Online payments and digital money are now part of everyday life for people and businesses around the world. PayPal has been one of the most popular payment platforms for years, letting millions of people send money, pay for goods, and do business online.

Meanwhile, BitPay is focused on cryptocurrency payments, a new way for merchants and customers to accept and use digital money like Bitcoin or Ethereum. Because both systems let people pay and receive money online, comparing PayPal and BitPay can help you understand which one fits your needs better.

PayPal is a widely known online payment platform that lets people send and receive money, pay for products, and manage funds across many countries. It also now allows merchants to accept cryptocurrency payments through a feature called “Pay with Crypto,” supporting coins like Bitcoin and Ethereum, which are converted to PayPal’s stablecoin or fiat currency during checkout.

BitPay is a payment gateway built specifically for cryptocurrency. It helps businesses accept crypto as payment and convert it into local currency or settle directly in crypto. BitPay supports major cryptocurrencies and offers tools for merchants to invoice, settle payments, and avoid fraud chargebacks.

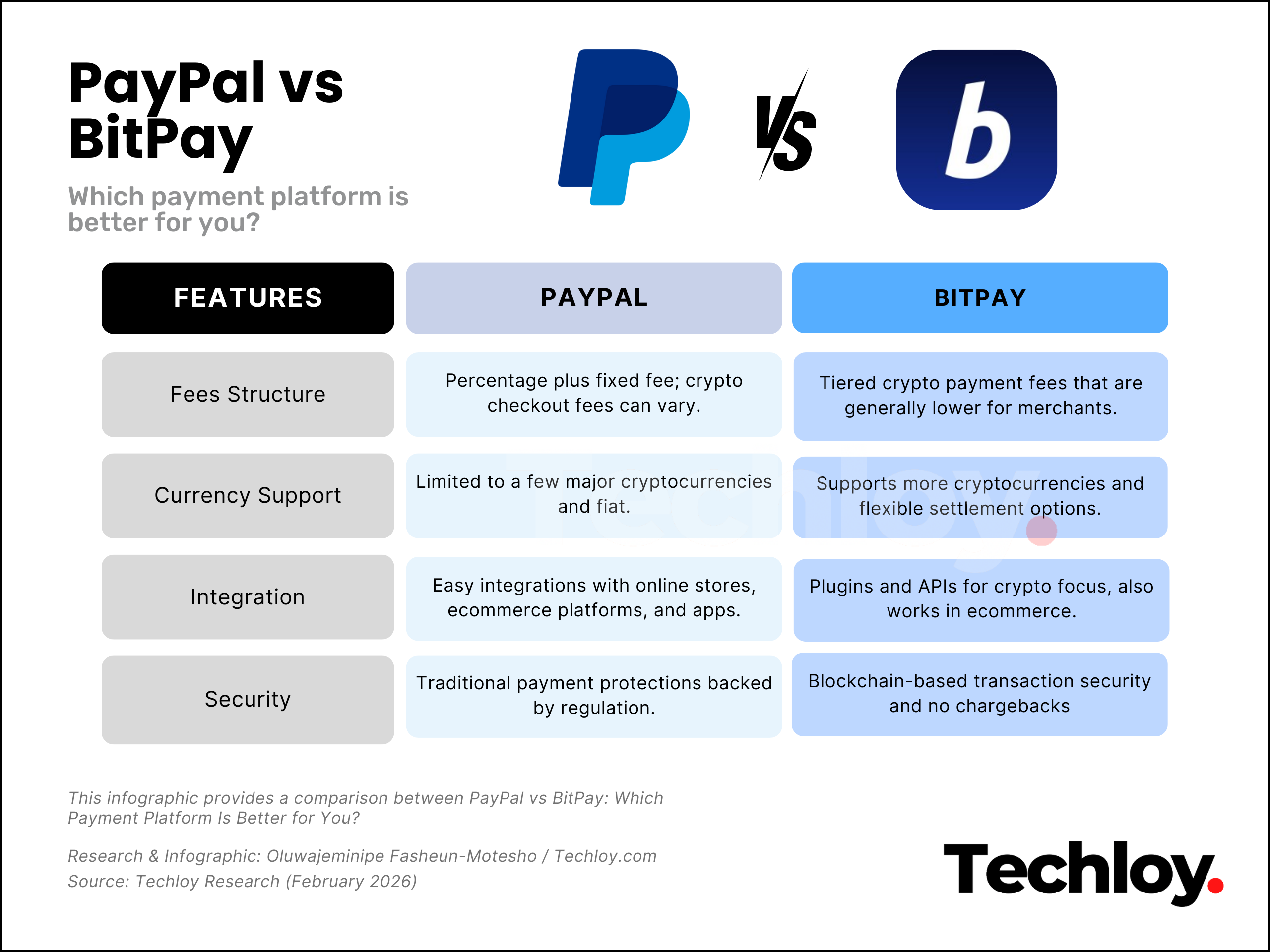

Now, let’s see how Paypal and BitPay stack up together:

/1. How They Work

PayPal works by letting users link bank accounts, cards, or balances to send and receive money online. For merchants, PayPal Checkout integrates as a payment option and can include crypto payments that convert immediately into fiat or PayPal USD (PYUSD) during checkout.

BitPay works through a crypto payment gateway. Merchants integrate BitPay into their online store or POS. Customers pay in crypto, and BitPay converts payments into the merchant’s chosen currency. It uses blockchain technology to record transactions and settlement.

