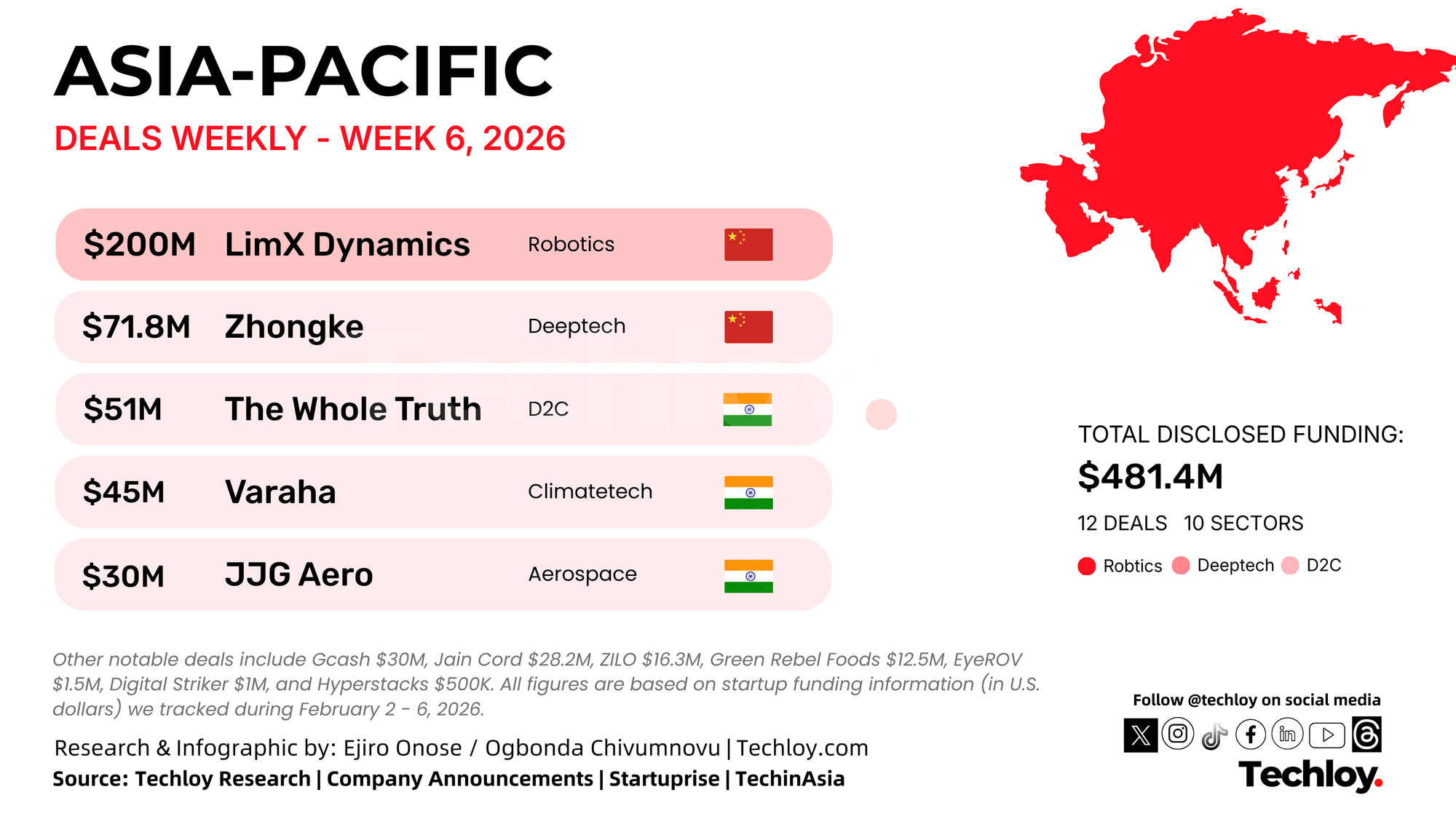

Startups in Asia raised a combined $481.4 million this week, based on disclosed funding rounds tracked by Techloy, with investor capital flowing primarily into Clean Energy, Robotics, and Climate Tech. A handful of larger growth-stage and strategic infrastructure deals accounted for the majority of the week’s funding activity.

