If you were asked, “How much equity should you give away as someone building a business?" What would your answer be? For most business owners, the instinct is to hold on to as much as possible.

After all, you worked hard to build it. But to answer that question properly, you first have to understand what equity is, and then why dilution happens, and when it might be necessary.

What is Equity?

From an investor’s perspective, "equity” can mean different things depending on the context. But in the business and startup concept, equity generally means ownership. When we say “ownership,” this basically means having a legal stake in a company, which can include having a say in certain decisions, and potentially a payout if the company is sold or goes public.

In practical terms, equity is the amount of shares you own. Take, for instance, if a company is divided into 1,000 shares and you own 100 of them, you hold 10% equity. This percentage reflects your claim on the company’s value and future success.

For founders, equity defines both their decision-making power and the share of rewards they’ll receive as the company grows. For employees, it’s often part of their compensation, giving them a personal stake in the company’s success. And for investors, equity is the payoff for taking the risk of putting their money into the business.

So, when we talk about equity in business, we’re talking about your ownership in a startup in its most tangible form, a piece of the pie that represents both your financial stake and your role in a company’s journey.

What is Equity Dilution?

In business and finance, equity dilution is known by a few different names—founder dilution, stock dilution, share dilution, private company dilution, or startup dilution. They all mean the same thing: your ownership percentage in the company gets smaller when new shares are issued.

