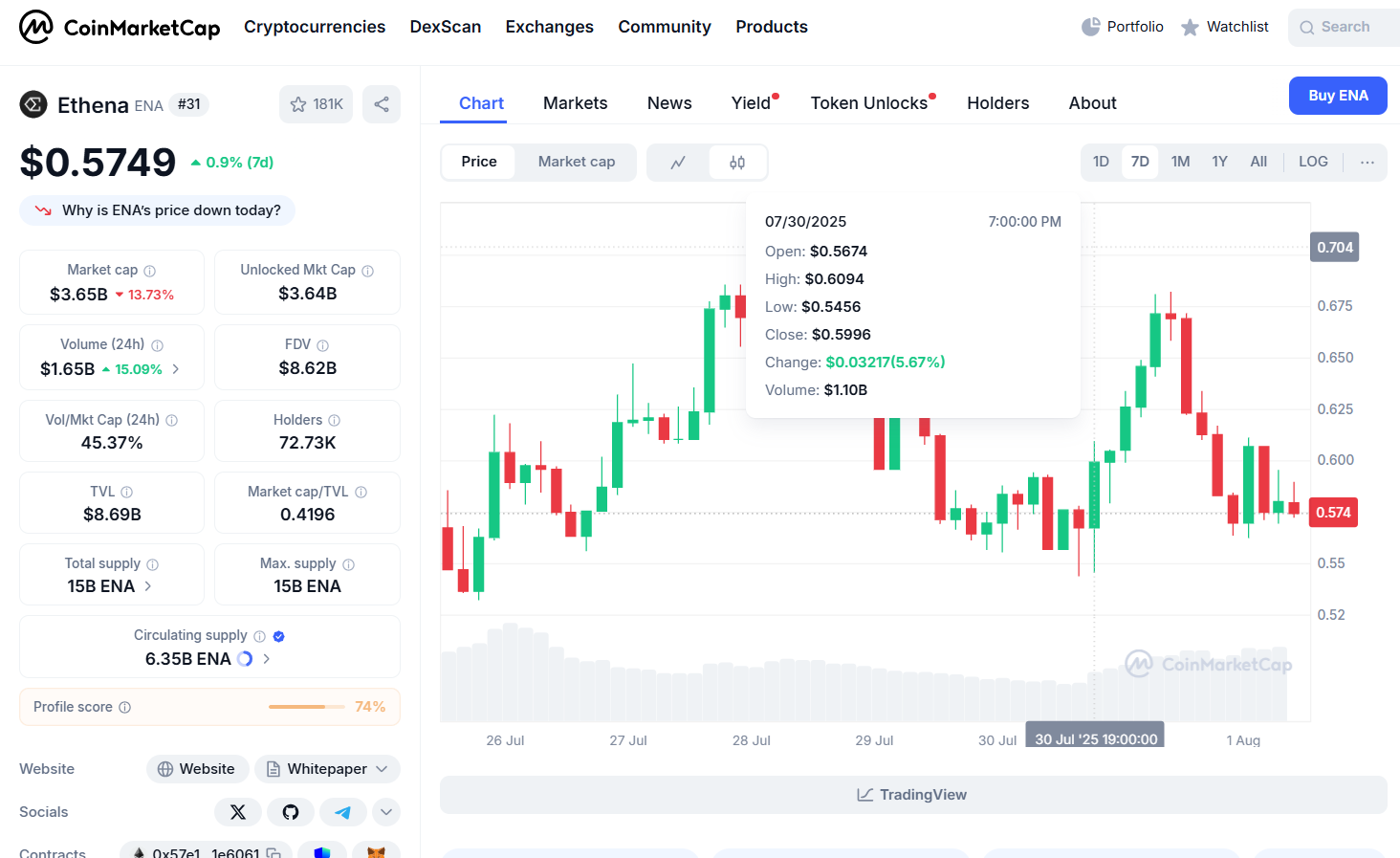

5. Ethena (ENA)—Up 10.73%

Ethena continues to outperform, registering a 10% gain this week and maintaining its spot among the top crypto performers for the second week running. Much of the upside appears to be driven by rising adoption of its synthetic dollar, USDe, as well as broader DeFi market interest.

The data reinforces the sentiment—24-hour trading volume has reached $1.66 billion, indicating strong market participation and liquidity. As fundamentals align with momentum, ENA remains a project to watch.

