Mid-week, the U.S. Bureau of Labor Statistics released fresh CPI data showing consumer prices rose 2.7% year over year through November. That’s down from 3% in September and below the 3.1% economists were expecting. It might not seem like a big deal since markets barely moved, but taking a closer look gives you a clearer picture.

Slowing inflation tends to push traders back toward risk. That means there’s a higher chance interest rates stay where they are, or even move lower down the line, which usually frees up liquidity across markets. While the broader crypto market hasn’t reacted dramatically yet, some tokens quietly benefited, posting small but noticeable gains.

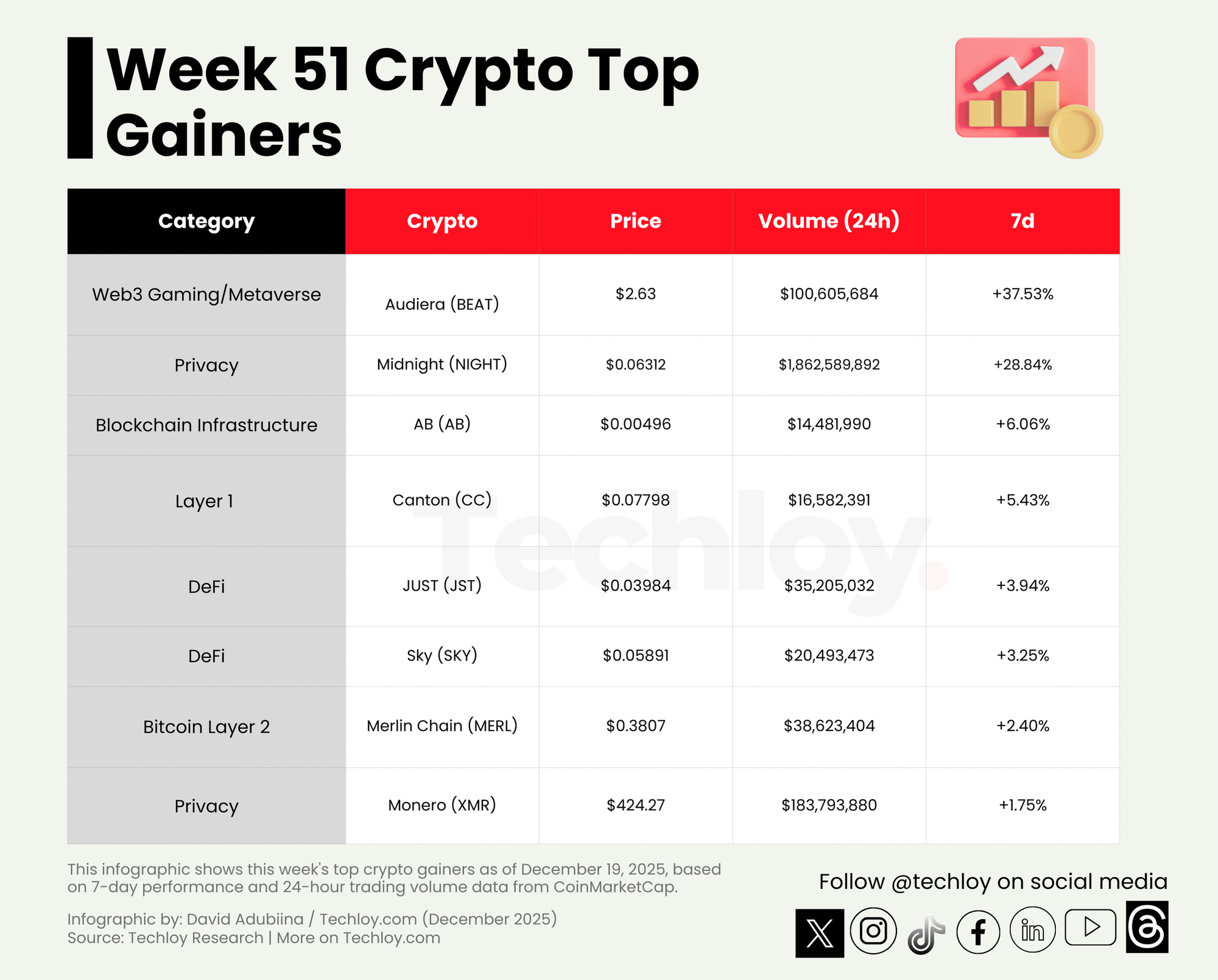

Among the week’s top gainers were smaller and mid-cap tokens that often move first. Audiera (BEAT) jumped 37.53%, Midnight (NIGHT) 28.84%, AB 6.06%, Canton (CC) 5.43%, and JUST (JST) 3.94%. Sky (SKY) and Merlin Chain (MERL) also edged up a bit. Meanwhile, bigger names like Monero (XMR) and Bitcoin Cash (BCH) rose more cautiously, and gold-backed tokens like Tether Gold (XAUT) and PAX Gold (PAXG) gained less than 1.1%.

