The ChatGPT’s mobile app is raking in the kind of numbers most startups can only dream about. Since its launch in May 2023, the iOS and Android app has already generated a jaw-dropping $2 billion in consumer spending.

According to Appfigures, that’s about 30 times more than the combined lifetime revenue of its rivals — Claude, Copilot, and Grok. In other words, it’s not even close.

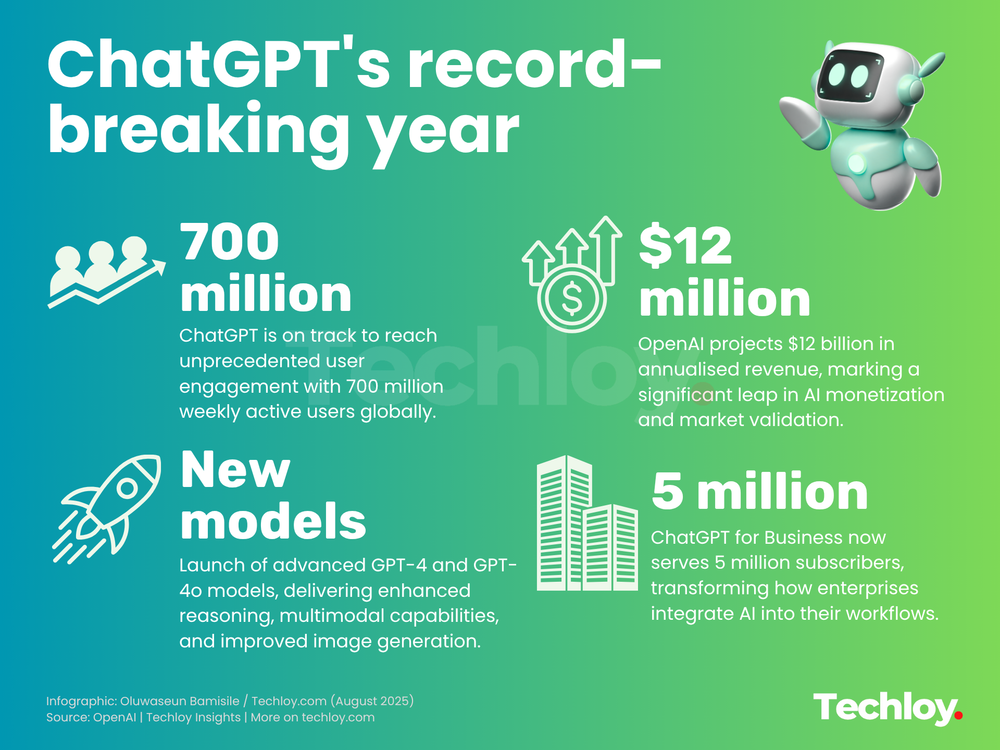

That revenue hasn’t trickled in slowly over the years, but accelerated like crazy in 2025. Between January and July alone, the app pulled in $1.35 billion, a 673% jump from the same period in 2024. If you break that down, it’s almost $193 million every month, compared to just $25 million last year. Overall, the ChatGPT app for iOS and Android devices has now reached a combined $2 billion in global consumer spending.

And it’s not just money that’s scaling. Install numbers are soaring, too. The app has now been installed 690 million times, with 318 million of those installs happening in 2025 alone, nearly three times higher than last year. That means ChatGPT is adding around 45 million new users every month, up 180% year-over-year. India leads the way with 13.7% of global downloads, while the U.S. comes second with 10.3%. Interestingly, though, Germany ranks second in spending, contributing 5.3% of total lifetime revenue.

So yes, ChatGPT is absolutely dominating the mobile AI race. To put it in perspective, xAI’s Grok — Elon Musk’s much-hyped competitor — has made just $25.6 million this year. That’s only 1.9% of ChatGPT’s haul. And even though Grok only rolled out stand-alone mobile apps in 2025, it’s still miles behind. Claude and Copilot aren’t doing much better as competitors. Consumers, it seems, are voting with their wallets.

But here’s where things get interesting. You might look at these numbers and assume OpenAI is printing money. But the twist here is that despite billions in revenue, OpenAI and other AI companies in general are burning through even more cash than they make.

Are AI Companies Actually Profitable?

While ChatGPT’s app revenue looks like a runaway success story, we have to ask: is AI itself actually a profitable business? Here’s where the shine fades a little.

So far, the answer is no. In fact, the companies building the models, OpenAI, Anthropic, and xAI, are some of the most cash-hungry operations in tech. Yes, they’re generating billions in revenue. But their expenses are even higher, thanks to the astronomical costs of training models, building data centers, and hiring top-tier AI talent.