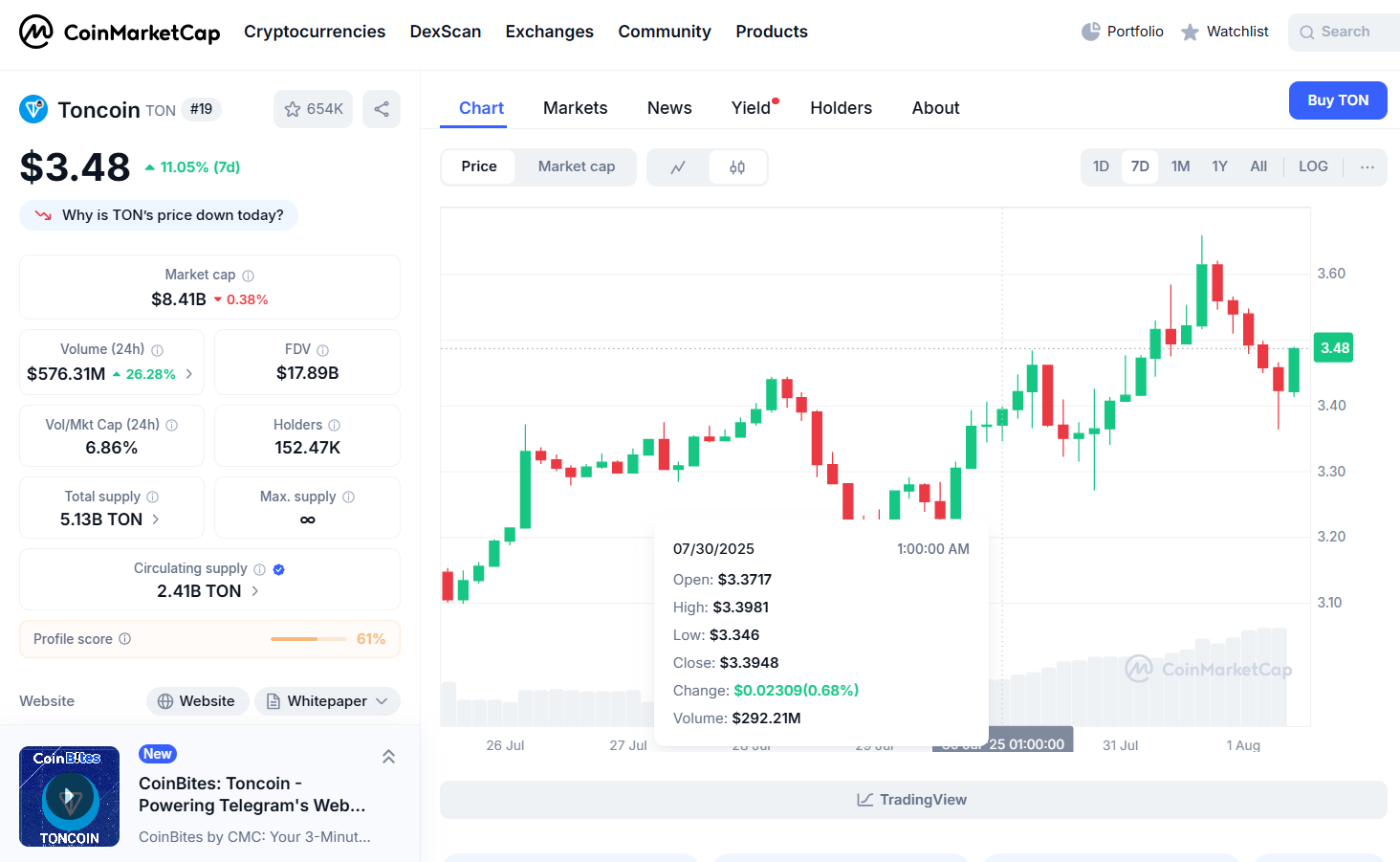

6. Toncoin (TON)—Up 10.11%

Following a steady stream of ecosystem activity, Toncoin recorded a 10.11% gain this week, now trading at $3.43. Its close integration with Telegram continues to give it a unique edge, positioning TON as one of the few layer-1s with a built-in user base. Trading volume stayed strong above $600 million, reflecting sustained market confidence.

