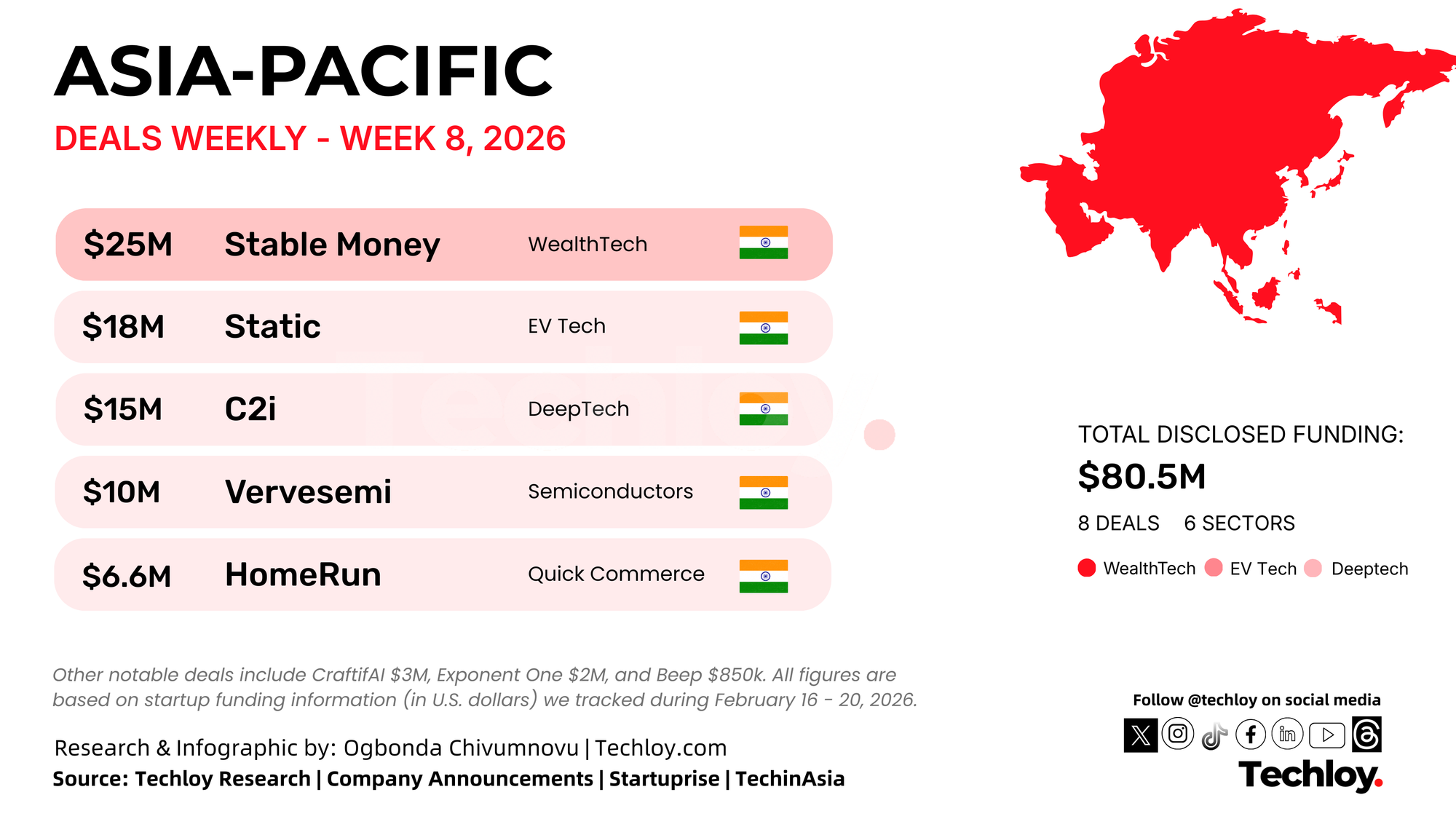

Startups across Asia raised ~$80.5 million this week, based on disclosed funding rounds tracked by Techloy. Funding activity leaned heavily toward fintech and EV infrastructure, while semiconductor innovation and B2B commerce platforms continued to draw strong investor interest. India accounted for the bulk of deals, reflecting sustained momentum in both early-stage and growth capital markets.

The Week’s Largest Startup Funding Rounds

Here are the biggest disclosed startup funding and investment rounds across Asia, ranked from highest to lowest.

/1. Stable Money, $25 Million, WealthTech, India

Stable Money, a digital investment platform focused on fixed-income products, raised $25 million in a Pre-Series C round led by Peak XV Partners, with participation from Z47, RTP Global, and Fundamentum Partnership. The company will use the capital to scale marketing efforts, launch new wealth-tech products, and onboard more bond providers and banks to broaden investment options for users.

/2. Statiq, $18 Million, EV Tech, India

EV charging startup Statiq secured $18 million in a mix of equity and debt funding led by Tenacity Ventures, with participation from Y Combinator, Shell Ventures, and RCD Holdings. The company plans to expand its charging network across Tier I and Tier II cities, deploy fast DC chargers on highways, improve uptime to 99.9%, and begin exporting hardware internationally.

/3. C2i Semiconductors, $15 Million, DeepTech, India

Bengaluru-based C2i Semiconductors raised $15 million in Series A funding led by Peak XV Partners. The startup is developing advanced power management solutions to address rising energy demands in AI data centres, aiming to improve efficiency from grid-level supply to GPU performance.

/4. Vervesemi Microelectronics, $10 Million, Semiconductors, India

Vervesemi Microelectronics secured $10 million in a Series A round led by Ashish Kacholia and Unicorn India Ventures. The fabless semiconductor company builds machine learning-powered analog signal chain chips and will use the funds to accelerate commercial launches, expand production, and grow its presence in India, the U.S., and other global markets.

/5. HomeRun, $6.6 Million, Quick Commerce, India

HomeRun raised approximately $6.6 million in a Series A round led by Sorin Investments. The construction materials quick commerce platform will use the funds to expand into new cities, widen its product catalogue, and enhance delivery technology.

/6. CraftifAI, $3 Million, AI Software, India

CraftifAI secured $3 million in seed funding led by Ankur Capital, with participation from IvyCap Ventures, Capital-A, and Antler. The startup plans to strengthen its engineering team, scale sales and marketing, and expand into international markets.

/7. Exponent One, $2 Million, Fintech, India

Exponent One, a newly launched fintech subsidiary of Exponent Energy, secured $2 million in pre-seed funding from AdvantEdge Founders. The venture aims to provide tailored asset financing solutions for commercial EV drivers and fleet operators, addressing key barriers to EV adoption.

/8. Beep, $850,000, EdTech, India

EdTech startup Beep raised $850,000 in a Pre-Series A round backed by Knowhere Ventures LLC, Pacific Global Solutions Limited, LeadAngels FLV, and angel investors. The company plans to scale to 5 million users, partner with 150 additional colleges, and introduce industry-focused programmes aligned with hiring demands.

Conclusion

This week’s funding rounds reflect a clear pattern: investors are backing infrastructure for the next phase of growth. Whether it is fixed-income wealth platforms, EV charging networks, semiconductor power efficiency, or commerce logistics, capital is flowing toward startups solving foundational bottlenecks. Deeptech and mobility continue to gain institutional confidence, while fintech remains a steady anchor. If momentum persists, the intersection of AI, energy efficiency, and financial access could define Asia’s funding narrative in the months ahead.