Often, you hear that a company has just raised $12 million in a Series B round or $3 million in startup funding. Those headlines sound exciting, but what many people don’t stop to ask is, how did they even decide what the company was worth before the money came in? That’s where pre-money valuation comes in. A common misconception, one I used to have too, is that startups come up with a number they need to keep the business running, and if investors like the idea, they just throw in the money. But that’s not how it works. There’s a whole process of figuring out what the business is worth before any cash changes hands. And the term you’ll hear over and over in this context is pre-money valuation.

What is pre-money valuation?

Pre-money valuation simply means the estimated worth of a company before it receives new funding or investment. Think of it like the price tag placed on the business at that exact point in time—before new money flows in and changes the numbers.

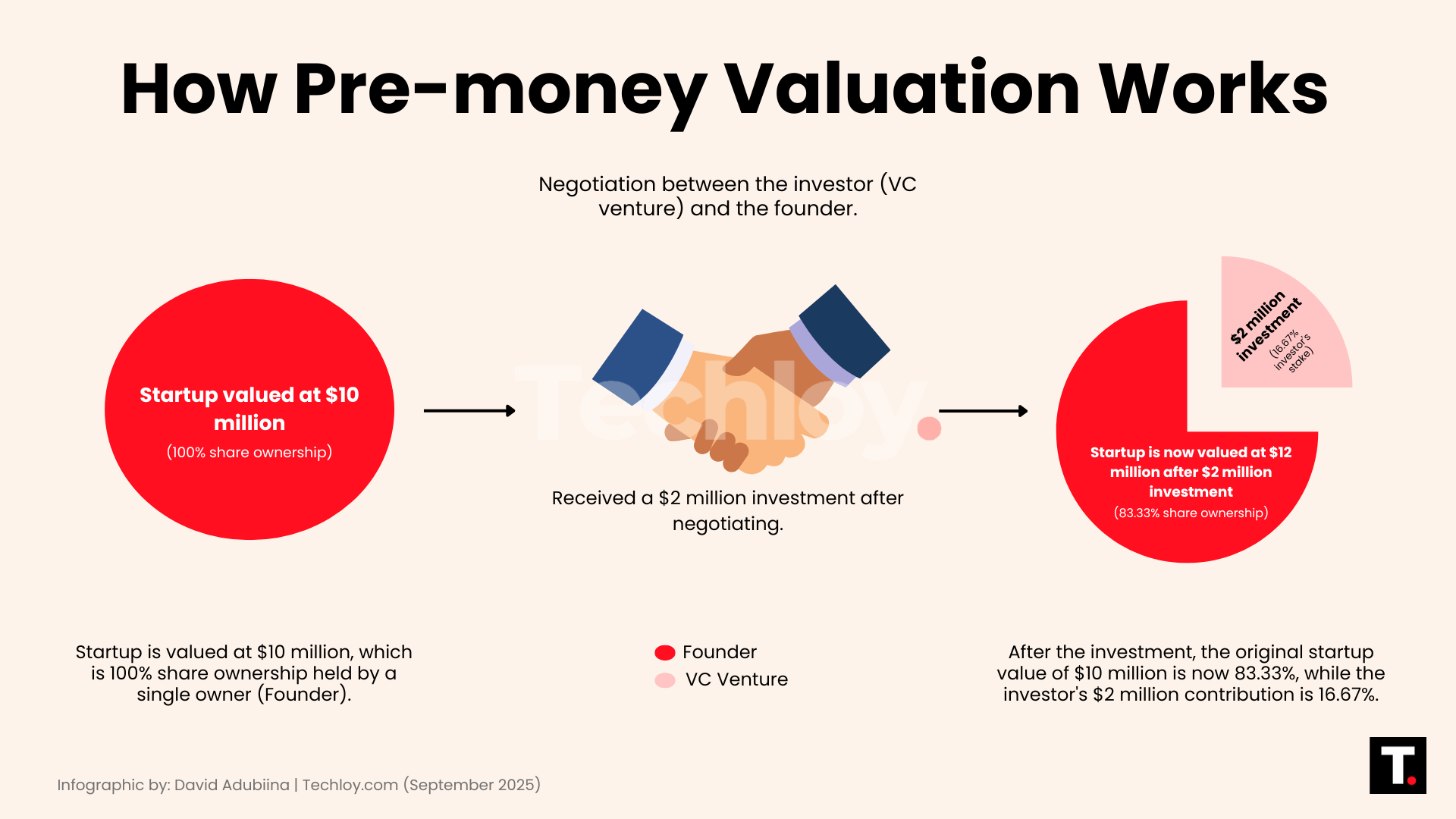

Say you have a startup. You’ve built a product, attracted some users, and maybe even started generating a little revenue. Now you’re looking for investors to put in $2 million so you can grow faster. Before any deal is made, everyone has to agree on how much your company is worth right now; that’s the pre-money valuation.

Why is pre-money valuation important?

If your startup is valued at $8 million pre-money, and an investor puts in $2 million, your company’s value after the deal (called post-money valuation) becomes $10 million. That $2 million investment would then buy the investor a 20% stake in your company ($2 million out of $10 million).

So, the pre-money valuation isn’t just a random number. It sets the stage for how much ownership you, as a founder, keep and how much the investor gets in return.

Investors and founders use it as a benchmark during negotiations. It helps decide the equity split, the price per share, and even the confidence level in how much potential the company has. A higher valuation means founders give away less ownership for the same amount of money, while a lower valuation means investors get a bigger slice of the pie.

How does pre-money valuation work?

1. Know the baseline value

The first thing you want to take note of in a business, whether as an investor or the owner, is the value of the company before any new money comes in. This pre-money valuation is the starting point that tells everyone what the company is worth right now.

2. The negotiation stage

Once there’s a baseline, the conversation shifts into negotiation. Founders will naturally push for a higher valuation because that means they give away less equity. Investors, on the other hand, want the valuation to be lower so they can secure more ownership for their money. The final number is usually somewhere in between, depending on how much belief there is in the business.

