As the second-largest cryptocurrency by market capitalization, Ethereum has steadily held its place as a core pillar of the industry. Its adaptability and practical value have made it the go-to platform for builders, often eclipsing Bitcoin in terms of innovation. That said, it hasn’t exactly been smooth sailing. Between the Israel–Iran dispute, China’s crypto bans, and ongoing tariff wars, macro pressures have weighed heavily on ETH’s price. Even so, the network’s recent scalability upgrades and lower gas fees have made it more attractive than ever. Institutions and retail investors alike are starting to treat Ethereum not just as a bet on the future, but as both a reserve asset and a working tool for developers building on it. In this piece, we’ll look at the biggest Ethereum holders by wallet, the top public companies adding ETH to their balance sheets, and why companies are leaning into Ethereum in 2025.

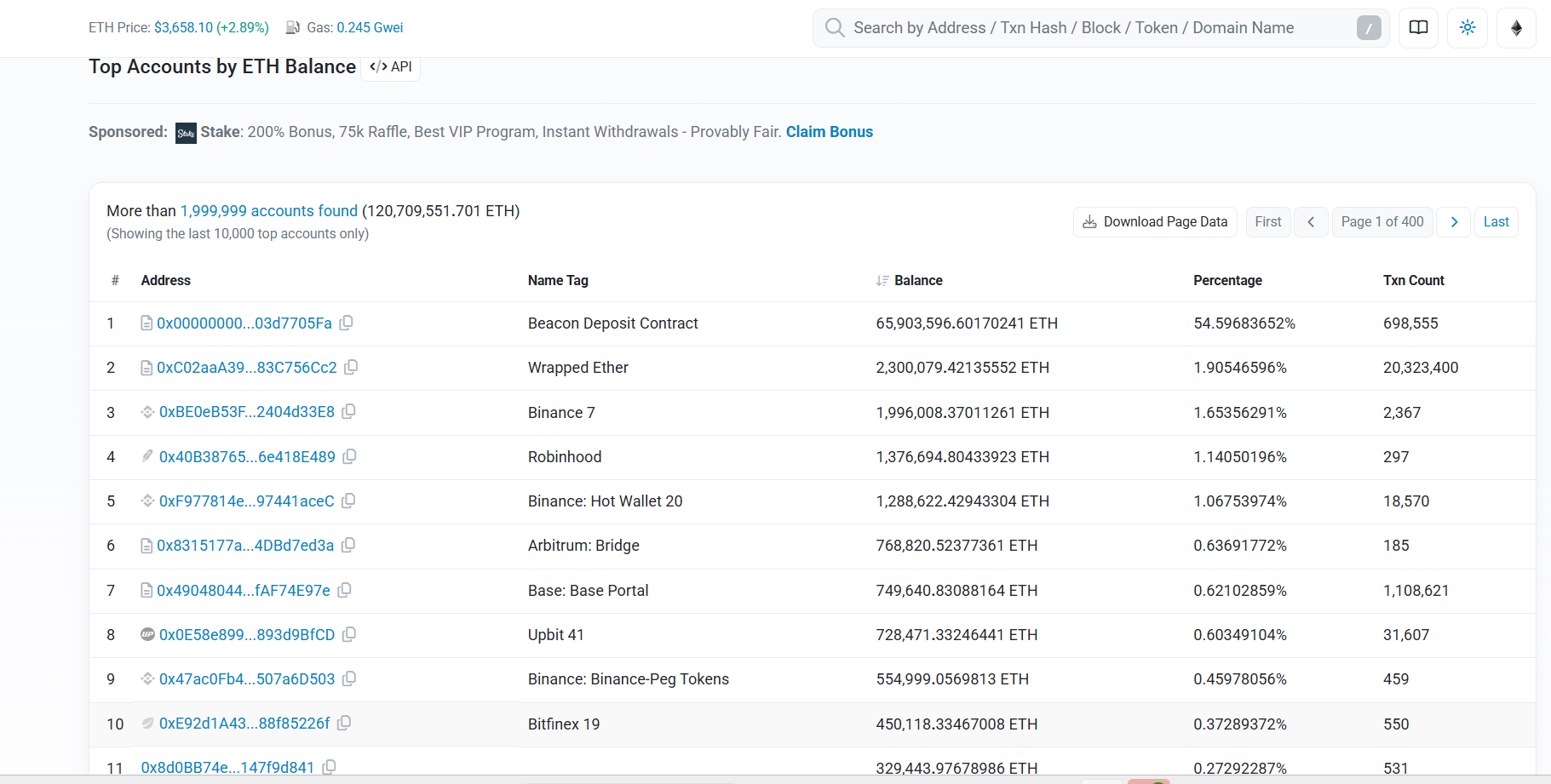

Top Ethereum Holders by Wallet (as of August 5, 2025)

Recent data from Ethereum’s blockchain explorer Etherscan shows that most of the largest wallets belong to the network’s core infrastructure and major exchanges. The Beacon Deposit Contract holds 65,899,561.34 ETH, which accounts for 55% of the total supply of 120.71 million ETH. Wrapped Ether follows with 2,298,153.30 ETH, making up 2%. Binance 7 holds 1,996,008.37 ETH (1.7%), Robinhood holds 1,376,694.80 ETH (1.1%), and Binance Hot Wallet 20 holds 1,288,622.43 ETH (1.06%).

Among Layer 2 and bridge contracts, the Arbitrum Bridge holds 768,400.29 ETH (0.64%), while Base Portal holds 749,136.54 ETH (0.62%). Upbit 41 accounts for 728,471.33 ETH (0.6%), Binance-Peg Tokens hold 554,999.05 ETH (0.46%), and Bitfinex 19 rounds out the list with 450,118.33 ETH (0.37%).

Public Companies Holding ETH (as of July 24, 2025)

Public companies are also building significant Ethereum positions in 2025. SharpLink Gaming leads with 360,807 ETH (about $1.33 billion). For a gaming company betting on Web3, ETH functions less like a hedge and more like core inventory.

Bitmine Immersion follows with 300,657 ETH (around $1.11 billion), signaling a pivot beyond Bitcoin mining into Ethereum’s expanding ecosystem. Coinbase Global, Inc. holds 137,300 ETH (roughly $507.34 million), a natural move for a company constructing the infrastructure it also invests in.