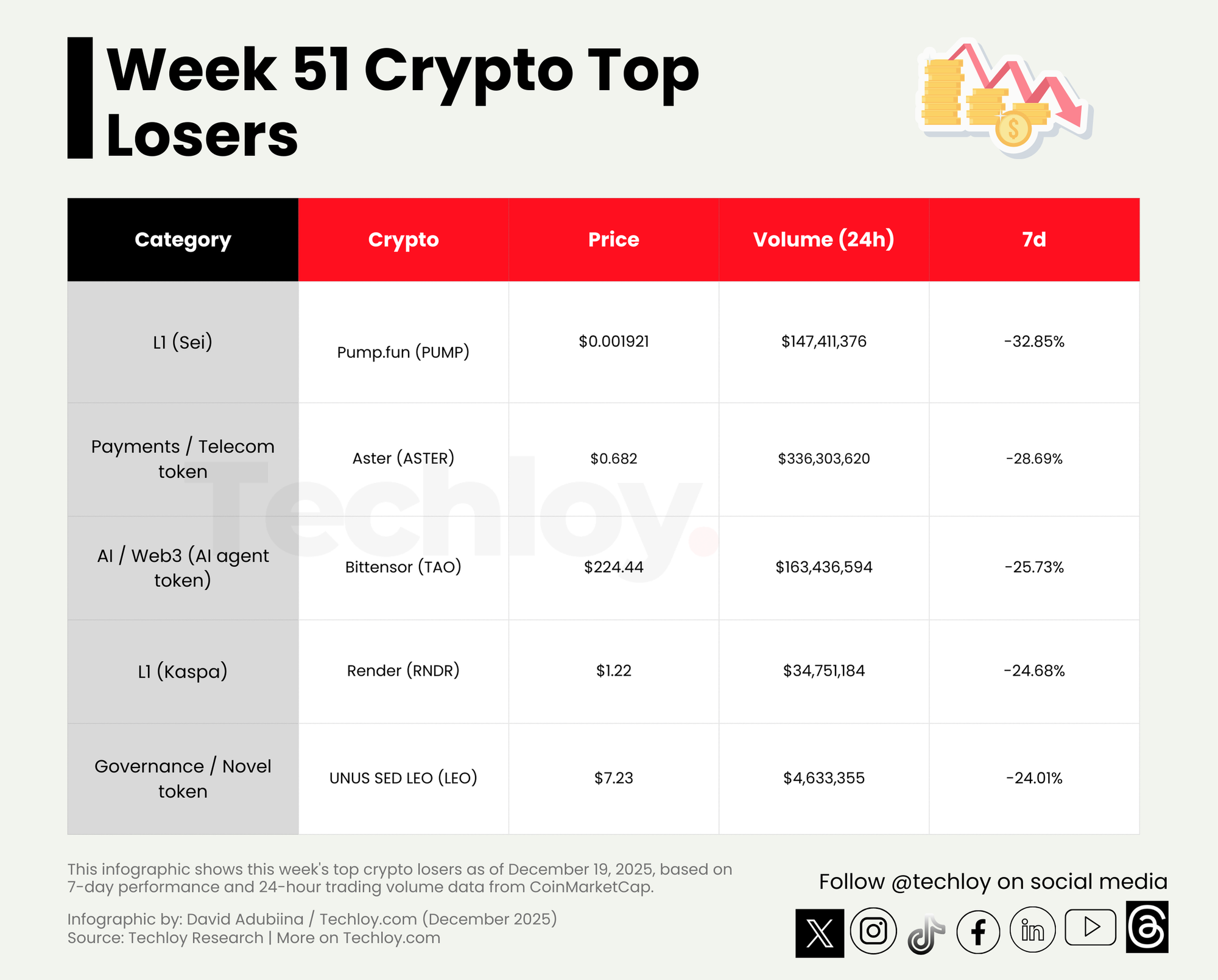

On the losers' side of the list is Pump.fun (PUMP), which fell 32.85% on the week, the steepest drop among the top decliners. Aster (ASTER) followed with a 28.69% loss. Bittensor (TAO) slid 25.73%, while Render (RNDR) dropped 24.68%. UNUS SED LEO rounded out the top five losers, down 24.01%, pointing to profit-taking across AI and utility-focused tokens that had already seen strong runs.

Notably, this week’s gainers and losers reflect a market responding to macro relief rather than chasing a single narrative. Whether that calm holds or gives way to fresh volatility may hinge on the final major macro event of the year: the Bank of Japan’s interest rate decision on December 19.