/2. Fees and Cost

PayPal’s standard payment fees include a percentage of each transaction plus a small fixed fee. Merchant fees typically range around 2.9% plus a fixed amount per transaction, and international or special payments can add more. For PayPal’s crypto payments, fees for merchants start around 0.99% but may increase after trial periods.

BitPay’s fees for merchants are usually lower than many traditional card processors. The tiered pricing means smaller volumes pay around 2% plus a small, fixed fee, and higher volumes pay around 1% for transactions.

/3. Supported Currencies and Crypto

PayPal supports a handful of well-known cryptocurrencies for payments, including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. These are usually converted into fiat or stablecoin at checkout, and users cannot always withdraw crypto to external wallets.

BitPay supports a wider range of cryptocurrencies and directly handles crypto payments before conversion. Merchants can often choose how to settle funds in local currency or crypto.

/4. Security and Trust

PayPal is a well-established platform with strong buyer and seller protections, regulatory oversight, and fraud monitoring. This makes it familiar and more trusted for online payments.

BitPay uses blockchain and payment gateway security practices, including fraud safeguards, real-time settlement, and encryption. However, crypto payments depend on blockchain confirmations and wallet security.

Conclusion

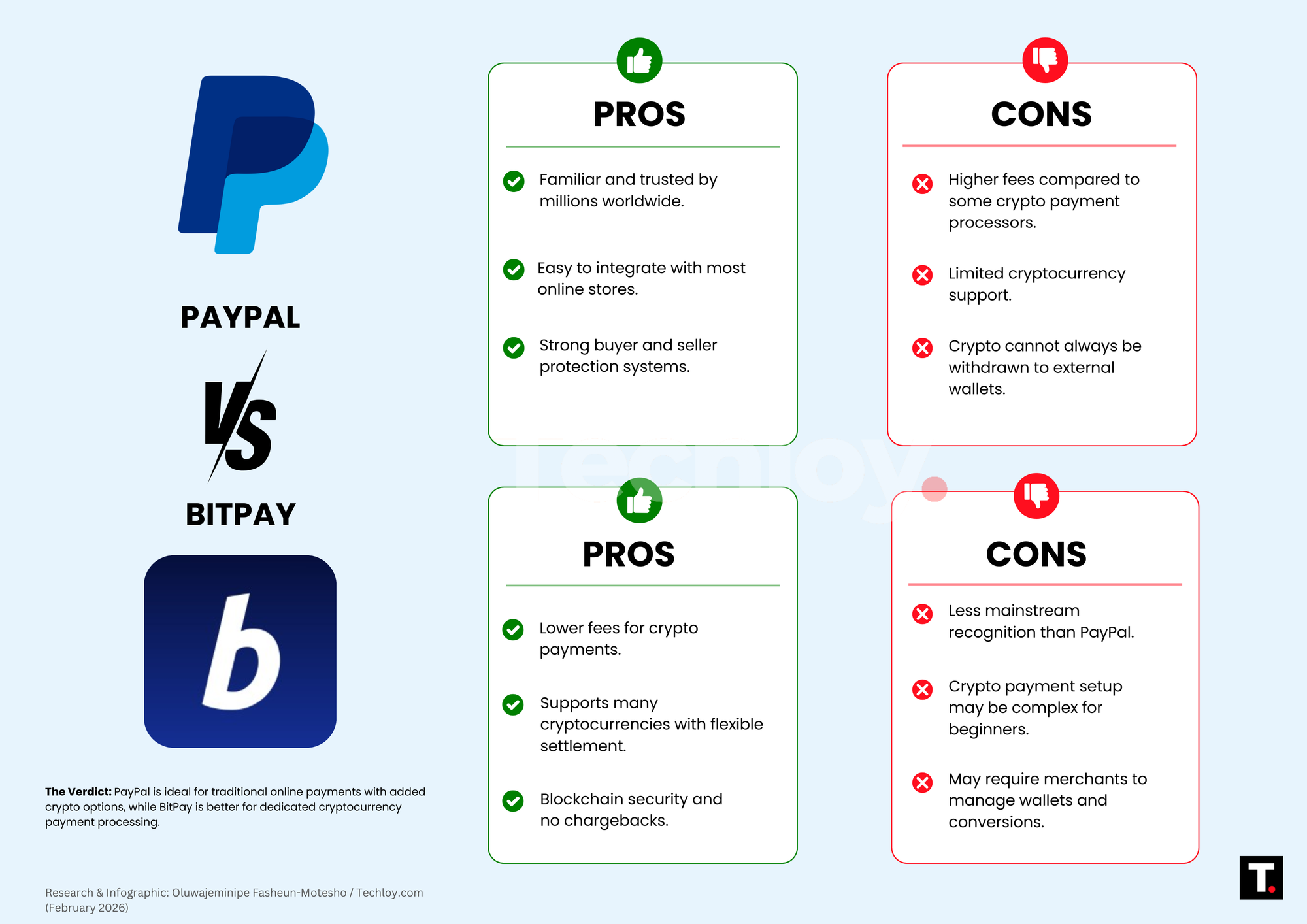

PayPal and BitPay serve different needs in the online payment world. PayPal is a well-known, trusted platform for traditional and now crypto-enhanced payments, with strong protections and easy integrations. BitPay is focused on cryptocurrency payments and offers lower fees and broader crypto acceptance, making it appealing for businesses that want to accept digital money directly.

If you want a familiar tool with broad support and buyer protection, PayPal is a strong choice. If you want lower fees and more flexible crypto payment options, BitPay may be better, especially for crypto-focused businesses.