When you hear “Black Friday,” you probably think of discounts, deals, and a little shopping chaos. In crypto, though, a Black Friday means something else entirely.

Last weekend, the market went through its own crash sale. More than $20 billion in leveraged positions were wiped out, and around $450 billion in market value disappeared after renewed trade tensions between U.S. President Donald Trump and China. Trump's plan to impose a 100% tariff tariff on Chinese imports starting November 1 sent shockwaves through global markets, and crypto felt it immediately.

It was one of those moments that show how fast things can turn when politics, fear, and leverage collide. Yet even as prices fell, some investors were looking for safety. Gold and gold-backed tokens quietly became the week’s biggest winners, a reminder that when uncertainty hits, people still run toward stability.

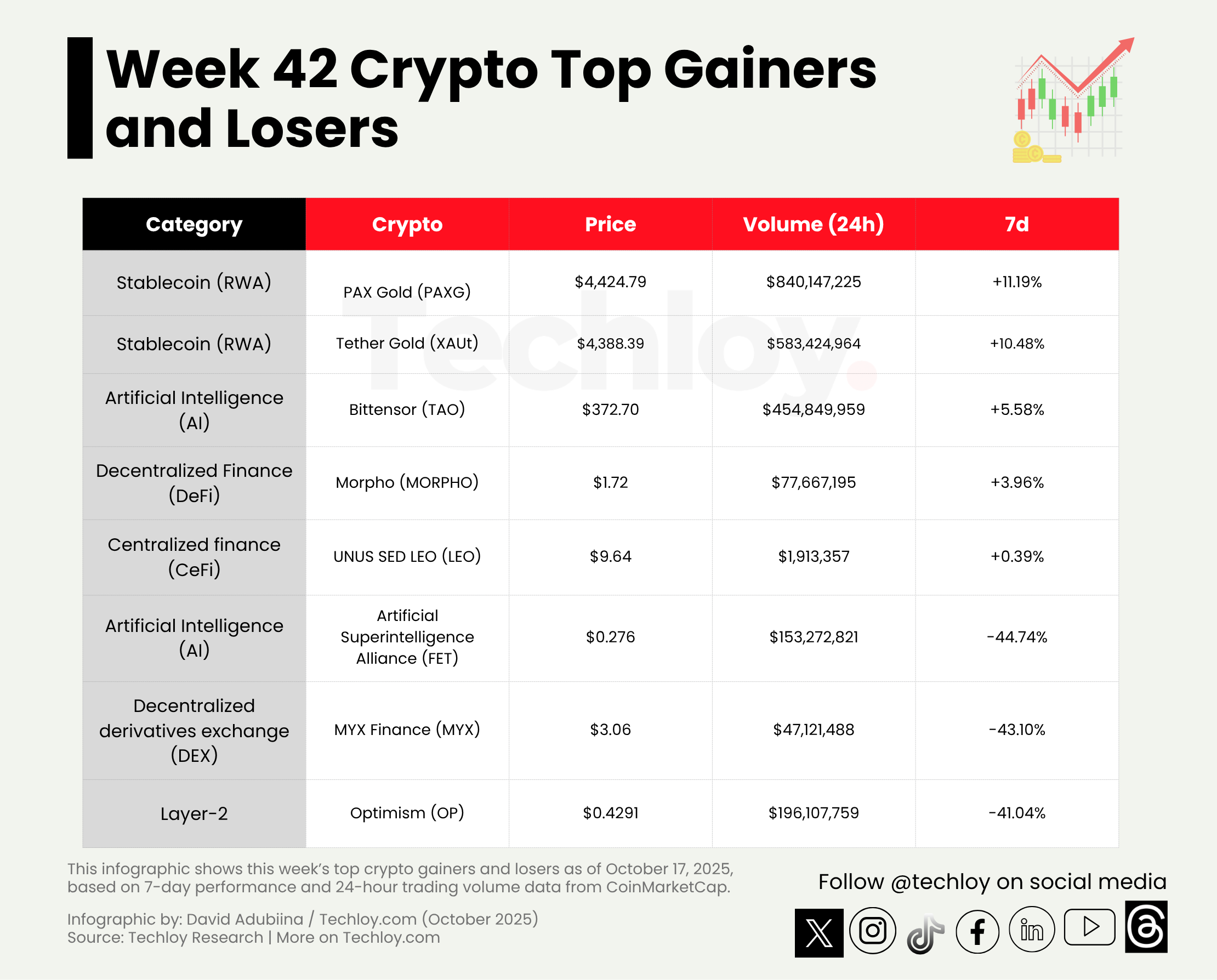

PAX Gold (PAXG) led the way, trading around $4,424 with daily volume above $840 million. Tether Gold (XAUt) followed with a 10.48% rise. Those moves underline how investors shift from speculation to security when the market starts shaking.

But not everyone played defense. A few high-risk assets held up surprisingly well. Bittensor (TAO) climbed 5.58% on renewed interest in decentralized AI networks, while Morpho (MORPHO) gained 3.96% in the DeFi space. UNUS SED LEO (LEO) inched up 0.39%, proving that some corners of the market can stay calm when everything else looks red.

On the flip side, though, Artificial Superintelligence Alliance (FET) plunged 44.74%, leading to a wider correction in AI tokens. MYX Finance (MYX) fell 43.10% amid thin liquidity, and Optimism (OP) dropped 41.04% as activity on layer-2 networks cooled, at least for now.

Looking back, Week 42 portrays a market split between safety and speculation. Gold-backed tokens had their moment, while high-risk bets get riskier. Maybe this was crypto’s version of Black Friday after all, but not the kind where you fill your cart. This one was about holding on to what’s left, riding out the chaos, and hoping the worst was behind you.