The Week’s Largest Startup Funding Rounds

Here are the biggest disclosed startup funding and investment rounds across Asia.

/1. LimX Dynamics, $200 Million, Robotics, China

LimX Dynamics is a general-purpose robot company specializing in "Embodied AI" and humanoid mobility technologies. The Series B funding, led by Stone Venture and backed by JD.com, will accelerate the development of its "Tron 2" shape-shifting robots and global expansion.

/2. Zhongke Qingneng, $71.8 Million, DeepTech, China

Zhongke Qingneng specializes in large-scale cryogenic technology and helium refrigeration equipment essential for nuclear fusion and aerospace. The Pre-A++ funding from NIO Capital and Kunpeng Capital will support the development of critical low-temperature infrastructure.

/3. The Whole Truth, $51 Million, D2C, India

The Whole Truth is a direct-to-consumer (D2C) startup known for its transparency and 100% natural ingredients in protein bars and chocolates. The Series D capital will be used to scale its in-house manufacturing capabilities as the company prepares for a future IPO.

/4. Varaha, $45 Million, Climate Tech, India

Varaha is a tech-enabled platform that generates carbon credits through nature-based solutions and regenerative agriculture. The funding will allow the company to expand its operations, helping smallholder farmers monetize sustainable practices while offsetting global carbon emissions.

/5. JJG Aero, $30 Million, Aerospace, India

JJG Aero manufactures high-precision machined components and assemblies for commercial and defense aerospace OEMs. The funds from Norwest Venture Partners will help increase manufacturing capacity at its Karnataka facility to meet surging global demand.

/6. GCash (Fuse Financing), $30 Million, Fintech, Philippines

Fuse Financing is the lending arm of the GCash super-app, providing credit access to unbanked individuals and small businesses. The loan facility from the Asian Development Bank (ADB) will be deployed to support women-led MSMEs and expand financial inclusion.

/7. Jain Cord, $22.8 Million, Manufacturing, India

Jain Cord is a specialized textile manufacturer producing corduroy and linen fabrics for global fashion brands. The Series A funding from the Lohia Family Office will support working capital needs and capacity expansion to sustain its 46% annual growth rate.

/8. ZILO, $15.3 Million, Fashion Tech, India

ZILO is a "fashion quick commerce" platform that delivers curated apparel and lifestyle products to consumers in under 60 minutes. The Series A investment led by Peak XV Partners will fuel its expansion from Mumbai into other top-tier Indian cities.

/9. Green Rebel Foods, $12.5 Million, Food Tech, Indonesia

Green Rebel Foods is Southeast Asia’s leading plant-based meat and dairy alternative startup, creating products tailored to Asian culinary tastes. The fresh capital will drive product innovation and support further expansion into international markets.

/10. EyeROV, $1.5 Million, Robotics, India

EyeROV designs and manufactures industrial-grade underwater drones and remotely operated vehicles (ROVs) for infrastructure inspection. The Pre-Series A funds will help the company scale its operations following a major contract with the Indian Navy.

/11. Digital Striker, $1 Million, Adtech, India

Digital Striker provides AI-driven digital marketing and advertising supply chain solutions. The seed funding from Foxhog Ventures will be utilized to set up a local manufacturing unit for optical fiber tools and enhance its service capabilities.

/12. Hyperstacks Inc., $500K, Fintech, Philippines

Hyperstacks provides blockchain-based infrastructure to help traditional financial institutions launch Web3 and crypto-banking services. The seed funding will support product development and partnerships with regional banks.

Conclusion

With $481.4 million in disclosed funding this week, investor attention in Asia remains concentrated in hard-tech sectors like robotics and aerospace, while consumer brands and climate tech startups continue to secure strong growth-stage backing.