- SoftBank sold its entire Nvidia stake for about $5.83 billion.

- It has committed up to $30 billion to OpenAI, including a $22.5 billion tranche approved in late 2025.

- SoftBank also cut its T-Mobile stake, raising about $9.17 billion.

For most investors, Nvidia has been the most dependable winner in the artificial intelligence (AI) economy. Its chips power nearly every major model, its margins have expanded quickly, and its valuation has climbed to historic levels as global appetite for compute has grown.

This dominance made SoftBank’s decision to sell its stake and redirect billions toward OpenAI and large-scale AI infrastructure one of the most surprising moves in the sector this year.

What looked like a retreat from the safest trade in artificial intelligence turns out to be evidence of where SoftBank believes the next wave of economic power is forming.

MORE INSIGHTS ON THIS TOPIC:

- The AI funding boom is here—but most of the money is flowing to a tiny club

- The U.S. government is getting a cut from Nvidia and AMD's AI chip sales to China

- OpenAI Becomes World’s Most Valuable Private Company

Did SoftBank sell Nvidia at the peak?

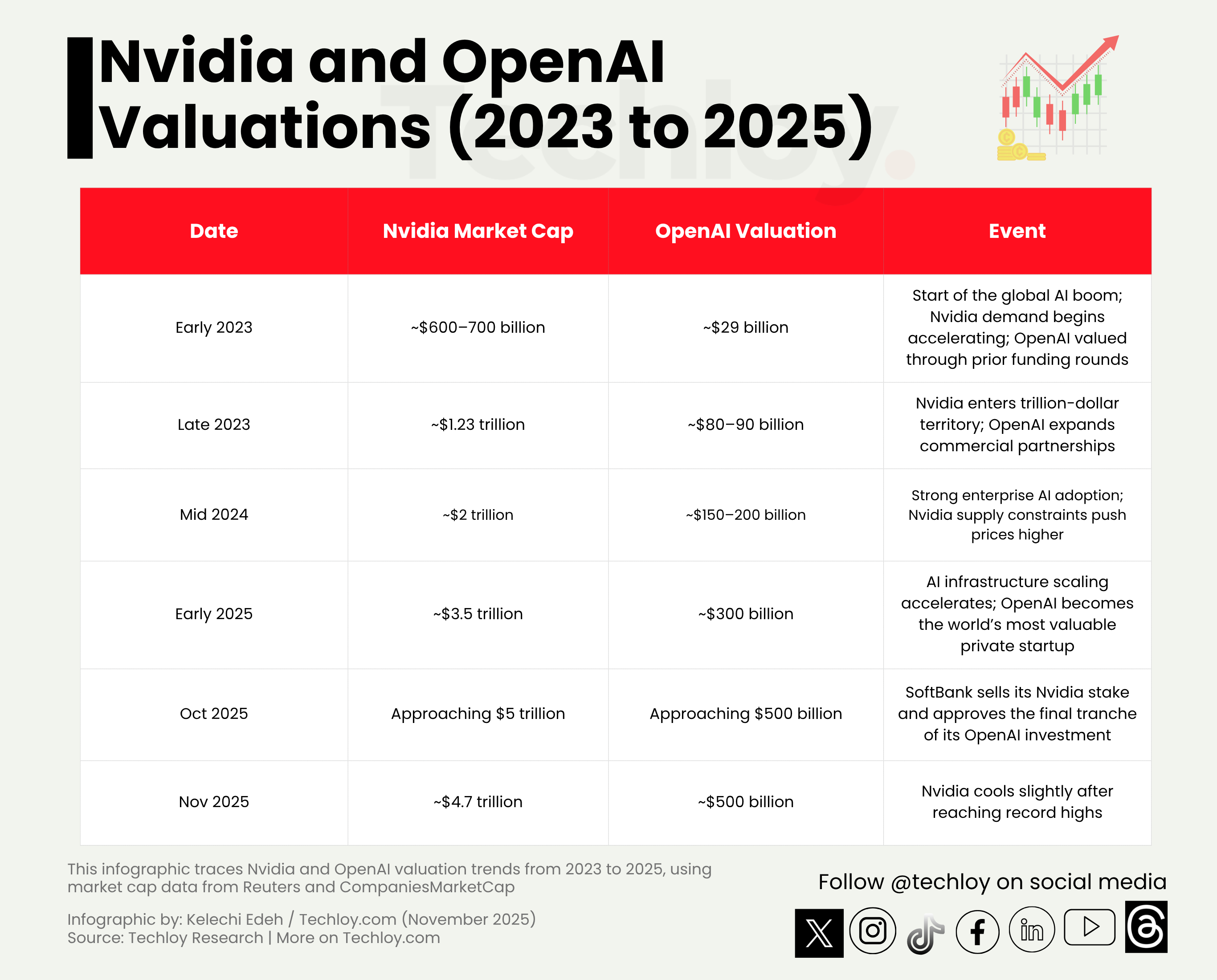

SoftBank offloaded its 32.1 million Nvidia shares for about $5.83 billion. At that moment, Nvidia’s valuation had nearly tripled in two years and was approaching the $5 trillion mark. Revenue was soaring, margins were widening, and investors had begun treating the stock almost like a guaranteed instrument for exposure to high-performance computing.

That stability was part of the problem. By then, Nvidia’s forward multiple already reflected several years of expected chip demand. Much of the future upside was baked into the stock price. For a company like SoftBank that seeks asymmetric outcomes rather than incremental gains, hardware no longer offers the steepest growth curve.

OpenAI, meanwhile, was on a very different path. A secondary transaction in late 2025 pushed the company toward a $500 billion valuation, reflecting growing confidence in the platform and model layers. Nvidia was valued as the leader of the present. OpenAI was valued as the engine of the future.

What made OpenAI more compelling than Nvidia?

Holding Nvidia limited SoftBank’s exposure to a single part of the AI system. Chips and hardware remain fundamental, but they are tied to cycles of semiconductor supply, export regulations, and foundry capacity. Even during periods of overwhelming demand, the economics are shaped by bottlenecks outside the company’s control.

