India’s Adani Group loses $70 billion in market value in less than a week

In a report made available to Techloy by Hindenburg Research, Indian multinational conglomerate, Adani Group – worth over $218 billion – has been accused of "stock manipulation", among other allegations. As a result, the market value of most of Adani Group subsidiaries has seen a sharp loss of up to

In a report made available to Techloy by Hindenburg Research, Indian multinational conglomerate, Adani Group – worth over $218 billion – has been accused of "stock manipulation", among other allegations.

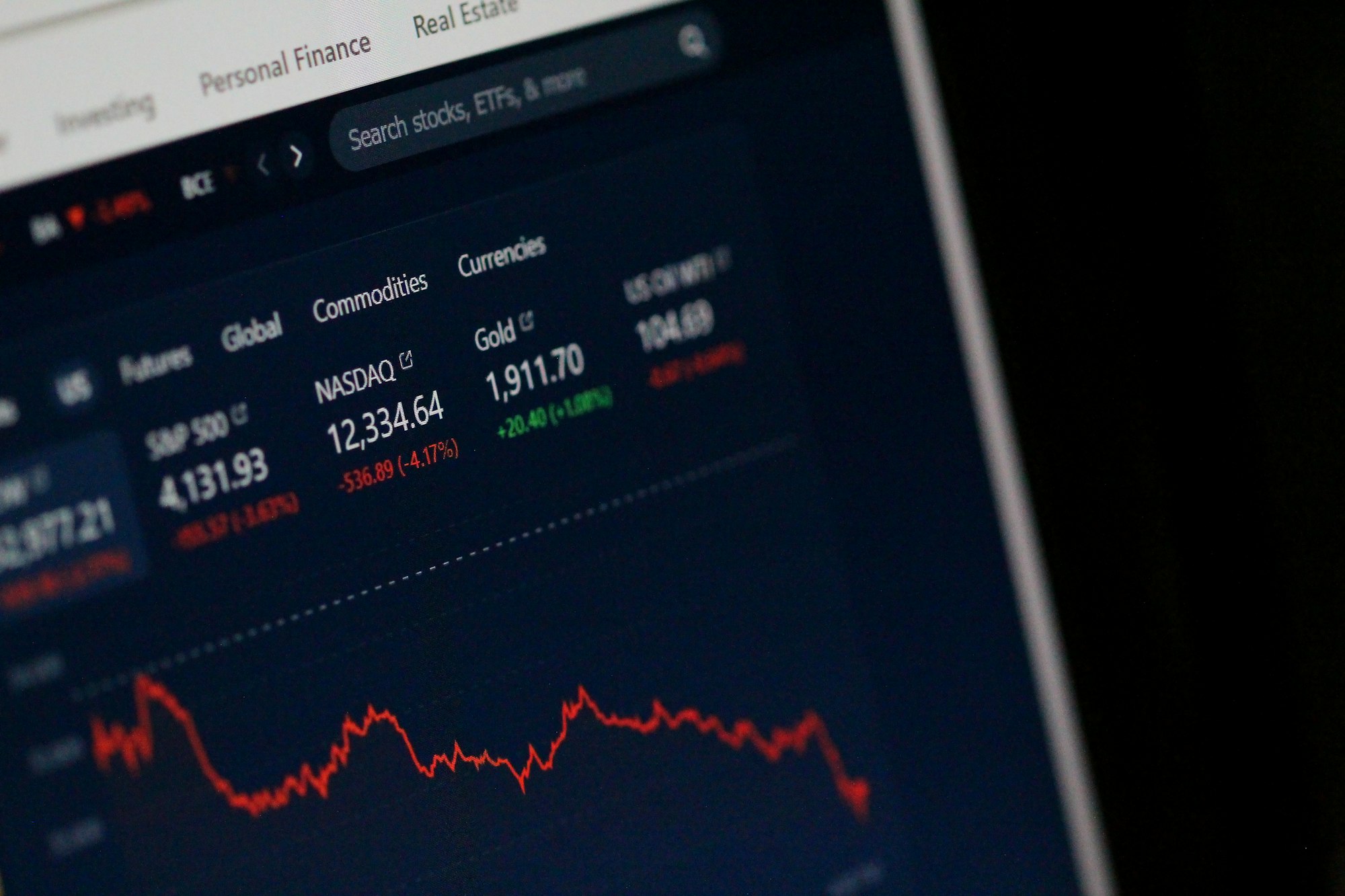

As a result, the market value of most of Adani Group subsidiaries has seen a sharp loss of up to $70 billion within the past week, according to the Financial Times.

The Short seller firm Hindenburg had in the report accused Adani Group of a "brazen stock manipulation and accounting fraud scheme over the course of decades" and disclosed a short position against Group.

Adani Group is the second largest conglomerate in India, with 7 key publicly listed equities (9 in total) and a collective market value of about INR 17.8 trillion ($218 billion).

Following the report by the short seller, shares and bonds by some of the Group's listed companies have continued to fall. Only Adani Enterprises, one of its subsidiaries has been able to manage a stock increase.

Adani Total Gas, Adani Green Energy and Adani Transmission all dropped the maximum daily 20% limit, allowed by the Bombay Stock Exchange and the National Stock Exchange of India. Multiple bonds issued by Adani Group entities also fell.

Gautam Adani, the company's Chairman and founder, also saw his net worth fall to $92.7 billion from a $119 billion fortune, according to Bloomberg’s Billionaire Index. He is the richest man in Asia and was one-time second only to Elon Musk globally.

Adani Group has since rebutted the Hindenburg’s report in a 400-paged response it released over the weekend, calling it a “malicious combination of selective misinformation,” adding that it has “always been in compliance with all laws.”

The group added that Hindenburg’s allegations were a “calculated attack on India, independence, integrity and quality of Indian institutions, and growth story and ambition of India.”