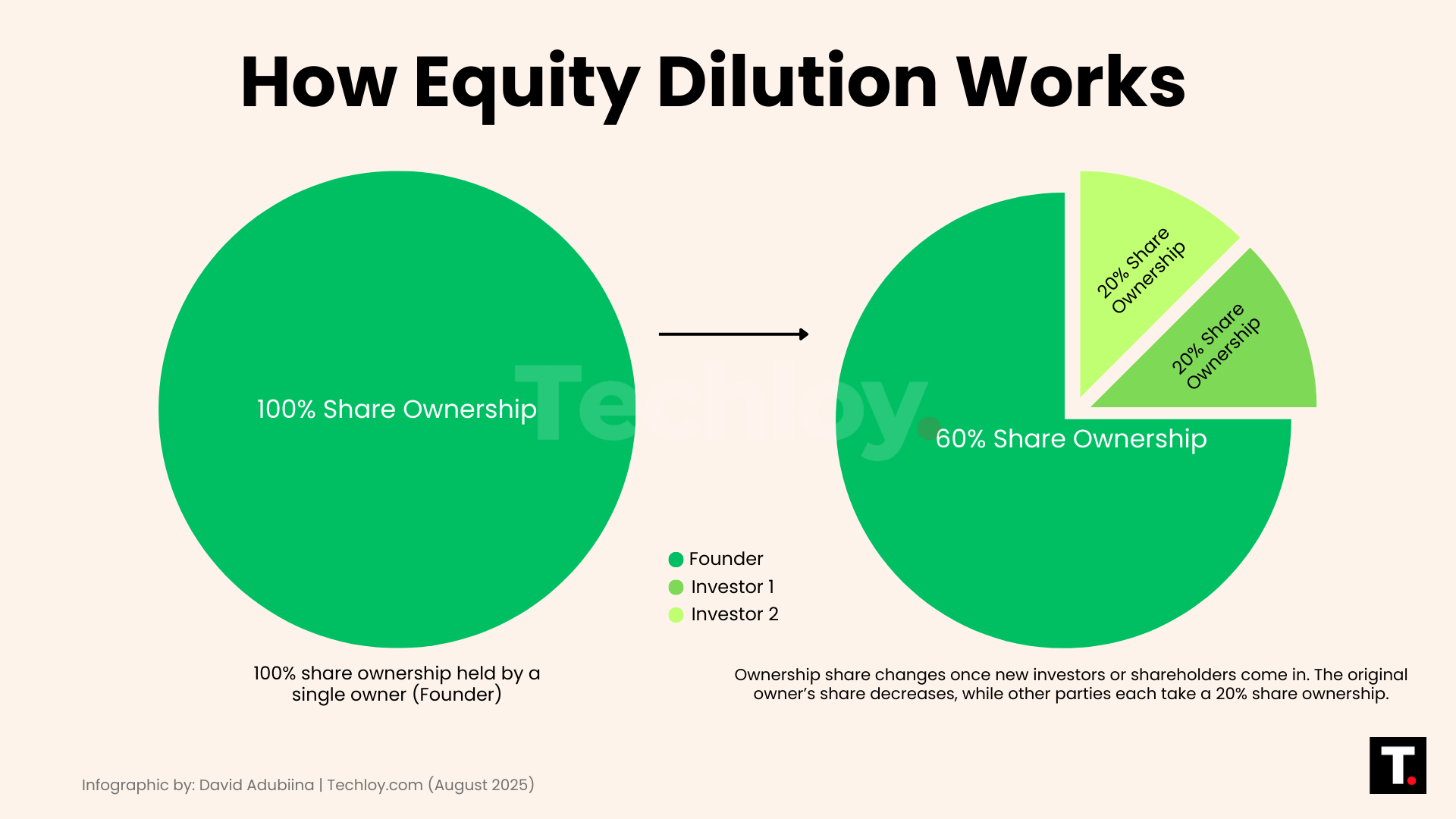

Normally, when you start a business, you own 100% of it; every share, every decision is all yours. But the moment you raise money or issue new shares for any reason, your share gets smaller. Why? The number of shares you personally hold will not change, but because the total pool has grown, your share now is a part of the whole pie.

How Equity Dilution Works

To understand how equity dilution works, you can think of it like a pizza you ordered. At first, you have the whole pizza to yourself, meaning you have 100% ownership until a friend comes over, and you cut the pizza in half so they can have a share. Now you have 50%. More friends arrive, and you keep slicing. Eventually, your once-whole pizza is down to a much smaller slice—still yours, but not the same size you started with.

In business, instead of friends, these “guests” are new investors, employees with stock options, or even strategic partners. Each one takes a slice of equity in exchange for something. This could be money, skills, or resources that they bring to the table.

Why Equity Dilution Happens

Equity dilution isn’t automatically a bad thing. In fact, for most growing businesses, it’s almost unavoidable. At its core, dilution happens when you bring more people into the ownership pool — and in exchange, you get something that’s supposed to help the business grow. The tricky part is knowing when it’s worth it.

Here are the most common reasons why equity dilution occurs:

1. Raising Money from Investors to Fund Growth

This is the most familiar reason for equity dilution in most cases. There are times when you need to scale, whether to open new locations, launch a product, or invest in marketing, and an investor is willing to give you that money in exchange for equity. You might have to give up a portion of ownership in hopes that the company will grow significantly.

Take, for example, you own 100% of a business worth $100,000. That’s your “whole pizza.” If an investor offers $50,000 for 25% of the company's current value of $200,000. Your share automatically drops to 75%. However, when the business grows to $1 million, your 75% is now worth $750,000.

2. Offering Stock Options to Attract and Retain Talent

Cash-strapped startups can’t always compete with big corporations on salaries. That’s where equity comes in. By offering stock options or equity grants, you give employees a reason to stay committed — because if the company succeeds, their shares will be worth something substantial.

Yes, this dilutes your stake. But think of it as buying loyalty and hard work without having to pay for it upfront. The right hire could create enough value to outweigh the small percentage you give away. Many of the biggest tech companies — from Google to Shopify — used equity incentives early on to keep top talent motivated while still operating lean.

3. Bringing in a Co-Founder or Key Partner with Valuable Expertise

Sometimes, you can’t do it alone as effectively as when you have like-minded people who can build alongside you, and as such, a co-founder or key partner is important to help increase the company’s chances of success. Instead of paying them in cash, you offer equity so they’re invested in the long-term outcome.

This is common in tech startups where, say, a non-technical founder brings in a technical co-founder to build the product. Giving away, say, 20% might hurt in the short term, but if that person’s expertise is the reason the product works and investors take interest, it’s a smart trade.

4. Converting Debt into Equity

This happens with instruments like convertible notes or SAFEs (Simple Agreements for Future Equity). Instead of paying back a loan in cash, you agree that the debt will convert into shares at a later date — often when you raise your next funding round.

This can be helpful because it delays the need for cash repayment while still rewarding early supporters. Of course, it means your ownership percentage will drop when the conversion happens, but it can be a lifeline when you need funds urgently without adding repayment pressure.

