Even with all the talk about stronger blockchains and tighter security, we keep seeing cracks in the system. Hacks and attacks don’t care about marketing promises; they go straight for the jugular. Which makes you wonder: Is any blockchain really safe?

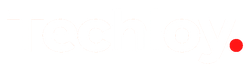

This week, global cryptocurrency exchange Kraken decided to pause Monero (XMR) deposits after an ongoing 51% attack rattled the network. Now, on its own, that might sound like just another technical hiccup, but here’s the kicker: the attack came from Qubic, an AI-focused layer-1 blockchain and mining pool that managed to take control of a majority of Monero’s hashrate.

For context, when a miner controls more than half of a blockchain network’s total hashing power, they basically gain the ability to double-spend and shuffle transactions at will. It’s the nightmare scenario for any proof-of-work chain, because once you can reorganize the ledger, trust in the network starts to wobble.

Qubic claimed on Monday that it reorganized six Monero blocks, essentially flexing its newfound dominance. Monero’s community, of course, pushed back and downplayed the claims, but the fact that Kraken wasn’t taking chances says a lot.

What makes this even more interesting is the back-and-forth battle that’s been brewing. Qubic had been eyeing Monero’s hashrate for weeks, but at one point, it slipped down to being the seventh-largest miner after suffering a denial-of-service (DDoS) attack on August 4. That attack, according to Sergey Ivancheglo — the individual who later claimed responsibility for the 51% attack — slashed Qubic’s hashrate from 2.6 gigahashes per second (GH/s) to just 0.8 GH/s.

A DDoS, by the way, is when a system gets bombarded with junk traffic to the point where it can’t handle real requests. It’s like clogging a highway with parked cars so actual drivers can’t get through.

But persistence paid off—it eventually crossed that critical 51% threshold, at least briefly, long enough to cause ripples.

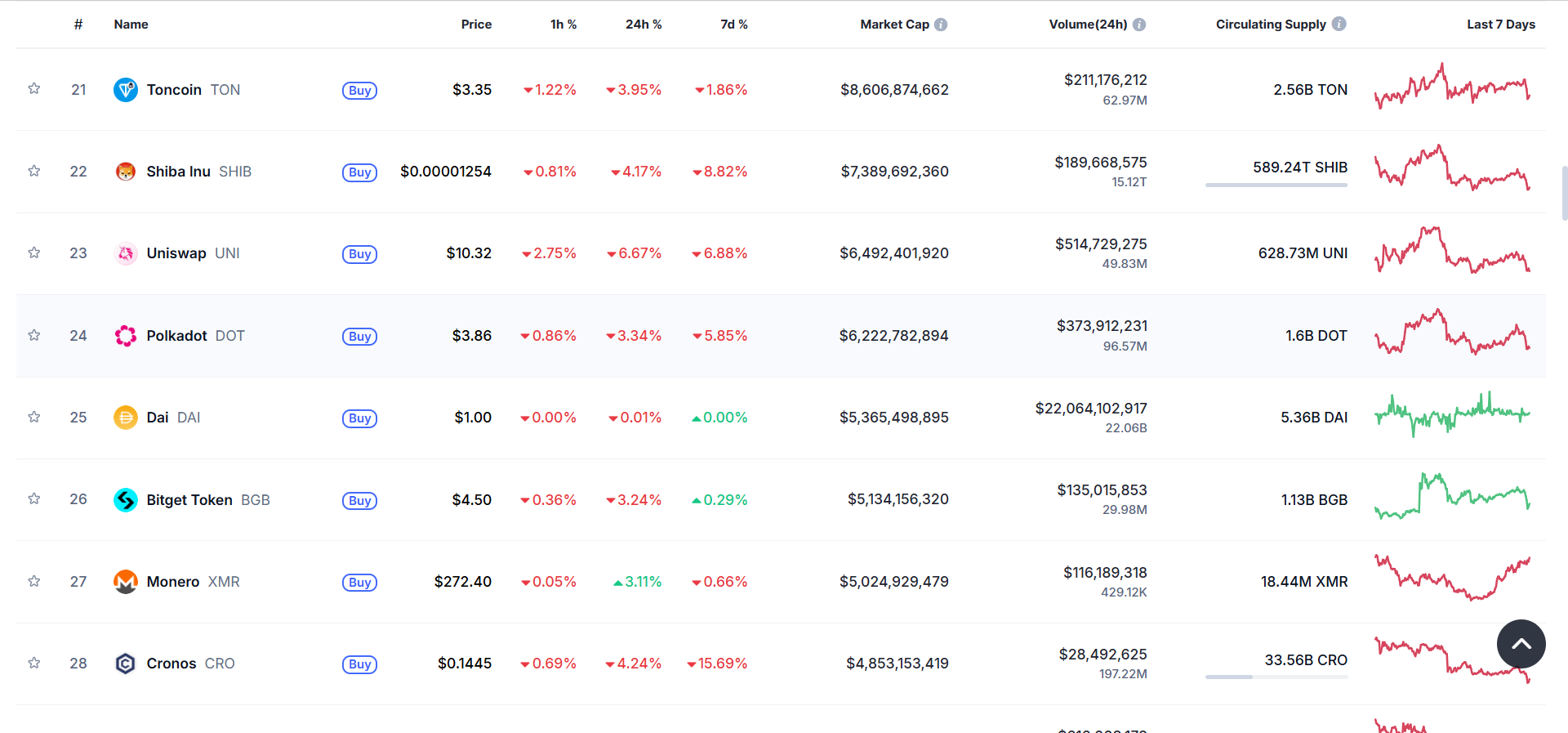

Whether or not this was a full-on “takeover,” as Qubic claims, the fact that a mining pool can flex enough muscle to reorganize blocks on one of the most privacy-focused chains out there is alarming. As the 27th largest cryptocurrency by market cap, Monero has long been branded as the go-to choice for financial privacy in crypto.

However, this incident shows that it isn’t immune to power plays. Makes you wonder, if Monero can be shaken, is there a platform that is untouchable?