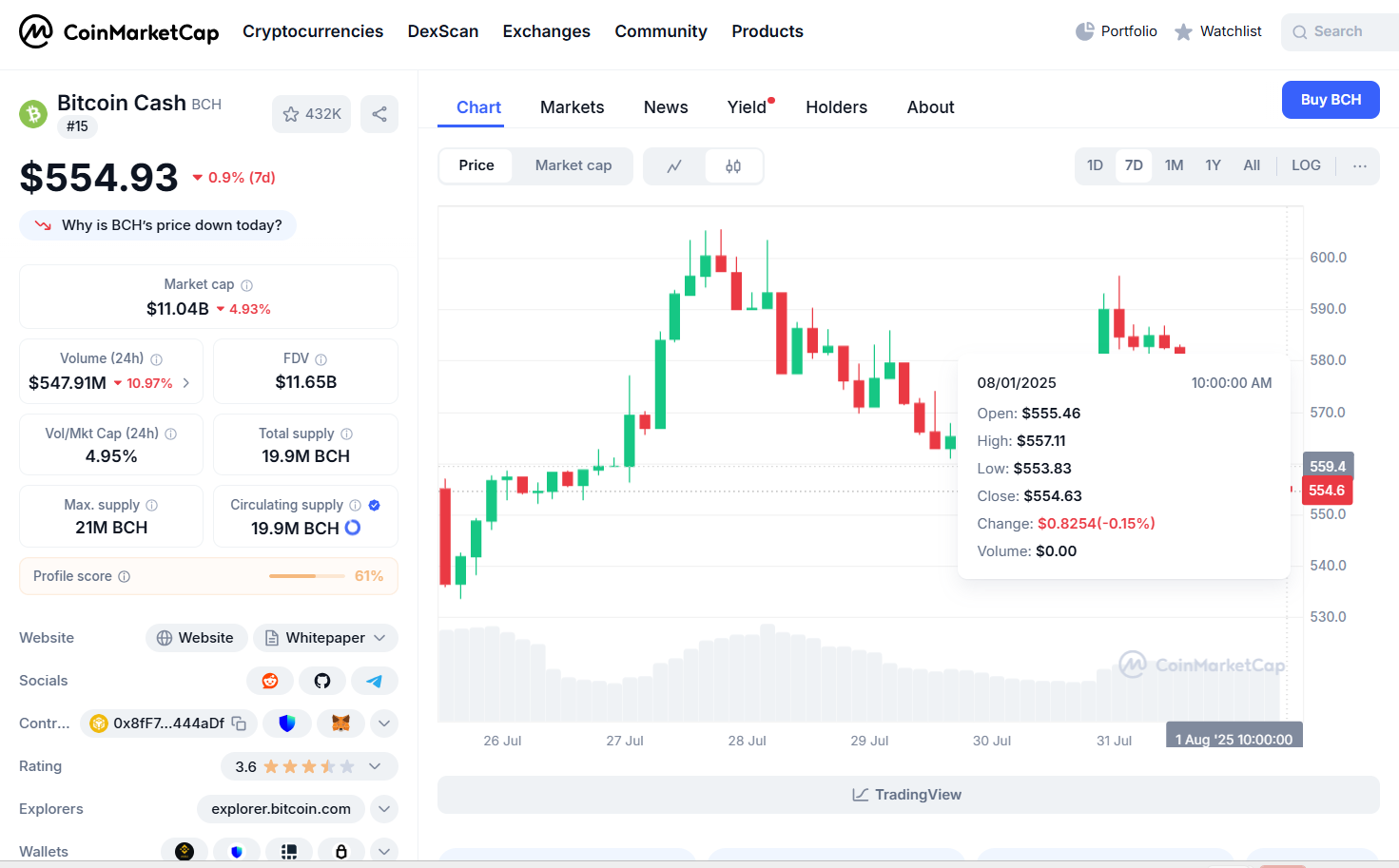

7. Bitcoin Cash (BCH)—Up 5.45%

Momentum also picked up for Bitcoin Cash, which rose 5.45% to $556.36. While it often moves in Bitcoin’s shadow, BCH tends to follow broader market sentiment during upswings—and this week was no exception. With $542 million in trading volume, it’s clear there’s still meaningful activity around this forked asset.

