Nigerian B2B payments startup Duplo raises $4.3 million to launch new products

Duplo, a Nigeria-based payments startup that is facilitating and enabling easy business-to-business (B2B) payments, has raised $4.3 million in its seed funding round from Liquid2 Ventures, Soma Capital, Tribe Capital, Commerce Ventures, Basecamp Fund, Y Combinator and Oui Capital, an existing investor. * The fund will be used to launch

Duplo, a Nigeria-based payments startup that is facilitating and enabling easy business-to-business (B2B) payments, has raised $4.3 million in its seed funding round from Liquid2 Ventures, Soma Capital, Tribe Capital, Commerce Ventures, Basecamp Fund, Y Combinator and Oui Capital, an existing investor.

- The fund will be used to launch the startup's new products and expand into new business verticals in Nigeria, the company claims.

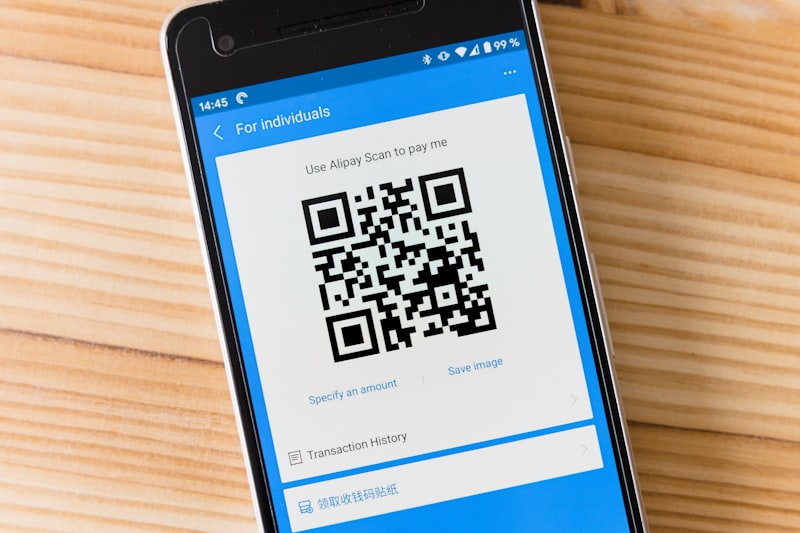

- Duplo allows FMCG brands to onboard retailers on its platform, collects payment digitally, and access real-time insights for business improvement. FMCG distributors on its platform can track and reconcile payments and also automate payments to vendors, manufacturers, and suppliers, and make instant payments for large quantity transactions.

- It also offers financial services such as automating invoice generation and processing, receiving and approving bills, collecting and disbursing funds, and completing account reconciliation. Its platform is integrated with accounting and enterprise resources planning (ERP) tools used by Nigerian businesses such as SAP, Microsoft Dynamics, QuickBooks, and Sage. The integration reflects payments made through Duplo on these platforms, saves time, and minimizes risks and fraud for finance teams in businesses.

- The payment startup now facilitates payments from Nigerian merchants to businesses in the US, UK, and Europe in 24-48 hours. With this payment option, it has increased registered businesses on its platform by 1000% and its total payment volume grew by 4,200 in the past five months.