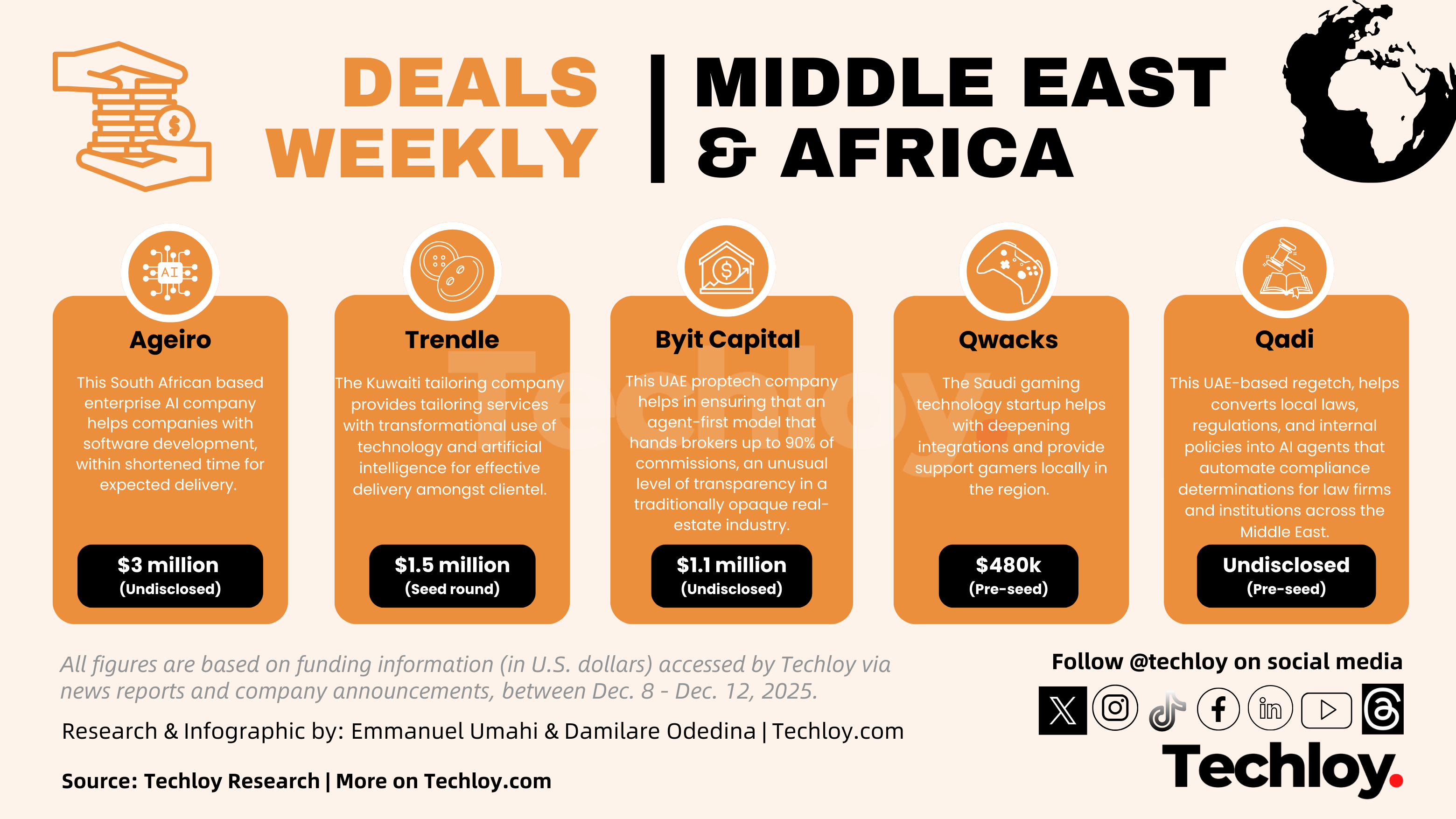

This week’s funding activity across Africa and the Middle East feels like a peek into the region’s tech future, one where AI isn’t just a feature, but the backbone; where traditional sectors get their long-overdue upgrade; and where local creators finally get the tools they’ve been waiting for. Here’s how the week unfolded, starting from the biggest raise down to the smallest.

Ageiro set the tone with a $3 million raise, and it’s easy to see why investors are paying attention. The South African enterprise AI company is tackling a very real pain point: software development that drags on for months. Ageiro promises to compress that timeline into days by translating business intent directly into production-ready applications. It’s a bold ambition, but exactly the kind of infrastructure play African enterprises are warming up to as automation becomes less of a luxury and more of a necessity.

From there, the week gets even more interesting with Trendle, the parent company of MASAHA, closing its second Seed round at a $1.5 million valuation. MASAHA is what happens when technology meets one of the region’s most traditional craft industries: tailoring. Their newly upgraded app, and a roadmap packed with AI-powered features, signals a push to modernise a sector that has largely stayed untouched by digital transformation. With a coalition of strategic partners offering legal, technical, and marketing muscle, MASAHA is inching tailoring towards a future where custom work meets automation.

Close behind is Byit Capital, which secured $1.1 million as it pushes to redefine real estate brokerage across the GCC. Originally founded in Egypt, the platform has built serious momentum in the UAE with an agent-first model that hands brokers up to 90% of commissions, an unusual level of transparency in a traditionally opaque industry. With more than 40,000 freelance brokers and thousands of mapped projects already on the platform, the new capital is paving the way for an aggressive expansion into Saudi Arabia. Byit isn’t just scaling a business; it’s trying to reset an entire market’s power balance.

Then there’s Qwacks, a Saudi gaming technology startup that pulled in $480,000 (SAR 1.8 million). What makes this raise important isn’t just the number, but the timing. Saudi Arabia is moving rapidly from being a country of gamers to a country of game makers, and Qwacks is building the infrastructure to make that jump possible. Their stack—Flock for multiplayer backend, Protokite for AI-assisted playtesting, and DataDuck for market intelligence—sounds like the missing puzzle pieces local studios have been looking for. The funding gives Qwacks the runway to deepen integrations and support more developers across the region.

And rounding out the week is Qadi, which stepped out of stealth with its pre-seed raise led by Incubayt. While the amount isn’t disclosed, the idea is powerful enough on its own: turning regional laws and regulations into AI agents that can make compliance decisions. It’s a direct answer to one of MENAT’s biggest bottlenecks, complex legal frameworks that slow down sales, product launches, and operational workflows. Qadi wants to turn that complexity into a competitive advantage, automating everything from contract reviews to advertising compliance in a way that protects data sovereignty.

Across these stories, a clear theme emerges: the region is no longer just building apps; it’s building infrastructure. AI for compliance, AI for software development, backend tools for gaming studios, and platforms modernising traditional industries, these aren’t surface-level products. They’re the foundations that enable entire markets to move faster.