One widely agreed-upon fact in business is that every company relies on cash flow, no matter its structure, whether a sole proprietorship, partnership, or corporation.

A business’s survival depends on it, but before most startups reach steady, positive cash flow, they start in the red, spending their own reserves just to keep operations running. How fast that money is going out, and how long it can last, is known as burn rate, a metric that can make or break a young business.

What is Burn Rate?

Burn rate is essentially the speed at which a company is spending its cash. Startups and early-stage businesses use it to track monthly spending, estimate their runway, and plan when they might need additional funding. Oftentimes, startups are unable to generate positive net income in their early stages because they are focused on growing their customer base and improving their product.

As a result, seed-stage investors or venture capitalists often provide funding based on a company’s burn rate, using it to gauge how much time a startup has to reach key milestones before needing more cash.

Why Burn Rate Really Matters for Startups?

Say you start a company with $100,000 in cash and keep your burn rate at $5,000 per month. You are likely to last much longer than a startup with the same cash reserve but a higher burn rate of $15,000 per month. That difference in spending speed often decides whether a startup survives long enough to figure things out or dies before it ever finds product-market fit.

It’s how founders and investors track how much cash a company is chewing through each month before it starts bringing in real money. It also tells you the company’s runway, basically how long it can stay alive before the cash dries up.

Types of Burn Rate and How to Calculate Them

When we talk about burn rate, they’re usually classified into two: gross or net burn rate. Both matter, but they tell slightly different stories about how a business is really doing.

Gross Burn Rate measures how much a company spends each month to keep operations running, ignoring any revenue coming in over a period. It looks at total operating expenses such as salaries, rent, software, marketing, and all the other costs of keeping a business.

Formula:

Total Monthly Operating Costs = Gross Burn Rate

For example, if a startup spends $8,000 on staff, $2,000 on rent, and $1,000 on software every month:

$8,000 + $2,000 + $1,000 = $11,000 gross burn rate

Net Burn Rate, on the other hand, shows how much money a company actually loses each month after accounting for revenue. It can never be higher than the gross burn rate, and it gives a clearer picture of how long a business can operate before running out of cash.

Formula:

Gross Burn Rate − Monthly Revenue = Net Burn Rate

For example, if your gross burn rate is $11,000 and the company makes $4,000 in monthly revenue:

$11,000 − $4,000 = $7,000 net burn rate

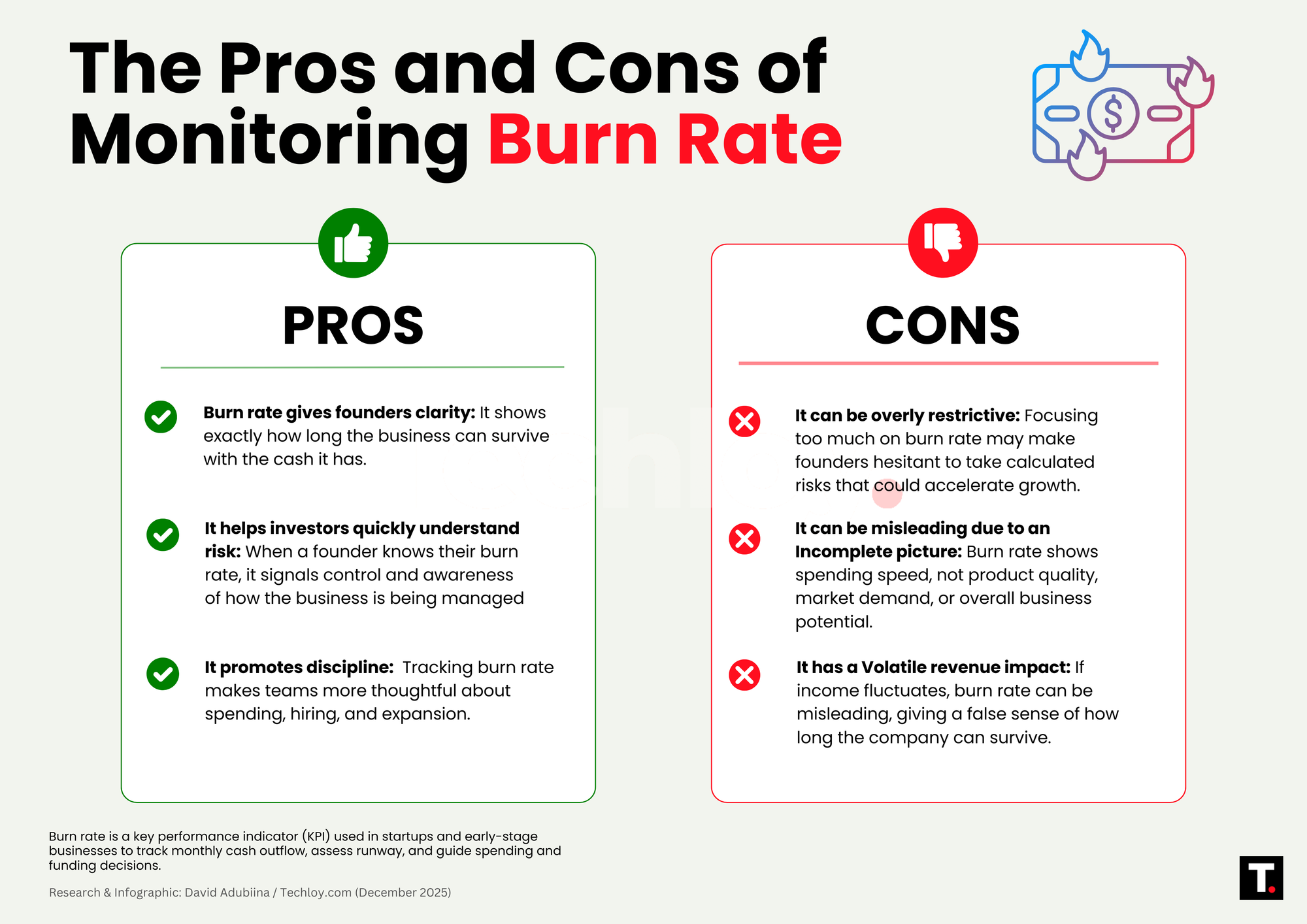

Pros and Cons of Using Burn Rate in Business

Conclusion

As a business owner, you want to keep your burn rate as low as possible without slowing down growth. The faster you’re burning through cash, the sooner you run into financial pressure, and that’s when tough choices have to be made.

Investors may push for quicker revenue milestones, or they might need to pump in more funding to give the company time to reach profitability. Regardless, keeping an eye on burn rate helps you make smarter spending decisions, stretch your runway, and give your startup the best chance to survive and grow.