With the third quarter now in full swing, startup funding across Africa and the Middle East seems to be picking up steam again. This past week alone saw a mix of mega-deals and strategic rounds amounting to over $350 million across deeptech, proptech, logistics, fintech, and AI infrastructure, signs that investor confidence is staying strong despite a cautious global outlook.

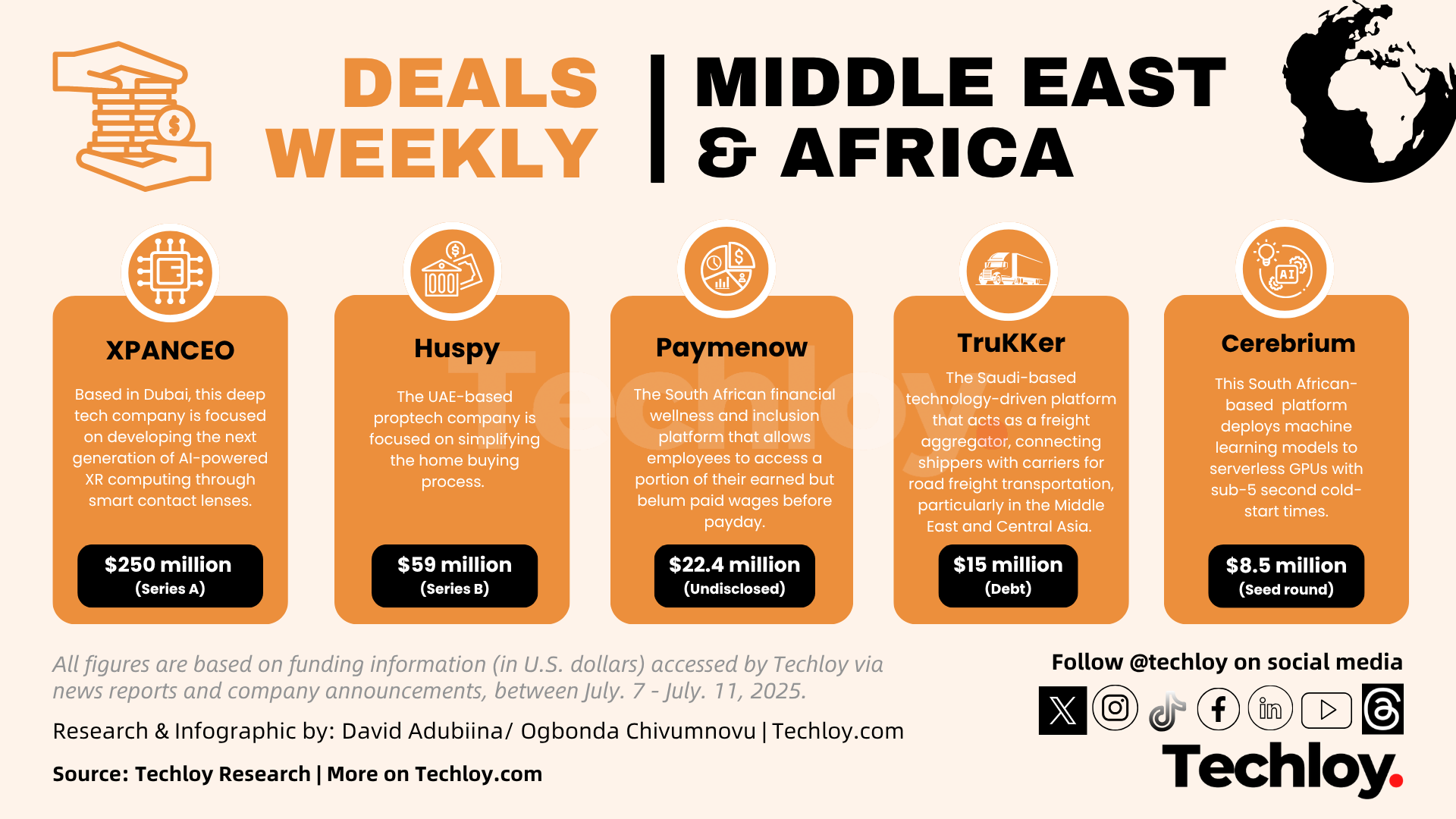

The biggest headline of the week came from XPANCEO, a futuristic deeptech company working on next-gen wearable interfaces. The Dubai-based startup secured a massive $250 million Series A round at a $1.35 billion valuation, led once again by Opportunity Venture (Asia), the same backer behind its earlier $40 million seed raise. The new capital will go toward commercializing its tech, growing its global R&D and product teams, and pushing forward on regulatory approvals and pilot deployments.

Not far behind was Huspy, the UAE-based proptech startup, which announced a $59 million Series B led by Balderton Capital, with participation from Peak XV, ExBorder Partners, Turmeric Capital, and others. Huspy, which helps users buy homes more seamlessly through its online platform, plans to expand its footprint to over 10 cities globally, including Madrid, Valencia, and Dubai. The raise signals growing investor appetite for proptech models that blend digital convenience with on-the-ground real estate operations.

Shifting to Africa, one of the week’s standout moves came from South Africa’s Paymenow, which landed $22.4 million in strategic funding from Standard Bank. The platform, which enables employees to access part of their earned wages ahead of payday, is positioning itself as a key player in financial wellness across emerging markets. With the backing of one of Africa’s largest banks, it’s now poised to accelerate its reach and deepen partnerships across the continent.

Meanwhile, in the logistics space, Saudi-based freight network TruKKer raised $15 million in debt from Ruya Partners. The company, which runs a tech-driven freight platform connecting shippers and transporters, says the funds will go toward expanding operations and improving its tech stack, a move that aligns with its broader goal of digitizing the region’s fragmented trucking industry.

Also in South Africa, AI infrastructure startup Cerebrium made headlines with an $8.5 million seed round led by Gradient Ventures, Google’s AI-focused fund. Backed by Y Combinator and a roster of strategic angels, Cerebrium is building a high-performance serverless platform for deploying AI workloads. The fresh capital will help the team roll out new features and support the growing demand from enterprise clients looking to streamline AI deployment without managing complex backend infrastructure.

Across the Red Sea, Saudi SaaS startup Rekaz closed a $5 million seed round, led by COTU Ventures, with participation from Impact46, Shorooq Partners, Numrah Capital, and others. Rekaz is developing an operating system for service businesses, streamlining how companies manage bookings, payments, and client workflows. With the funding, the startup plans to double down on product development and expand its reach in the MENA region.

Finally, rounding out the week is Kenya’s BuuPass, which raised an undisclosed strategic investment from Yango Ventures. The mobility startup operates a B2B2C marketplace for booking travel tickets across web, mobile app, and USSD, while also offering SaaS tools to bus operators. As demand for streamlined transport systems grows in East Africa, BuuPass is quietly becoming a crucial piece of infrastructure for the region’s intercity travel market.