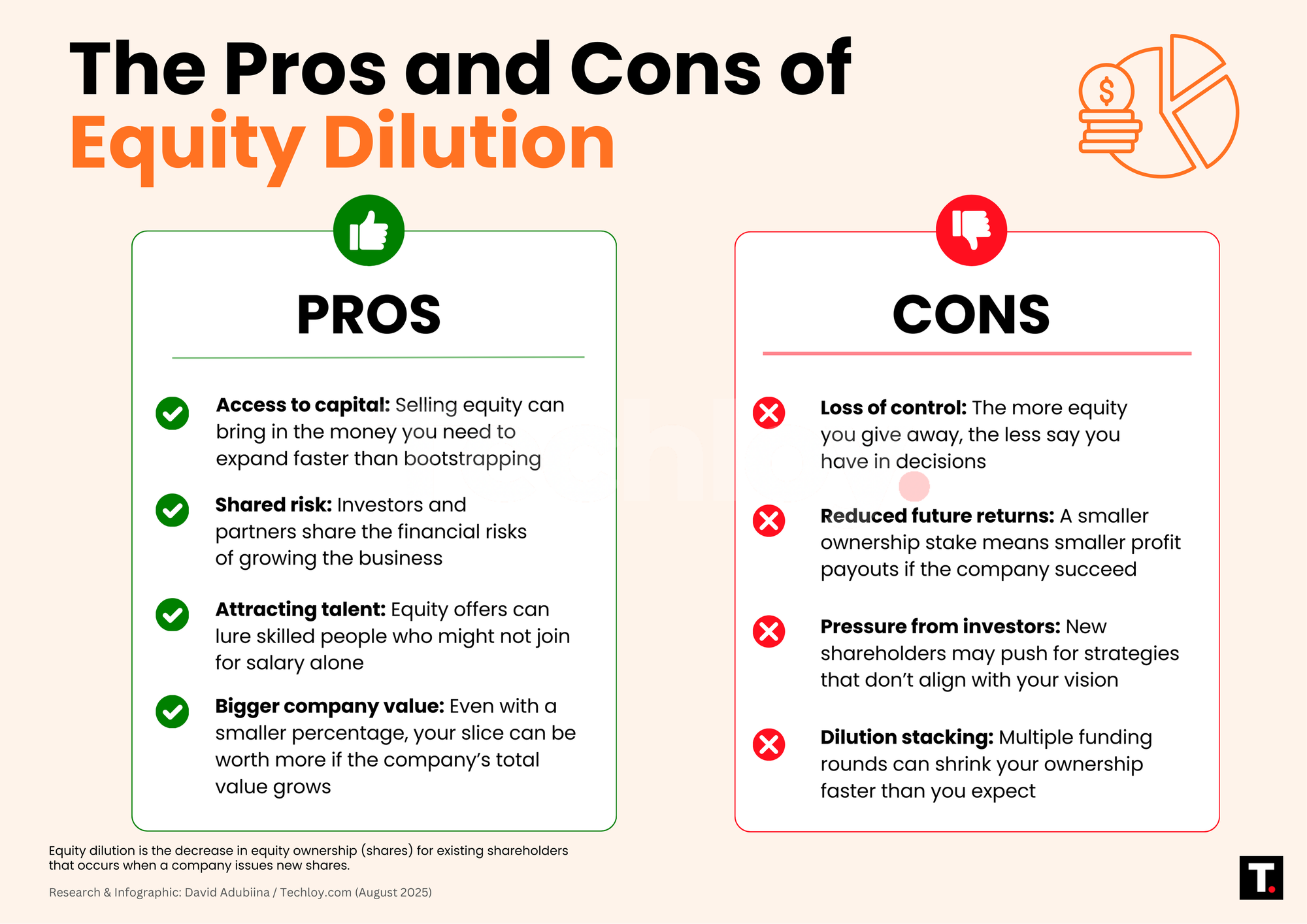

Pros and Cons of Equity Dilution in a Business

Conclusion

While it is the dream of every founder or business owner to grow their business, it is not in every case that equity dilution helps. The most important thing is knowing when dilution is worth it.

Sometimes giving away your business shares is the only way to unlock the resources, skills, or connections needed to grow. At other times, it’s better to hold off and protect your stake. The best founders don’t just think about how much of the company they own today; they think about what their smaller piece could be worth if the company becomes truly successful.