Investing in cryptocurrency can feel exciting and confusing at the same time. Many beginners wonder where to start, what risks to watch out for, and how to keep their money safe. Because crypto is new and digital, it works differently from traditional banks or stock markets.

Millions of people around the world now use cryptocurrency, but at the same time, many people lose money because they rush in without understanding the basics. We asked an expert what his advice for beginners’ looking to start investing in crypto in 2026 was. Here is what he told us, edited for clarity and length.

Editor’s Note: We agreed to withhold this source’s identity because of his role in the crypto space and the security implications that can come with speaking publicly about personal investment practices.

Learn How Crypto Works First

Before you spend any money, it is very important to understand what cryptocurrency actually is. Cryptocurrency is a type of digital money that runs on technology called blockchain. This technology keeps a record of all transactions, and it is shared across many computers, so no single person or bank controls it. Bitcoin was the first crypto, and since then many others like Ethereum, Binance Coin, and Solana have been created. Each cryptocurrency works a little differently and may have a different purpose.

Learning about how wallets work, how transactions happen, and what makes each coin different helps you see the big picture.

If you skip this step, it is very easy to make mistakes because you do not know what you are investing in. Take your time to really understand key ideas like decentralization, private keys, blockchain, and trading before you put your money in.

Choose the Right Cryptocurrency

Once you know the basics, the next step is picking which cryptocurrency you want to invest in. There are thousands of coins, but not all of them are useful or safe. Some are created only to trick people or fade away soon after launch. Well-known cryptocurrencies like Bitcoin and Ethereum have been around for many years and are used by many people, so they are often seen as safer choices for beginners. These big coins have strong networks, many users, and more information available online to help you learn about them.

Don’t just pick a coin because someone on social media says it will pump or increase in price quickly. Do your own research so you understand why you are investing in that coin and what makes it worth your money.

Decide How Much You Can Safely Invest

Investing in crypto should be done with money you can afford to lose. Many beginners think they need to put in a lot of money, but this is not true. Crypto prices can go up fast, but they can also crash quickly. Setting a budget means deciding how much money you are comfortable investing without hurting your life or savings if prices drop suddenly. Some people start with a small amount like $50 or $100 while they learn, and they only add more later when they feel confident.

You can also decide to invest a small fixed amount every month, instead of putting all your money in at once. This approach helps you avoid worrying too much about price changes on any single day. Before you invest, write down your budget and stick to it. Never borrow money or use money for bills, rent, or food to invest in crypto. A clear budget protects you emotionally and financially, so you can make better decisions without fear or panic.

Buy Crypto Only Using a Trusted Platform

Once you know what to buy and how much, you need a safe place to buy it. A lot of beginners use exchanges to buy crypto. Exchanges are websites or apps that let you trade regular money for crypto easily. Some well-known exchanges include Coinbase, Binance, Kraken, and KuCoin. These platforms have many users and strong security systems. Before you choose an exchange, check whether it is regulated in your country, what fees it charges for buying and selling, and what security features it offers.

A secure platform will use two-factor authentication (2FA), strong encryption, and require verification to protect your account. Always use an email and password that are different from your other online accounts, and make sure you enable extra security options on the platform. Avoid exchanges that are unknown or new without reviews, because they may not protect your money well. A secure platform gives you peace of mind and reduces the chance of hackers stealing your funds.