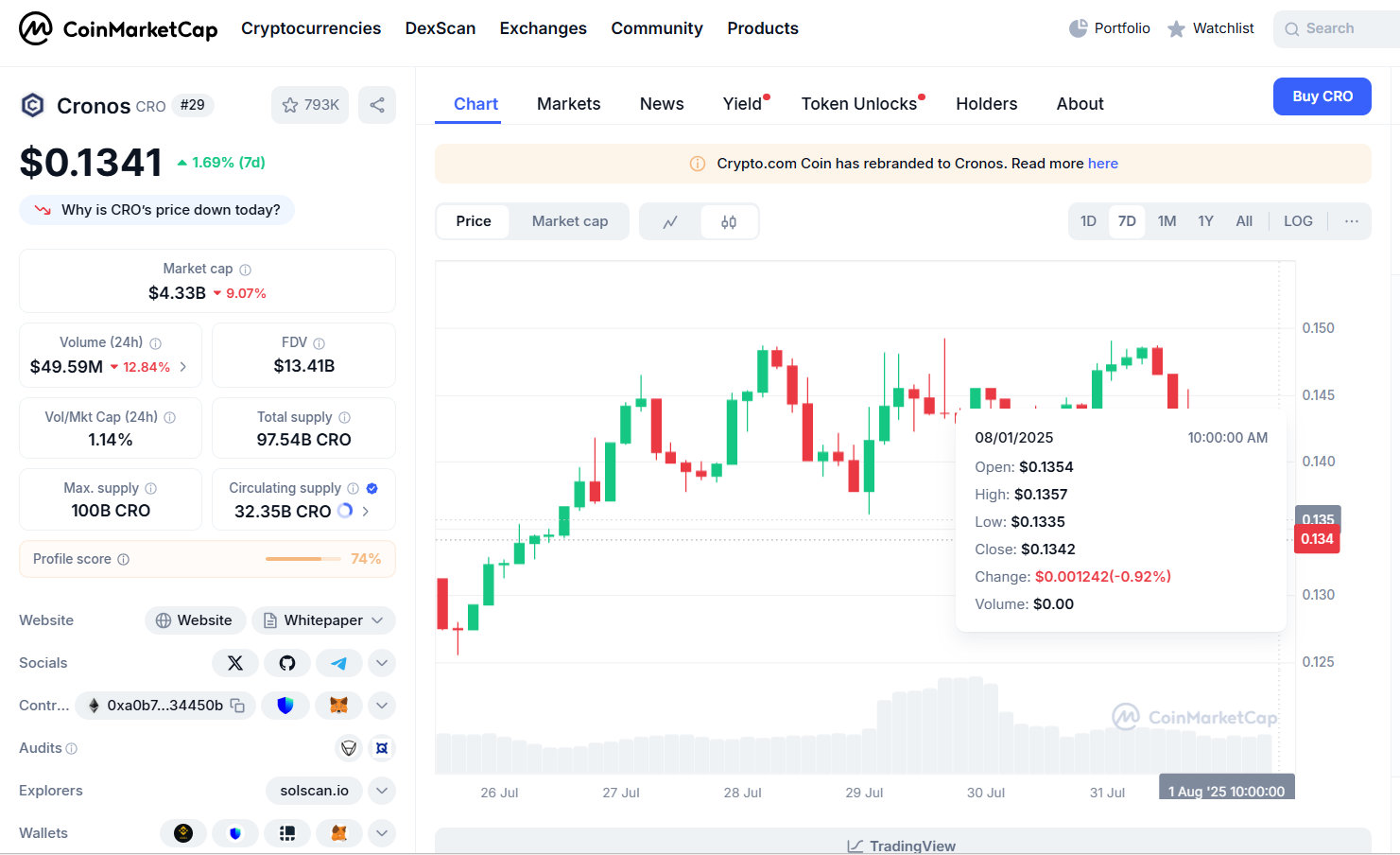

8. Cronos (CRO)—Up 4.96%

Crypto.com’s native token CRO edged up by nearly 5%, bringing its price to $0.1357. This minor price movement is largely attributed to strong on-chain activity within its growing DeFi and NFT ecosystems.

9. Pump.fun (PUMP)—Up 4.31%

Speculation remains alive and well, as Pump.fun jumped 4.31% to $0.002661. Despite the name, it posted over $610 million in trading volume, putting it ahead of several more established tokens this week. While risky by nature, meme coins like PUMP continue to attract outsized attention in short bursts.