Bit Digital has 120,306 ETH (valued at $444.54 million), balancing its exposure between Bitcoin and Ethereum. BTCS Inc. recently increased its holdings to 55,788 ETH (about $206.14 million) after purchasing an additional 22,935 ETH, doubling down on proof-of-stake yields.

Further down the list, GameSquare Holdings holds 10,170 ETH, likely tied to its gaming operations. Intchains Group Limited sits on 7,023 ETH, split between 6,347 ETH directly held and 676 ETH staked via Coinbase. KR1 plc holds 5,500 ETH, Exodus has 2,550 ETH, and BTC Digital Ltd. carries 2,100 ETH — smaller positions, but part of the same trend of companies leaning into Ethereum as both an asset and a platform.

Why Companies Are Buying ETH in 2025

For some, it’s about hedging against inflation, while for others, it’s about powering their operations. And for most, we could say it’s a mix of both.

Ethereum’s proof-of-stake model pays staking rewards, turning ETH into a productive asset rather than something you hold for price pump. Companies running DeFi platforms, gaming ecosystems, and even infrastructure services need ETH to power transactions, smart contracts, and staking. Hence, its undeniable utility.

Then there are companies like Coinbase, where ETH is central to the products they’re building. SharpLink and GameSquare's recurring multi-million-dollar acquisitions signal not just a bet on price but a belief that Ethereum could become a core part of blockchain-based gaming and betting infrastructure.

And with upgrades making transactions faster and cheaper, the long-term play feels less risky than it did a few years back.

Conclusion

With the current price of ETH at $3,660 and a market cap of $443.53 billion, it’s not a fluke to say Ethereum’s outlook seems stronger than ever. Despite the volatility that still defines the market, corporate accumulation is painting a clearer picture of where things are heading.

If this pace continues, Ethereum could solidify its role as the backbone of decentralized applications while also becoming a fixture on corporate balance sheets, a dual identity that few assets can claim.