China’s artificial intelligence sector opened 2026 with a series of major developments that signal growing momentum in its domestic chip and model-training ecosystem, as U.S. export restrictions continue to limit access to advanced Nvidia hardware.

On Friday, Shanghai-based Biren Technology debuted on the Hong Kong stock exchange, with shares opening 82.1% higher, raising $717 million at the top of its target range. Retail demand exceeded supply by more than 2,300 times, according to exchange filings, making it the strongest first-day performance for a Hong Kong listing above $700 million since 2021.

The listing comes days after Baidu’s chip subsidiary Kunlunxin filed confidentially to list in Hong Kong, according to regulatory disclosures. JPMorgan estimates Kunlunxin’s chip sales could reach 8 billion yuan in 2026, up from 1.3 billion yuan in 2024. AI startups MiniMax and Zhipu are also preparing fund-raising rounds expected to exceed $1 billion combined, according to people familiar with the matter.

Biren Bets on Older Nodes and Chiplet Design

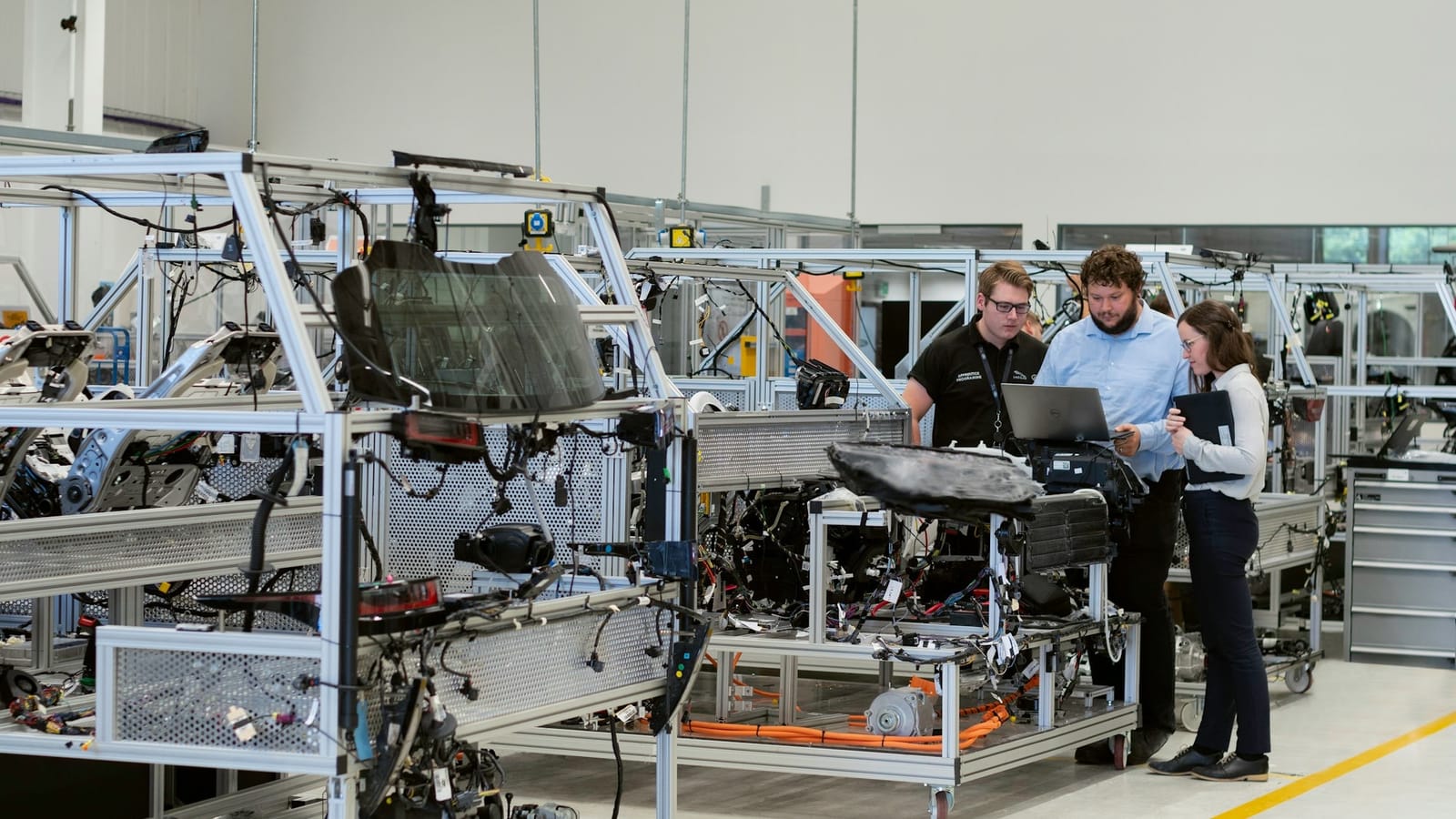

Biren’s flagship BR100 accelerator is manufactured on TSMC’s 7-nanometre process, two generations behind Nvidia’s leading chips, but uses a chiplet architecture that splits the processor into multiple smaller tiles. The company says this approach has improved manufacturing yields by around 20% while reducing costs.

State-owned telecom operators including China Mobile and China Telecom have begun deploying Biren chips in data-centre environments, according to company statements.

Training Models Without Breaking the Budget

While investors piled into chip stocks, DeepSeek dropped a research paper that caught the attention of analysts who usually ignore academic publications.

The paper introduces Manifold-Constrained Hyper-Connections (mHC), a novel method to scale AI models without the computational chaos that usually accompanies massive training runs. DeepSeek's team of 19 researchers tested it on models with 3B, 9B, and 27B parameters. The result? The larger models remained stable—a notoriously difficult feat when training costs typically spiral out of control.

Wei Sun from Counterpoint Research called it a "striking breakthrough." The significance isn't just one clever trick; DeepSeek stacked multiple optimization techniques to minimize training costs while potentially boosting reasoning performance. Think of it as finding five small shortcuts that, combined, cut your commute time in half.

Notably, the paper's lead author is Liang Wenfeng, DeepSeek's founder. This level of hands-on involvement from leadership suggests they are preparing something significant. Speculation now points toward a major model release around mid-February, coinciding with the Spring Festival.

What It Actually Means

China is playing a different game now. While Western AI labs compete on who has the biggest GPU clusters, Chinese companies are optimizing for efficiency under constraint.

Kunlunxin's chips excel at inference—running models after they're trained—rather than the intensive training runs that still demand Nvidia's top-end hardware. This segment represents 80% of global AI workload volume yet gets less attention than the flashy training phase. For business applications, this is what matters: you train once, then run millions of queries.

DeepSeek's R1 model already demonstrated this approach could work at scale, delivering performance comparable to expensive Western models. If mHC delivers on its promise, that cost advantage widens further.

The Bottom Line

Western AI companies spent years assuming superior compute access gave them an unassailable lead. That assumption is now being stress-tested. Not because China matched the hardware, but because they changed the efficiency equation enough that the hardware gap matters less.

The Biren IPO surge confirms that investors believe this strategy has legs. The 82% pop wasn't just retail hype; it reflected institutional conviction that domestic chip production can serve a massive local market, even if it never catches Nvidia on raw specs.

The first trading day of 2026 made one thing clear: China's AI sector isn't waiting for permission to move forward.