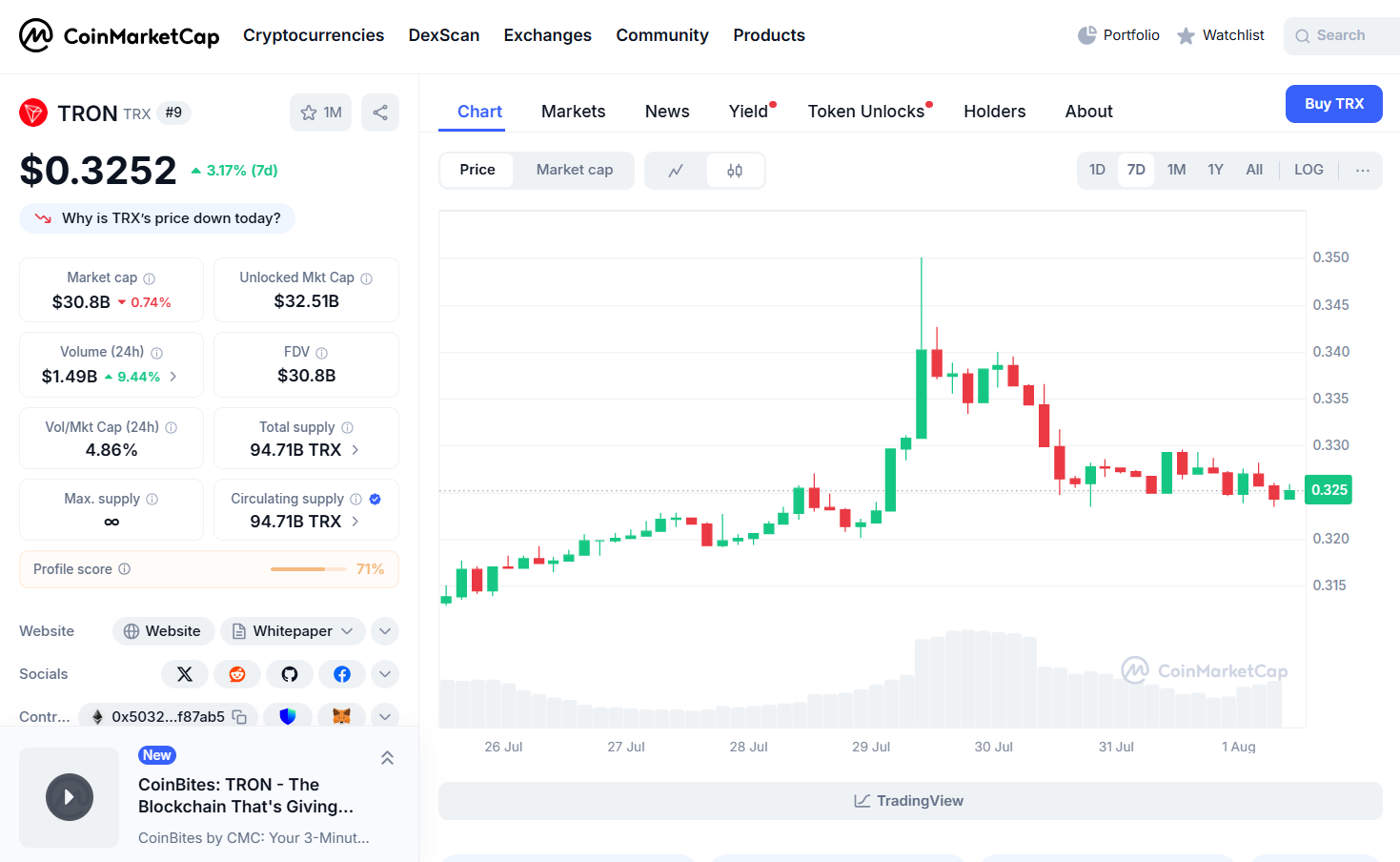

10. TRON (TRX)—Up 3.09%

TRON rounds out the list with a modest 3.09% climb to $0.3247. With $1.49 billion in trading volume. TRON’s consistent rise is tied to its stablecoin activity and regional payments adoption in Asia.

Conclusion

While Bitcoin remains in consolidation mode, altcoins continue to steal the spotlight. This week’s top gainers include a mix of foundational networks, DeFi contenders, and a few surprise meme coins that show smart money is flowing into utility tokens. Whether these rallies are sustained into next week will depend on macro sentiment and market liquidity—but for now, the green candles are lighting up.

Image source: CoinMarketCap