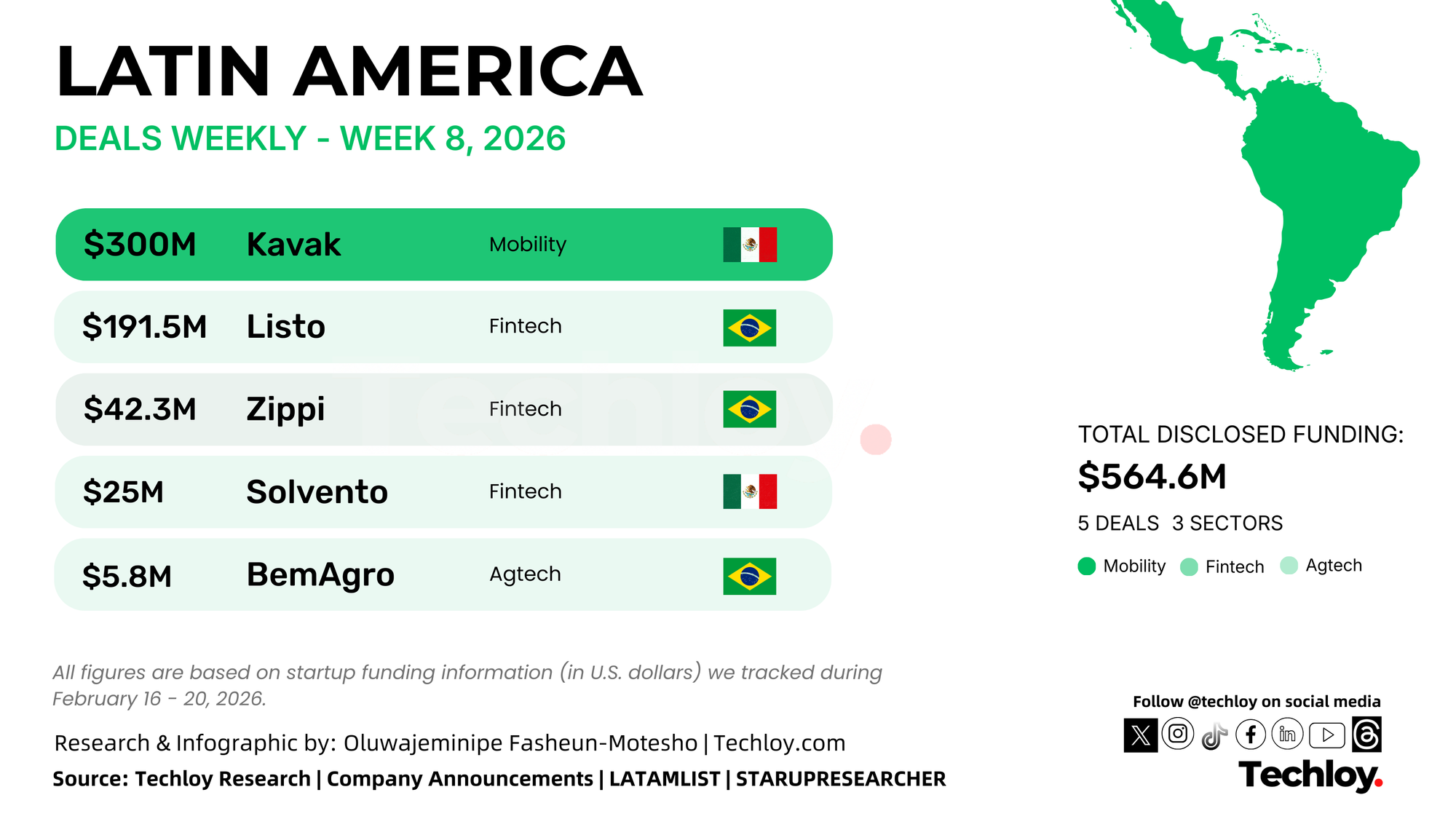

Startups across Latin America raised a combined $564.6 million this week, based on disclosed funding rounds tracked by Techloy. The majority of the capital went to fintech companies, especially those focused on credit and automotive finance. A single mega round accounted for more than half of the total funding.

The Week’s Largest Startup Funding Rounds

Here are the biggest disclosed startup funding rounds across Latin America, ranked from largest to smallest.

/1. Kavak, $300M, Mobility, Mexico

Kavak is an online used car marketplace that combines physical showrooms with a digital platform. Customers can buy and sell cars and access servicing. The company also provides financing through its lending arm, Kuna Capital.

The Mexico-based company raised $300 million in an equity round led by Andreessen Horowitz, which invested $200 million. WCM Investment Management co-led the $100 million round alongside Foxhaven Asset Management. The round follows last year's equity and debt raises. Kavak has reached an annualized run rate of about $600 million in loans.

/2. Listo, $191.5M, Fintech, Brazil

Listo is a fintech focused on Brazil’s automotive sector. The company raised $191.5 million through a Credit Rights Investment Fund structured by Itaú BBA and UBS BB.

The funding includes $133 million in new capital, with the rest coming from existing investors who extended their terms. Listo will use the funds to expand its credit portfolio and strengthen operations. The company manages a credit portfolio of $191.5 million and processes about $1.91 billion in digital transactions each year, serving more than 120,000 businesses in the automotive sector.

/3. Zippi, $42.3M, Fintech, Brazil

Zippi is a Brazilian fintech focused on providing credit to micro-entrepreneurs. The company raised $42.3 million through the third issuance of its Credit Rights Investment Fund.

The round includes Credit Saison as its first international investor, alongside Itaú Asset, Itaú BBA Treasury, Bradesco BBI, and Valora Investimentos. Zippi uses Brazil’s Pix payment system and alternative data to provide working capital that matches the daily cash flow of small businesses. The new funding will expand its lending capacity and strengthen its market position.

/4. Solvento, $25M, Fintech, Mexico

Solvento provides liquidity and payment solutions for transport and logistics companies. Its platform helps carriers manage working capital and deal with delayed payments.

The Mexican startup raised $25 million from BBVA Spark, following its Series A in November 2024. The funds will support fleet operations, routes, and logistics services, while increasing liquidity across its network.

/5. BemAgro, $5.8M, Agtech, Brazil

BemAgro develops artificial intelligence solutions for agribusiness. Its geospatial intelligence platform supports soy, sugarcane, and forestry supply chains. The technology helps producers improve efficiency, manage climate risk, and make better decisions using data.

The Brazilian agtech raised $5.8 million in a Series A round led by The Yield Lab Latam, with participation from Grupo Colorado, CNH, Atvos, and Agroven. The company will use the funds to improve its AI platform, launch new products, grow its commercial team, and expand into Brazil and international markets. Since its previous round in 2024, BemAgro has tripled its revenue.

Conclusion

With more than $560 million raised this week, fintech clearly dominated funding activity in Latin America. Large credit and automotive finance platforms attracted the biggest checks, while agtech continued to secure steady growth capital.