At the very peak of the AI game sits OpenAI, the maker of ChatGPT, and it’s the perfect case study for the strange economics of this industry.

If you add up all its income streams: subscriptions, licensing deals, APIs for businesses, and app revenue, the numbers look dazzling. By mid-2025, OpenAI’s annualised revenue hit $13 billion, up from just $4 billion a year earlier. Impressive, right? Except, the company lost up to $5 billion in 2024 and could burn as much as $8 billion in 2025. Even worse, this cash burn is expected to continue for a while as analysts don’t expect it to turn cash-flow positive until 2030, when revenues might finally reach the $125 billion mark.

But OpenAI isn’t alone. Other AI companies like Anthropic, which runs Claude, are on a similar trajectory. Anthropic's revenue is growing fast, projected at $5 billion this year, up from $1 billion in 2024, but it isn’t anywhere near profitability either. The same goes for xAI. The company is forecasting only $1 billion in revenue by the end of 2025. An amount that is nowhere near enough to self-sustain the massive compute and operational costs that come with training and running these giant models.

Ironically, the companies making money from AI are not the app makers. It’s the infrastructure players like Nvidia who make the GPUs (Graphics Processing Units) essential for training and running AI models, and cloud providers like Microsoft (Azure), Amazon (AWS), and Google Cloud that are making significant revenue by providing the computing power needed for AI development.

They’re the ones selling the picks and shovels in this gold rush, and they’re cashing in while the miners (OpenAI, Anthropic, xAI) keep digging at a loss.

And that’s the paradox of AI right now. On one hand, it’s transforming industries, cutting costs, and unlocking new ways of working. On the other hand, the companies actually building the models are running some of the most expensive and unprofitable businesses in tech history.

OpenAI is Fueled by Investor Cash

So, how is AI still standing tall despite those losses? The answer is simple: investors’ money. The AI industry is being bankrolled by unprecedented levels of venture capital. None of the growth we're seeing in the AI industry today would be possible without investors.

OpenAI alone has raised nearly a lifetime total of about $60 billion (most of it in just 3 years). Its latest was a $40 billion Series F cheque from SoftBank Group and others that sent its valuation to over $300 billion.

It is the same story across the landscape. Every AI company is chasing the same playbook. Anthropic has also pulled in over $14.3 billion from giants like Amazon, Google, and Salesforce, with fresh fundraising underway that could value it at $170 billion. But like OpenAI, Anthropic is nowhere near profitable. Its annualised revenue is only projected at $5 billion in 2025.

Then there’s xAI, Elon Musk’s challenger. Despite only launching in late 2023, it has already raised about $17 billion, with another mega-round reportedly in the works that could value it between $170–200 billion. Again, massive valuations, massive funding, but no profits.

Zoom out, and it is a trend. In the first half of 2025, nearly $90 billion went into AI startups in the U.S., according to a previous Techloy report. In fact, a third of all global VC in Q2 went to just 16 companies, nearly all of them in AI, each raising at least $500 million. Scaling AI means massive upfront costs, and these AI companies are still in full burn mode.

This wave of capital is what’s keeping the whole ecosystem afloat. The capital is what allows AI companies to keep scaling, offering free or cheap products to hook users, and then banking on long-term freemium and enterprise models to eventually make the math work. How sustainable this strategy is is still being tested.

And it is this uncertainty that has left many investors quietly asking if any of these companies ever actually make money?

Will OpenAI Ever Break Even?

That’s the billion-dollar (or maybe trillion-dollar) question. Will companies like OpenAI, Anthropic, and xAI actually ever break even, let alone become profitable?

The optimistic camp says yes. The general consensus is that profitability will come around 2028–2030. By which time the massive upfront costs of building infrastructure will have levelled out, and revenue from subscriptions, enterprise licensing, and partnerships will have finally outpaced expenses.

The sceptical camp isn’t so sure. They argue that today’s AI hype is unsustainable and warn of a potential dot-com bubble-style correction if companies can’t prove clear returns. Already, surveys show a chunk of businesses abandoning AI projects because they can’t demonstrate real ROI.

Either way, one thing is certain: not every AI company will survive the shakeout. The leaders with deep-pocketed backers and wide distribution — like OpenAI, Anthropic, and xAI — are best positioned. But even they will have to prove they can move from growth-at-all-costs to sustainable profitability.

Conclusion

In short, ChatGPT’s $2 billion mobile milestone shows just how much demand there is for AI in everyday life. But behind the scenes, the real story is that AI is still running on investor fumes. Consumers are paying, yes, but not nearly enough to cover the staggering costs of developing and deploying these systems.

The AI gold rush is here. But like every gold rush, the first people to get rich are the ones selling shovels.