- The global server market hit a record $112.4 billion in Q3 2025, growing 61% year over year as AI infrastructure spending accelerated.

- Non-x86 servers surged 192.7% year over year, signalling a structural shift away from traditional CPUs toward AI-optimised architectures.

- The United States led regional growth at 79.1%, powered by a 105.5% jump in accelerated server deployments.

The machines that run the internet are changing faster than most of us realise. In the past, servers were silent workhorses, quietly crunching numbers. Now, they’re evolving into powerhouses built for artificial intelligence, capable of handling workloads that would have seemed impossible just a few years ago.

According to IDC’s Worldwide Quarterly Server Tracker, server revenue hit an all-time high of $112.4 billion in the third quarter of 2025, up 61% year over year. On the surface, that looks like a familiar boom story driven by AI hype and cloud spending. But buried inside those numbers is a more structural shift that matters far more than headline growth.

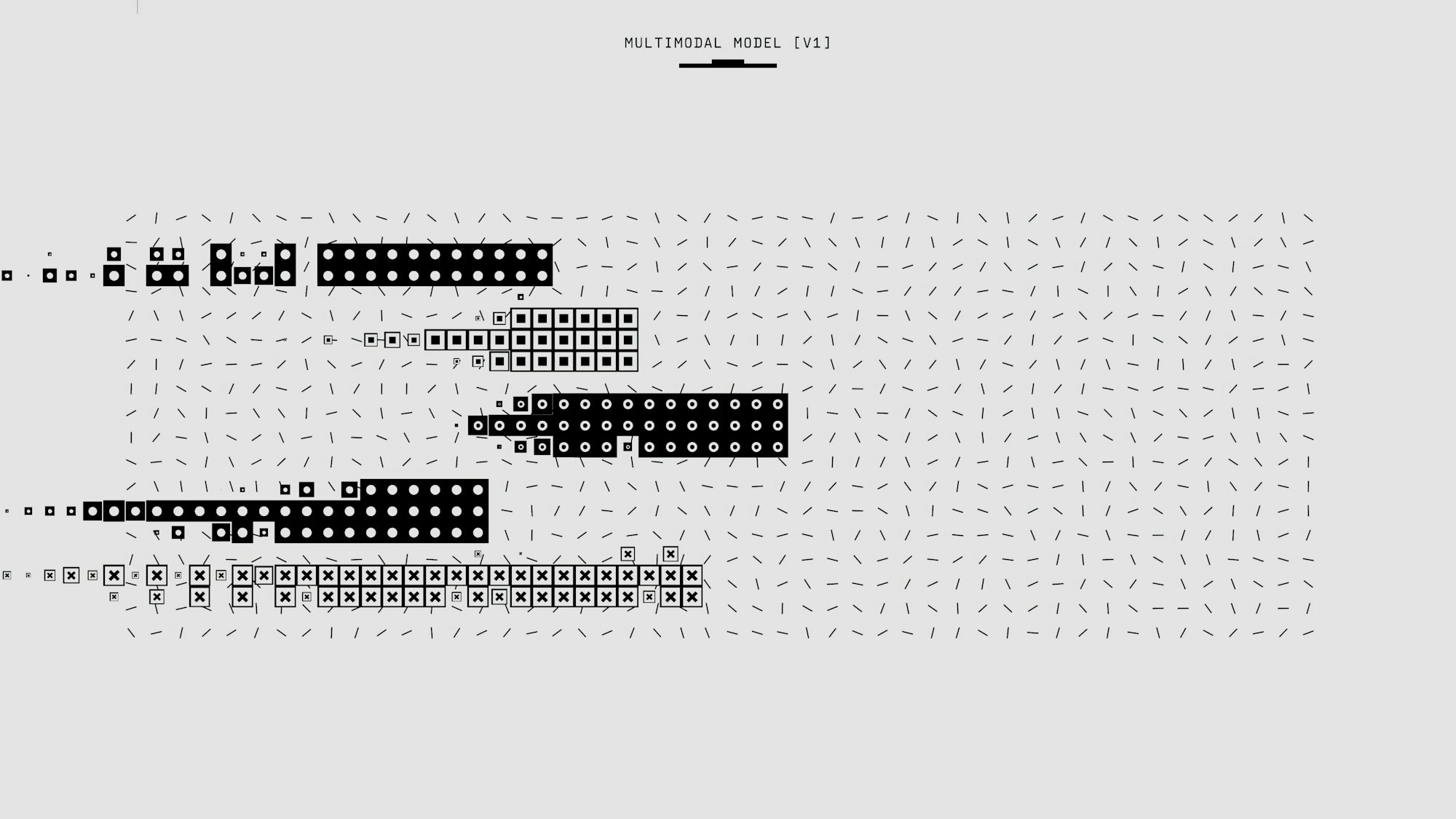

AI workloads are forcing data centers to abandon a one-size-fits-all server model, accelerating a shift away from traditional x86 systems toward GPU-heavy and non-x86 architectures designed specifically for high-density computing. That change is already well underway, and the Q3 2025 data shows it’s no longer experimental or niche. It’s becoming the new centre of gravity for how servers are built, bought, and deployed.