But OpenAI sits at the point where demand originates and compounds. Developers build on its models. Enterprises deploy them in production. Entire product categories now form within its ecosystem. And the infrastructure required to power this activity has become one of the most strategically valuable and capital-intensive segments of the industry.

This is where SoftBank placed its largest commitment. The company approved another $22.5 billion of a planned $30 billion investment in OpenAI in late 2025, putting itself inside the early stages of large-scale AI infrastructure projects, including early work connected to the proposed Stargate data-center initiative.

This shift doesn't pull SoftBank away from hardware completely. Its ownership of ARM keeps it linked to the global chip design foundation, reinforcing long-term exposure to semiconductors even as it concentrates new capital in the layers where future value is expanding fastest.

Did SoftBank need the liquidity?

SoftBank’s net profits more than doubled in Q2 2025 ¥2.5 trillion (~$16.6 billion), yet its capital requirements rose even faster. Funding OpenAI at this scale and entering large infrastructure projects required immediate liquidity.

During an investor briefing, SoftBank’s chief financial officer (CTO) Yoshimitsu Goto explained that the Nvidia sale was intended to maintain financial strength while freeing capital for new AI investments, including OpenAI and the data-center buildouts connected to it.

The Nvidia exit was only one part of this reallocation. SoftBank also cut its T-Mobile stake, raising roughly $9.17 billion for upcoming commitments. Together, these moves created the financial capacity for the most ambitious artificial intelligence investments in the company’s history. Investors reacted quickly, and SoftBank’s stock fell nearly 10% after the announcement, reflecting the scale and significance of the pivot.

What does this pivot reveal about AI's next chapter?

The decision reflects where SoftBank believes the next major wave of value will form. Chips remain foundational, but the systems that run on top of them will define artificial intelligence’s economic direction over the next decade. These systems determine enterprise adoption, cost structures, and the practical reach of artificial intelligence across industries.

SoftBank didn't exit Nvidia because it doubted the chip sector. It exited because the future of artificial intelligence will be shaped by the platforms and infrastructure built above the silicon. SoftBank intends to help build those systems.