In May 2024, Elon Musk landed in Bali to launch Starlink in Indonesia with fanfare and photo ops. But a little over a year later, the satellite internet provider has stopped accepting new users across the country. The reason being that it’s already out of capacity.

At first glance, this might look like a simple case of overwhelming demand. But zoom out, and a pattern starts to emerge — one that’s raising questions about whether Starlink can actually keep up with the expectations it's setting in fast-growing markets.

Indonesia now joins Nigeria and Kenya as the third major country where Starlink has had to pause new signups. In each case, the company promised fast, reliable internet for places traditional ISPs struggle to reach. And in each case, its fast growth has collided with not just regulatory or economic limits, but also technical ones.

Related articles:

- Starlink faces first subscriber loss in Nigeria after pausing kit sales

- Starlink’s still a victim of its own demand in Kenya

- Starlink launches in Congo after a year-long ban is lifted

In Kenya, for example, Starlink’s 2023 debut was met with huge demand. But by late 2024, it had to freeze new subscriptions in Nairobi and surrounding areas due to network congestion. As a result, between December 2024 and March 2025, it lost over 2,000 users and fell from seventh to eighth place among fixed internet providers, while local competitors like Safaricom picked up new users.

Nigeria followed a similar arc. After pausing new hardware shipments in late 2024, Starlink lost over 6,000 users in Q1 2025.

Now Indonesia, an archipelago of more than 17,000 islands with patchy broadband infrastructure, is facing the same bottleneck. Despite charging Rp 7.8 million (~$475.61) for its hardware kit and Rp 550,000/month (~$33.54), significantly more than local ISPs, which charge between Rp 200,000–400,000 ($12.20–$24.39), Starlink's demand in the country grew.

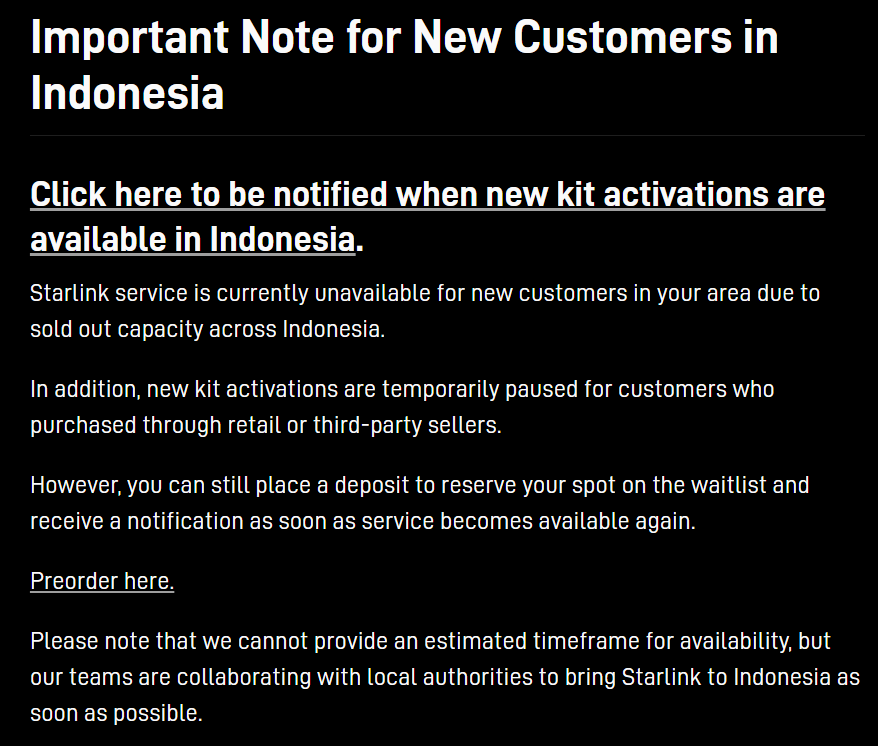

But supply, in the form of satellite bandwidth, couldn’t keep up. Starlink says capacity is “sold out nationwide,” and new user kit activations are on hold until further notice — leaving many prospective users, especially in remote areas, with no alternative.

Overall, Starlink seems to be dealing with more than just explosive growth and may be grappling with the physics and logistics of scaling satellite internet across entire countries.

If it can’t grow sustainably in the very markets that need it most, it risks doing the one thing no startup wants: opening the door for someone else, maybe Amazon’s Project Kuiper or a nimble local provider, to deliver on its promise.