Meta brought WhatsApp Pay to India in 2018, and it felt like a no-brainer. When an app already has nearly half a billion people (400 million back then) chatting every day, why wouldn’t they just send money the same way they send a “good morning” meme?

At the time, India was WhatsApp’s biggest market by far, and UPI, the government-backed instant payments system, was exploding in popularity. Google Pay and Walmart's PhonePe were onboarding millions, Paytm was still a budding fintech player, and WhatsApp had the one thing the others didn’t: built-in ubiquity.

So, what went wrong?

Why WhatsApp Pay hasn't been a hit in India

On paper, WhatsApp Pay should’ve crushed it. But a few things got in the way.

First, regulators never gave it free rein. The National Payments Corporation of India (NPCI) capped WhatsApp Pay at just 1 million users for years. The cap was slowly raised but only fully lifted in December 2024, by which time Google Pay and PhonePe had already cemented their dominance.

The numbers make it more obvious. Between December 2024 and May 2025, the NPCI says WhatsApp Pay added just 12 million transactions. Over the same period, Google Pay added around 700 million, PhonePe about 500 million. Today, seven years since WhatsApp Pay landed in India on a trial basis, it's a speck in a $3 trillion digital payments market dominated 80% by just two players [Google Pay and PhonePe].

The second thing is, WhatsApp didn’t really fight for the market. While rivals ran cashback campaigns, built merchant networks, and kept refreshing their products, WhatsApp Pay stayed barebones. Industry insiders say Meta hardly spent on marketing, merchant outreach, or user education. Add in India’s deep mistrust of Meta’s data practices, and one can see why adoption never really took off.

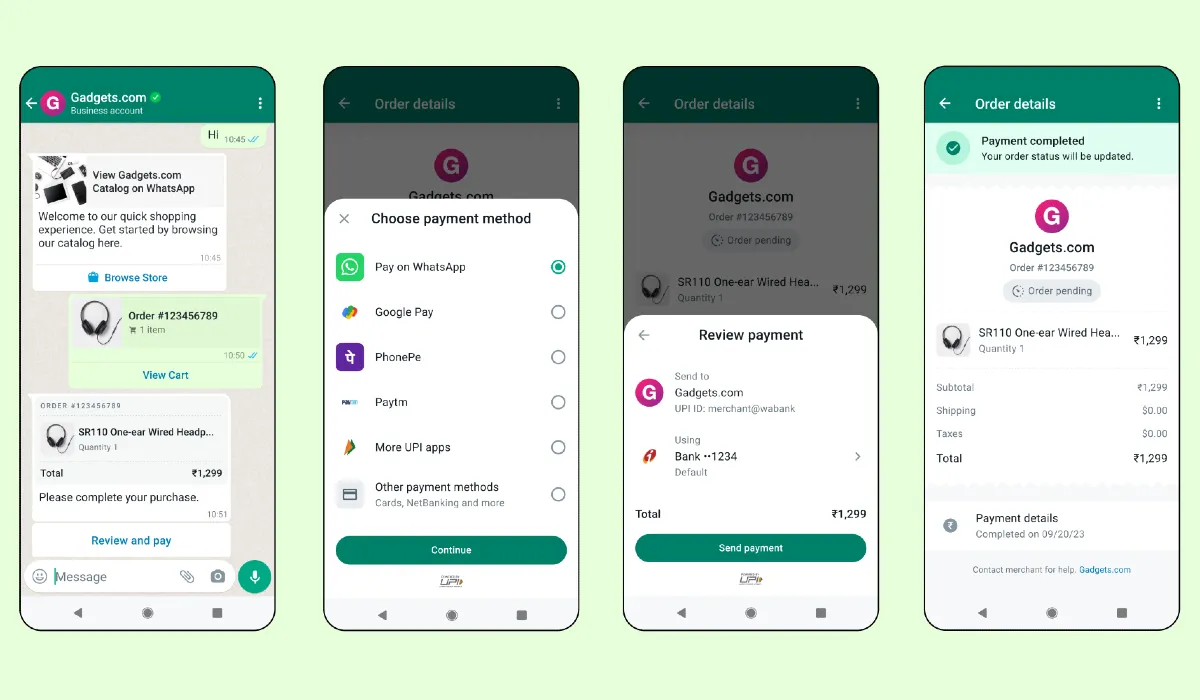

Even its big swing, a $5.7 billion investment in India's biggest telecom company, Reliance Jio in 2020 that led to a WhatsApp-JioMart integration in 2022, hasn’t delivered. The tie-up promised to bring grocery shopping and payments directly into WhatsApp, but adoption fell short, leaving that “super app” dream unrealized.

Regulatory hurdles explain part of the miss, but the bigger issue is intent. As one fintech veteran put it to Rest of World, “Even after the cap was lifted, WhatsApp didn’t do anything fundamentally different, no big product revamp, no cashback play, no merchant push, no marketing blitz. It’s like they lost interest.”

Outside India, a quieter story unfolds

If India was supposed to be WhatsApp Pay’s crown jewel, it turned out to be a missed shot. But Meta didn’t abandon the idea entirely, it quietly tested it in a few other markets.

Take Brazil, for example. WhatsApp Pay launched there in 2020 but hit a regulatory roadblock almost immediately, with Brazil’s central bank suspending it over competition concerns. It was later allowed back with restrictions. Today, with more than 140 million WhatsApp users in the country, it seems WhatsApp Pay peer-to-peer (P2P) transfers took off, and Meta is now expanding into merchant payments.

In Singapore, WhatsApp Pay arrived in 2023, but only in a limited form: users can pay registered businesses, not each other. And that’s it. Despite years of speculation, the much-discussed launches in Mexico and Indonesia never actually materialized. Meta floated the idea, but nothing went live.

So globally, WhatsApp Pay isn’t a sprawling fintech empire. It’s a patchwork: small but steady in Brazil, niche in Singapore, absent elsewhere.

So, what do we take away from this?

If we step back, WhatsApp Pay’s journey shows how even when you own the distribution, you don’t automatically win. India proved that timing, trust, and execution can outweigh sheer reach. By the time Meta got a green light, users had already built habits, and WhatsApp did little to break them.

Elsewhere, WhatsApp Pay is finding its footing by keeping ambitions modest: Brazil with peer-to-peer and merchant payments, Singapore with business transfers. It's not a global flop, but at the same time not the world-dominating payments revolution Meta once hinted at either.

And maybe that’s the bigger lesson: in fintech, ubiquity gets you in the door, but trust, and the will to invest, keeps you in the room.