The past weekend was one of those moments that reminded you that anything can happen at any time in crypto. Watching the market rise and fall isn’t new, but seeing unrealized gains vanish in a few hours just when everyone thought another rally was coming hits differently.

It all started after President Donald Trump announced a 100% tariff on Chinese imports and new export controls on key software technologies. That single policy move was enough to shake both traditional and crypto markets, sending investors scrambling to unwind risky bets.

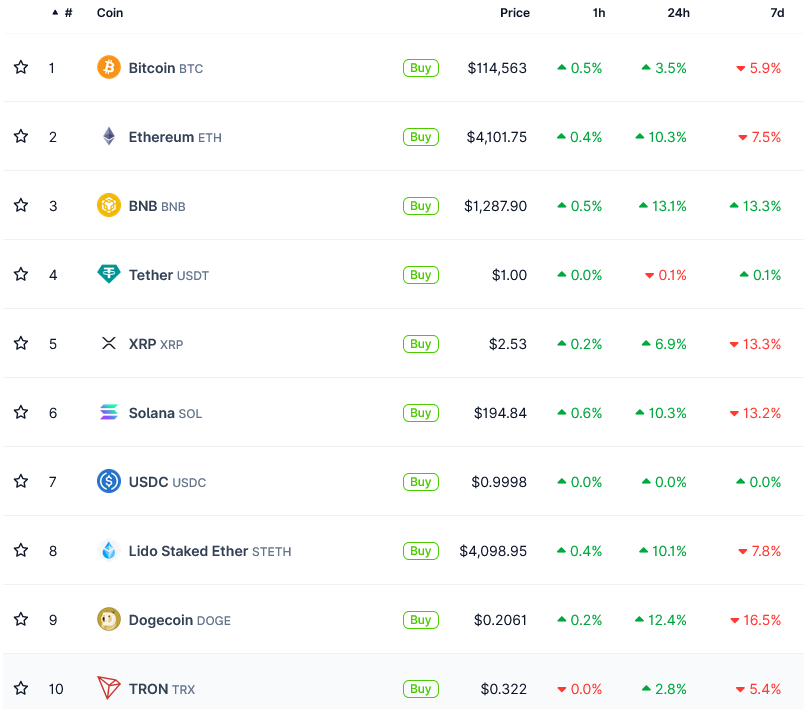

Within 24 hours, the crypto space saw more than $19 billion in leveraged positions liquidated. Bitcoin led the sell-off, dropping over 12% from its record above $125,000 to below $113,000. Ethereum followed with $4.4 billion in liquidations, Solana lost around $2 billion, and other altcoins combined for another $1.5 billion.

The panic rippled across the market. Dogecoin plunged 50% in minutes before bouncing back to around $0.19, while Binance briefly displayed $0 prices on several tokens, sending traders into further chaos. To make matters worse, east, a synthetic dollar on Binance, temporarily depegged after an oracle glitch. It was a reminder of how fragile exchange systems can be when multiple shocks hit at once.

But the mood shifted almost as quickly as it collapsed. When Trump struck a softer tone on China hours later, signaling that tensions might ease rather than escalate, markets steadied. Bitcoin reclaimed the $113,000 range, and Ethereum and Solana followed as traders cautiously stepped back in.

The rebound didn’t erase the damage, but it showed how quickly market psychology can flip when emotion, leverage, and politics collide.

Episodes like this show how closely crypto now moves with global events. A single headline can move billions when markets are this leveraged and liquidity this thin. The weekend’s chaos also exposed the cracks that still run through exchange infrastructure—proof that, despite years of progress, the system can still break under pressure.

Even so, confidence hasn’t vanished completely. The quick recovery suggests investors haven’t given up on crypto—just learned, once again, how volatile the game still is. In this market, you either ride the swings or watch from the sidelines.