The startup ecosystem across Africa and the Middle East is closing the year with ambition, innovation, and some seriously impressive funding rounds. From fintech to AI-powered construction robots, investors are backing companies that solve real problems and scale fast.

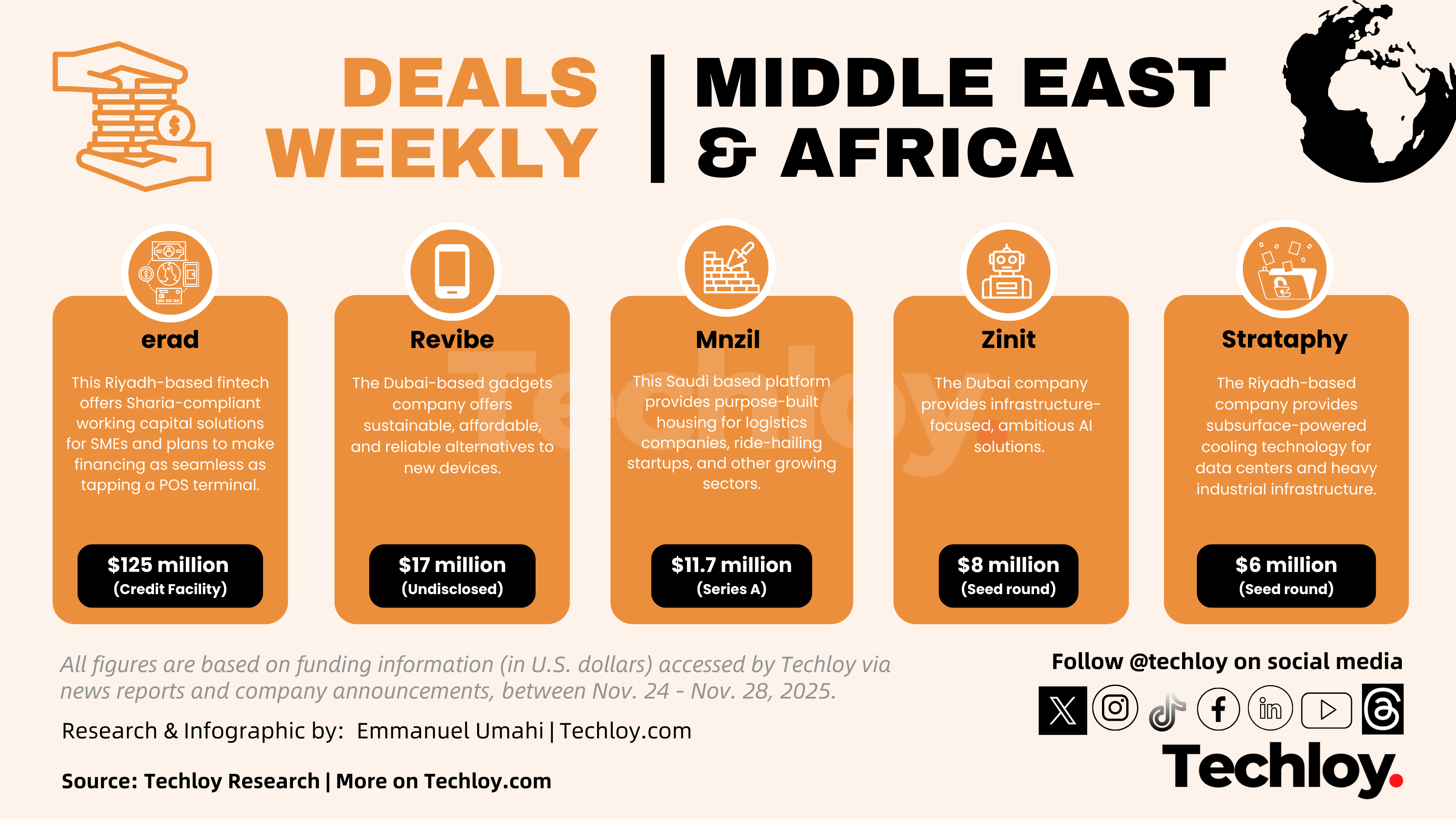

This week, the biggest headline comes from Saudi Arabia, where erad secured a staggering $125 million credit facility led by Jefferies, marking the global investment bank’s first major financing deal in the GCC. The Riyadh-based fintech offers Sharia-compliant working capital solutions for SMEs and plans to make financing as seamless as tapping a POS terminal. With this funding, erad is doubling down on embedded finance, deepening partnerships with suppliers, and extending capital to sectors like logistics, real estate, and manufacturing, essentially building the invisible rails of commerce.

Not far behind, Dubai-based Revibe raised $17 million to expand its refurbished electronics marketplace. While some see old phones, Revibe sees opportunity, betting on the growing circular economy in MENA. By offering sustainable, affordable, and reliable alternatives to new devices, the startup is not just selling gadgets—it’s selling trust in second-hand tech and confidence in a more circular future.

Workforce housing also made waves this week. Mnzil, a Saudi startup managing housing campuses in over 13 cities, raised $11.7 million Series A led by Founders Fund—their first-ever lead investment in Saudi Arabia. Mnzil provides purpose-built housing for logistics companies, ride-hailing startups, and other growing sectors. With new developments covering over 22,000 m², Mnzil is addressing a critical but often overlooked question in fast-growing cities: where do the people who build them live?

Dubai’s Zinit is another early-stage winner, closing an $8 million seed round. While still under the radar, the size of the round signals strong investor confidence in infrastructure-focused, ambitious AI solutions—exactly the kind of startup the region needs more of. Meanwhile, Riyadh-based Strataphy raised $6 million to scale its subsurface-powered cooling technology for data centers and heavy industrial infrastructure. In a world obsessed with AI, Strataphy is quietly building the physical foundation that keeps these models running, positioning geothermal engineering as the unsung hero of the AI era.

On the robotics front, Buildroid AI, backed by Tim Draper, raised $2 million in a pre-seed round to deploy AI-driven construction robots across the UAE’s $42.75 billion construction sector. The goal is not to replace humans but to build a digital-robotic workforce capable of cutting costs and construction time, literally shaping the cities rising from the desert.

Regulatory tech also had its moment, with Saudi-based STAMP raising $2 million to automate compliance processes across fintech, energy, healthcare, and government infrastructure. Finally, Cairo’s bluworks secured $1 million to digitize workforce management for SMEs across Egypt and the broader MENA region, ensuring that operational staff, retail workers, and blue-collar teams have the digital tools to keep businesses running efficiently.

Across the region, the narrative is clear: investors are no longer backing flashy consumer apps alone. They’re funding the structural backbone of the future—fintech that powers commerce, housing that protects the workforce, cooling that keeps AI alive, robotics that build cities, cybersecurity that guards digital assets, and compliance tools that keep growth legal. Tech in Africa and the Middle East is no longer just digital—it’s tangible, physical, and foundational. And with weeks like this, it’s clear the region isn’t just catching up; it’s building the infrastructure for the next era of global technology.