3. What shapes the valuation

This figure isn’t guessed or made up. Several things come into play: what the company has already built, whether it’s earning revenue or has a clear path to it, how strong and experienced the founding team is, the company’s position in the market, and how much potential there is for growth. A company with no revenue but a strong team and a big market opportunity can still attract a high valuation because of what it could become.

4. Calculating ownership

Once the pre-money valuation is agreed upon, it’s used to figure out how much of the company the investor will own after putting in money. The formula is simple:

Pre-Money Valuation = Post-Money Valuation - Investment Amount

So, if a startup is valued at $10 million before funding, and an investor puts in $2 million, the new value after the deal (post-money valuation) is $12 million. That $2 million now represents 16.67% of the company ($2M ÷ $12M).

How to determine pre-money valuation

Before pre-money can be determined, it has to be before an initial public offering (IPO) or before seed, angel, or venture capital funding is put into a company.

This is because investors don’t just hand over money blindly. They check a few key things first: how healthy the company’s finances are, how much room there is for growth, and who else is competing in the same space. To make sense of all this, they rely on a couple of common methods that help put a number on the company’s value.

1. Discounted Cash Flow (DCF)

One common way investors check a company’s value is by looking at what it could earn in the future. They take those future numbers and bring them back into today’s terms. If what they get shows the business is worth more than the amount to be raised, then it's certainly worth considering.

2. Comparable Company Analysis (CCA)

Another way startups use is by comparing the company to others in the same space. They’ll check things like sales, earnings, or overall market value. If your company looks way more expensive than your competitors, they may call it overvalued. That can shape how they negotiate, the terms they demand, or even whether they put in money at all.

Conclusion

Raising money can keep your business alive and help it grow, but the real trick is knowing when to give out equity and how much to part with. A higher valuation helps you hold on to more of your company, while a lower one can chip away at your control. At the end of the day, the goal is to get the funds you need without giving away the business you built.