Use a Wallet to Protect Your Crypto

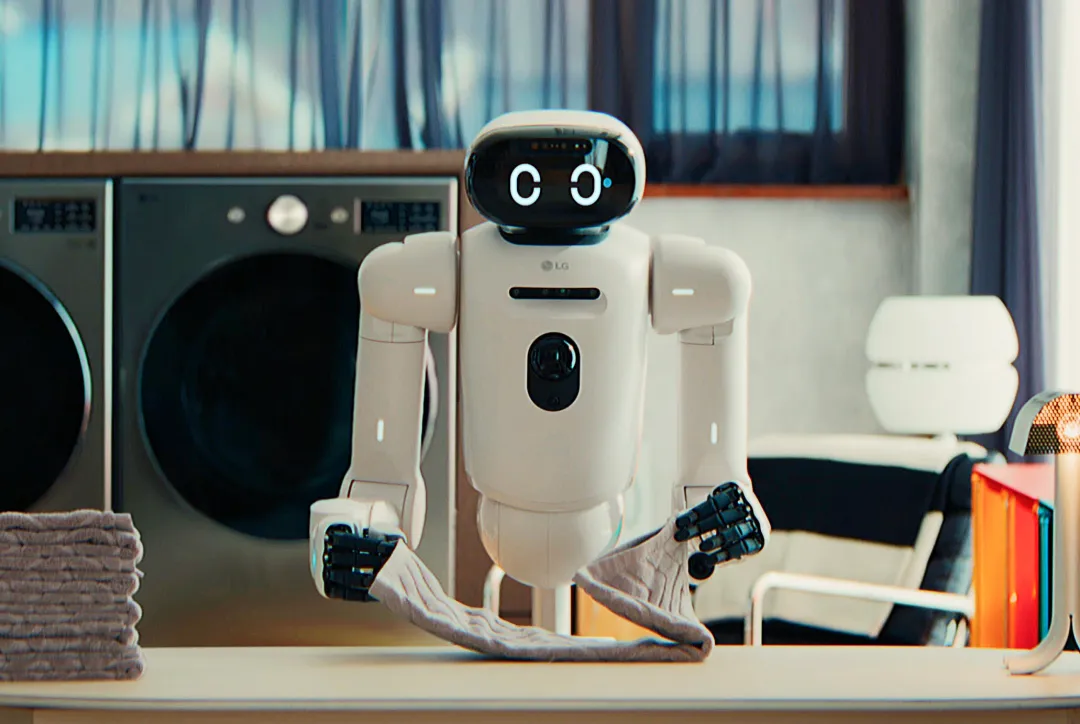

After you buy cryptocurrency, you need a place to store it. This place is called a wallet. There are many types of wallets, but the two main types are online wallets and offline wallets. Online wallets (sometimes called hot wallets) are connected to the internet, like the wallets inside exchanges or apps.

They are easy to use but can be more vulnerable to hacking. Offline wallets (cold wallets) are physical devices or paper storage that keep your crypto private keys offline. These are much safer from online attacks. For beginners, a common choice is to keep small amounts of crypto in an online wallet for active trading and send the rest to a hardware wallet that you control.

When you set up a wallet, you will get a recovery phrase or private key. This is the only way to get your crypto back if you lose access to your wallet, so it must be kept safe. Write it down on paper and store it in a safe place where only you can reach it. Never share your private key with anyone, even if someone claims to be support, real companies never ask for it. Knowing how wallets work and keeping them secure is one of the most important parts of protecting your investment.

Be Wary of Scams

Crypto has its share of scammers, and they try many tricks to steal your money. Some scammers post fake announcements on social media or send links that look real but lead to dangerous sites. Others promise guaranteed profits, giveaways, or exclusive investment signals to lure you into paying or installing harmful software. Many scams ask for your private keys, recovery phrases, or passwords, information you should never share. A safe habit is to double-check links, avoid clicking on unexpected messages, and only use official channels for communication.

If something sounds too good to be true, it usually is. Real investment opportunities do not promise huge returns without risk. Staying mindful means being alert to red flags, questioning strange messages, and not rushing into decisions when someone pressures you. Learning about common crypto scams helps you spot them early and protect your money.

Keep Track of Your Crypto Regularly

Investing in crypto does not end after you buy a coin. Prices can change quickly, and new news or updates can affect your investments every day. Once you have invested, watch your portfolio regularly so you know what is happening. This does not mean checking every minute, but you should understand major changes and why they happen. For example, if a project changes its team, alters its roadmap, or announces upgrades, it can affect the coin’s value.

Going long term requires patience, but paying attention to big developments helps you make informed decisions. You should also understand market patterns and avoid emotional reactions to normal price swings. Monitoring your investments gives you control and helps reduce fear and panic when markets move.

Think Long Term, Not Quick Profits

Many successful crypto investors think long term instead of looking for quick gains. Long-term strategies mean you buy crypto because you believe in its use and future potential, not just because the price is rising today. This approach helps you avoid emotional trading, which can lead to selling when prices dip and missing gains when prices rise.

A long-term mindset often involves holding coins for years and learning about the projects so you understand why you believe in them. You might choose to hold Bitcoin or Ethereum for the long haul because they have strong networks and use cases. Long-term strategies also help you avoid stress from short-term price movements, because you focus on the bigger picture.

Continue Learning as You Invest

The world of crypto changes fast. New technologies, laws, tools, and risks appear all the time. As a beginner, staying educated means reading news from trusted sources, following announcements from official project teams, and learning from reputable educators. Avoid anonymous social media posts that cannot be verified. Education also means learning from mistakes, both your own and others’.

Being educated helps you make better decisions, understand when a project is real or fake, and protect your crypto more effectively. The more you learn, the more confident you become in handling your investments.