MORE INSIGHTS ON THIS TOPIC:

- WHAT IS: Serverless Computing

- China's AI server market projected to grow 400% by 2027

- Memory chip market to decline by 16.2% in 2023 amid a worsening economic outlook

Why the x86 era is starting to bend

For decades, x86 servers were the default foundation of enterprise computing. They were flexible, well understood, and scaled predictably. That model still exists, but it’s now under pressure from workloads it was never designed to handle at scale.

In Q3 2025, revenue from x86 servers grew 32.8% to $76.3 billion. That’s healthy growth by any historical standard, and it confirms that traditional systems aren’t disappearing overnight. But the real signal lies in what’s growing faster, and why.

Non-x86 servers surged 192.7% year over year, reaching $36.2 billion in quarterly revenue. That kind of growth doesn’t happen because buyers are curious. It happens because existing architectures are becoming inefficient for the work being asked of them.

IDC attributes this surge largely to hyperscalers, cloud providers, and large research institutions deploying systems built around specialised processors optimised for AI training, inference, and high-performance workloads. These environments demand higher compute density and better performance per watt than general-purpose CPUs can reliably deliver.

As IDC research director Juan Seminara puts it, hyperscalers are leading “new, large deployments that require much higher compute density,” while AI-driven research projects are adding further momentum. The implication is straightforward: server design is being shaped less by versatility and more by task-specific efficiency.

GPUs are no longer an add-on, but the core

The same pattern shows up even more clearly when you look at GPUs. Revenue from servers with embedded GPUs grew 49.4% year over year in Q3, and those systems now account for more than half of total server market revenue. That could be seen as a redefinition of what a “standard” server looks like in 2025.

This growth is also being driven by hyperscalers and cloud providers building infrastructure around AI workloads that require massive parallel processing. Training large models, running inference at scale, and supporting AI-powered services all demand compute characteristics that CPUs alone can’t deliver efficiently.

What’s changed is commitment. GPU-accelerated servers are no longer deployed selectively for specific teams or experiments. They’re becoming the baseline for new data centre builds, with CPU-only systems increasingly playing a supporting role rather than leading the architecture.

That shift is reflected in the numbers. IDC estimates that total server revenue for the first three quarters of 2025 reached $314.2 billion, nearly double the same period in 2024. Embedded GPUs are central to that expansion, not a side effect of it. The message from buyers is clear: future capacity is being planned around AI-first workloads, not retrofitted later.

Different speeds across the globe

The AI-driven surge is global but uneven. The U.S. stands out as the fastest-growing server market, posting a 79.1% increase compared to Q3 2024. Accelerated servers, those designed for AI workloads, drove much of this growth, surging 105.5% in the same period.

Canada experienced similar dynamics, growing 69.8%, while the People’s Republic of China contributed 37.6% year-over-year growth and accounted for nearly 20% of quarterly revenue. Other regions, including APeJC, EMEA, and Japan, also posted healthy double-digit growth, demonstrating that AI-driven server adoption is a global phenomenon. Latin America, in contrast, grew only 4.1%, highlighting a lag in large-scale AI infrastructure investment.

Market share tells a similar story. Dell Technologies continues to dominate the OEM landscape, capturing 8.3% of revenue thanks to strong growth in accelerated servers. Supermicro follows with 4.0%, though it saw a 13.2% decline compared to Q3 2024.

IEIT Systems and Lenovo are statistically tied in third place, holding 3.7% and 3.6% of the market, while Hewlett Packard Enterprise rounds out the top five with a 3.0% share. The numbers tell a story: companies that embrace GPU-accelerated and non-x86 servers are seeing tangible revenue gains, while those relying on traditional designs are struggling to keep pace.

The market is telling a clear story

For enterprise IT teams, the trends are clear. Planning for the future means investing in specialized servers capable of handling AI workloads, not just traditional compute tasks. The race for AI infrastructure supremacy will favor those who understand how to balance CPU, GPU, and non-x86 architectures efficiently. Legacy x86 servers remain important, but they’re increasingly part of a hybrid approach rather than the sole backbone of enterprise data centers.

The server market’s explosive growth in 2025 is evidence of a structural transition in how computing infrastructure is conceived. Non-x86 servers are no longer fringe solutions. Embedded GPUs are no longer optional accelerators. Together, they’re redefining what modern data centres are built to do.

Enterprises that treat AI infrastructure as a future add-on will increasingly find themselves planning against a market that has already moved on. The data from IDC shows that the transformation is happening now, driven by real deployments, real budgets, and real performance constraints. The servers running tomorrow’s internet will look very different from those that powered the last decade. The companies preparing for that reality today will define what’s possible next.